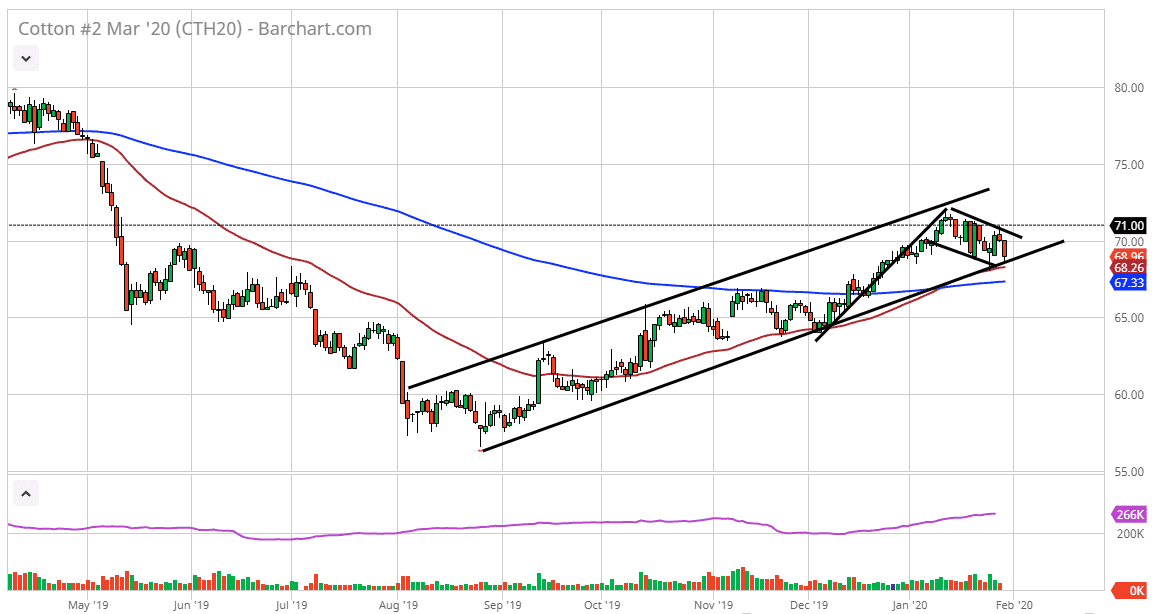

Cotton markets pulled back a bit during trading on Thursday, to reach down towards the uptrend line that has been part of the overall channel that we have seen in this commodity. At this point, cotton has been one of the better performers but the last couple of weeks have been relatively quiet. That being said, we are looking at the market testing the uptrend line and the 50 day EMA, both of which should cause a certain amount of support. Furthermore, we have recently seen the so-called “golden cross”, which is when the 50 day EMA crosses above the 200 day EMA. That tends to be a longer-term “buy-and-hold” signal for longer-term traders, but we are pressing major resistance simultaneously.

The $71 level continues to be important, and therefore I find it difficult to short this market anytime soon, as we have multiple reasons to think that there should be buyers underneath. The market would have to break down below the 200 day EMA to even begin to suggest that type of trading, and at that point it would take a significant turnaround. The bullish flag measures for a move towards the $80 level, which is an area that had been targeted previously, so everything is starting to line up in the same direction.

Cotton markets have been a decent play ticket away from some of the fears of the coronavirus and central bank loosening, as it is much more of a pure play on supply and demand. Whether of course has its influence but all things being equal it looks as if the market is going to continue to try to break higher. However, if it were to break down below the 200 day EMA it could open up the door to the $65 level, followed very quickly by the $60 level. In the meantime, it looks as if the market is simply trying to kill time and build out this bullish flag. We are getting fairly close to an area that needs to show a decision coming down, as we have a confluence of the uptrend line and the bullish flag that will eventually squeeze this market in one direction or another. At the moment, it looks as if the upside still is very focused, but it should be noticed that the $71 level has been both support and resistance multiple times historically speaking and therefore will continue to be a bit of a hurdle.