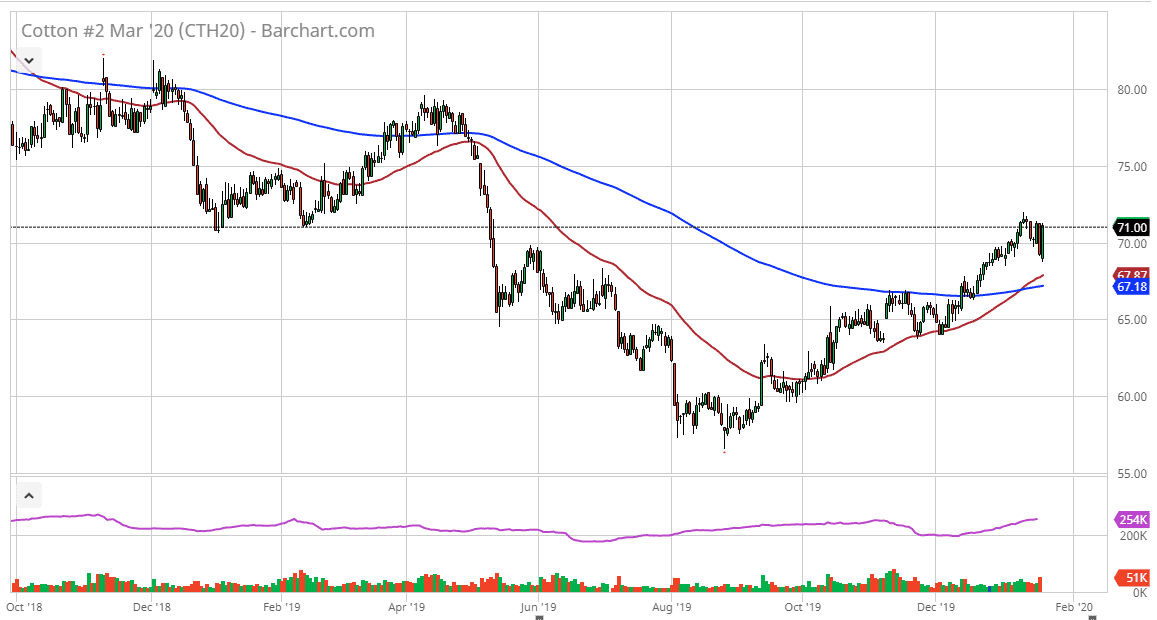

Cotton markets got absolutely hammered on Tuesday, which would have been the first full day of liquidity after the Martin Luther King Jr. holiday. Traders came back to take profits, as the market broke down below the $70 handle. Looking at the chart, the 50 day EMA has recently broken above the 200 day EMA, forming the so-called “golden cross”, one of the more well-known bullish technical figures.

Looking at the chart, the candlestick is rather negative, and it does suggest that we have a little bit of momentum to the downside coming into the picture. The 50 day EMA, currently sitting at the $67.74 level, should offer a bit of support, just as the 200 day EMA will as well, closer to the $67.14 level. When you look to the past, you can see that the market had recently banged up against previous support, so it does make sense that “market memory” will come into the picture and offer resistance. That being said, there should be quite a bit of noise between here in the $75 level, and it should be said that the market may have gotten a little bit ahead of itself. With that in mind, a pullback makes quite a bit of sense considering that markets can’t go in one direction forever.

The market has gone relatively straight up since the middle of August, and market simply cannot go straight up in the air. The technical formation of the last couple of days has formed a “double top, lower close.” That of course is a sign that the last 48 hours has turned decidedly negative, but it doesn’t necessarily ruin the overall trend. I believe that the next day or two might be slightly soft, but at that point you may start to see value hunters come back in and try to pick this market up. I would also expect the $65 level to be massively supportive, and a breakdown below that level could change the overall trend. We are most certainly at a crossroads right now, and the question is whether or not we can continue to go higher, or if the previous support becomes resistance in the market can’t climb any higher. Regardless, in the short term it certainly looks like there is a real threat to the downside so at the very least you should be on the sidelines waiting for value underneath.