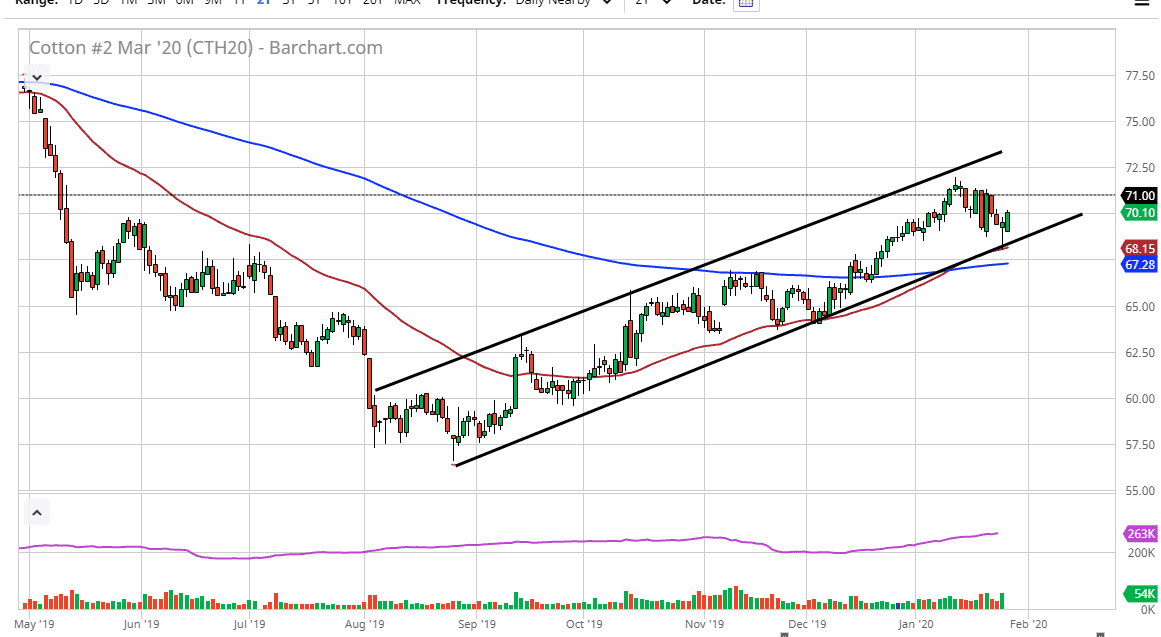

Cotton markets initially gapped lower to kick off the trading session but then turned around a break above the top of the hammer from the previous trading session that I had suggested would be important. The hammer of course is a very bullish sign, but the fact that it formed right on the 50 day EMA and the bottom of the uptrend and channel made it a very interesting bullish signal. The cotton markets also broke above the $70 level during the trading session on Tuesday, which of course is yet another bullish sign. Above there, we have the $71 level which is a significant resistance barrier that the market has been testing recently. Furthermore, it’s an area that has previously been very supportive, so it makes sense that there is a lot of “market memory.”

Looking at the chart, it’s obvious that the market will continue to reach higher, perhaps reaching towards the $72.50 level. At that point, we would probably continue the longer-term uptrend that we have seen, and if you take a little bit of artistic license, you can even go so far as to suggest that we are in the midst of forming a bullish flag. If we do break out above the top of the potential flag, it suggests that the market could go as high as $78. Obviously, it would change a lot if we do break out to the upside, and we could start to see quite a bit of momentum chasing at that point.

The alternate scenario of course is whether or not the market was to break down below the hammer from the Monday session, breaking below the 50 day EMA. If we do break down below that, the 200 day EMA underneath would be a potential support level as well. Breaking below there would finally send this market much lower, reaching down towards the $65 level. All things being equal, I do believe that the cotton market will continue to go higher, and with the Federal Reserve releasing its statement during the trading session on Wednesday late in the afternoon, that could put some pressure on the dollar and that might be reason enough for cotton go higher at that point. Because of this, we may have somewhat quiet trading earlier in the trading session but a little bit of clarity should be coming later in the day, perhaps in the Thursday session.