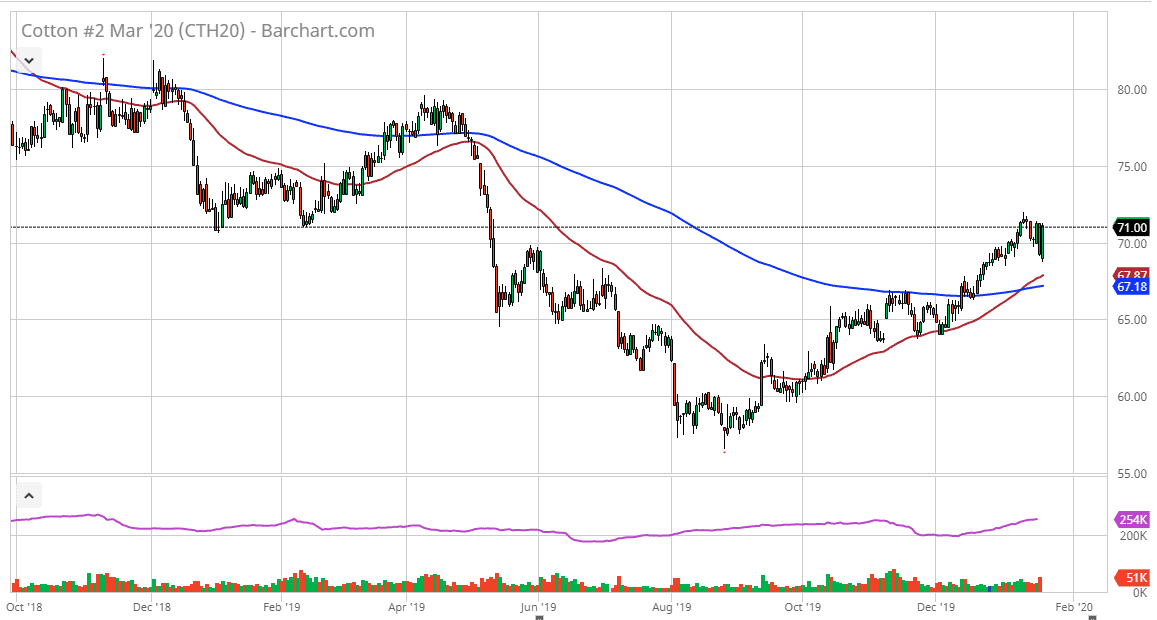

The cotton markets rallied significantly during the trading session on Wednesday, breaking significantly above the $70 level, and then close near the $71 handle. Ultimately, this is a market that is in a strong uptrend, and the reaction that we have seen during the trading session on Wednesday shows just how strong this upward momentum truly is. We have recently seen the 50 day EMA cross above the 200 day EMA, forming the so-called “golden cross” that a lot of longer-term traders like paying attention to.

Yesterday, I had anticipated that perhaps we will in turn around and reach towards the 50 day EMA but the market has turned around to show extreme strength almost immediately. That’s an even more bullish sign then pulling back to the 50 day EMA so for me I believe that this market will eventually go looking to higher levels. However, the $71 level is an area that you should pay attention to because it had been so supportive in the past. That support should now be resistance, exactly as we are seeing. If we break above the recent high, then I think the market probably goes towards the $75 level. This is a market that should continue to offer value, and as long as we can stay above the crucial 200 day EMA, currently at the $67.18 level, the market is in an uptrend using the most basic of technical analysis standards.

If we were to break down below the 200 day EMA the initial target would be $65, but then it’s very likely that we would go looking towards the $62.50 level after that. To the upside, the $75 level is going to be massive resistance, but I think that if we do reach that area it’s likely that we continue to go a bit further. If you look at the chart though, you can see that we are in a bit of a perfect channel, so a move in that manner would suggest that that we are getting a bit overextended, so perhaps we may favor a grind to the upside, perhaps go much higher than that. As things stand right now, I prefer to buy dips as they appear, as they should offer plenty of value in a market that is obviously a very bullish. I would also keep my position size somewhat small because if you are buying cotton now you are doing so after a significant move.