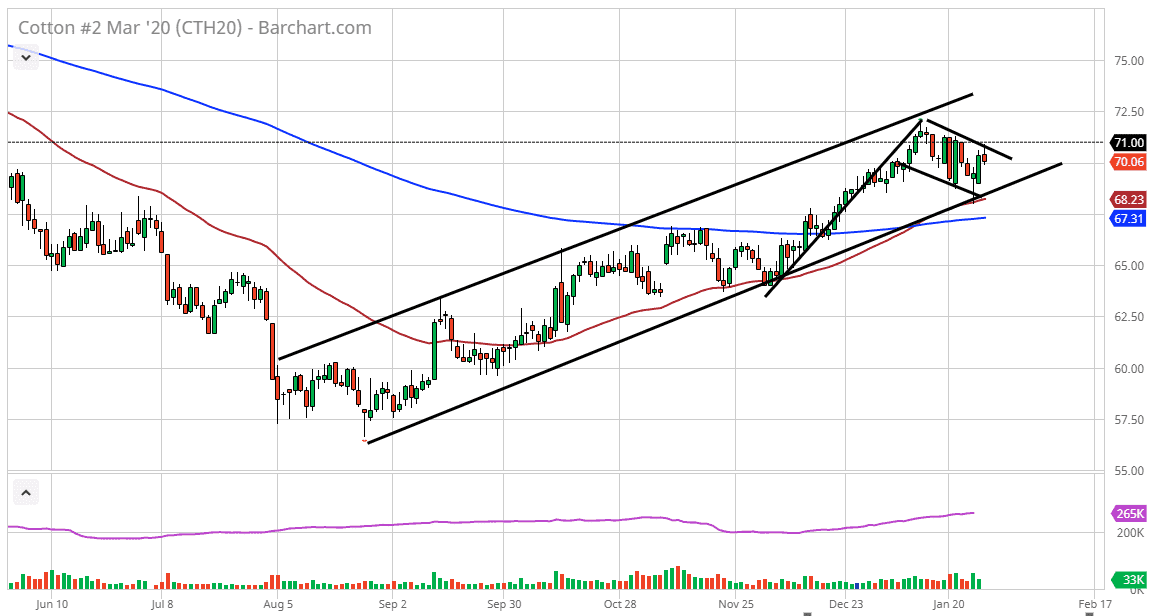

Cut markets have pulled back slightly earlier in the trading session on Wednesday as we continue to dance around the $70 level. There is significant resistance above at the $71 level as well, so it’s obvious that we are trying to build up enough momentum to make a bigger move. At this point, the market is still bouncing around in the body of a bullish flag, so it looks as if the most likely move next for the market will be higher. If we can clear the $71 level on a daily close, then it gives the cotton market the ability to go looking towards $72.50 and then after that to go forward to push the market based upon the flag pattern. Furthermore, based upon the flag, it suggests that the market has a move towards the $80 level as very possible.

The 50 day EMA is also crawling right along the uptrend line of the channel, so it shows just how much support that should be found in that area. All things being equal, the market looks very likely to continue going higher in general, as we have seen such a strong move to the upside. If we can break above the top of the bullish flag technical traders will come in and try to push up the value of cotton at that point.

However, if the market was to break down below the 50 day EMA and the uptrend line, the next support level will be closer to the 200 day EMA. If we do break down below there, then it sends this market to the downside as it will break through several key technical indicators at that point. In fact, if we get a daily close significantly below the 200 day EMA, at that point the trend not only changes, but then it becomes an opportunity to start shorting the commodity. All things being equal though, it looks as if the market is simply killing time in order to build up the necessary inertia to send this market to the upside. At this point, expect the occasional pullback after the breakout, but those should all be looked at as potential buying opportunities as well, as the market has been so bullish for so long. At this point, it looks as if the market is simply trying to find enough buyers to make the next leg happen.