Todd markets went back and forth during the trading session on Monday as traders went back to work. There has been a certain amount of short-term panic and the market as people continue to worry about the Chinese situation with the coronavirus. That has people selling off most commodities, but at this point it’s very unlikely that the cotton market continues to suffer as there is a massive amount of buyers underneath.

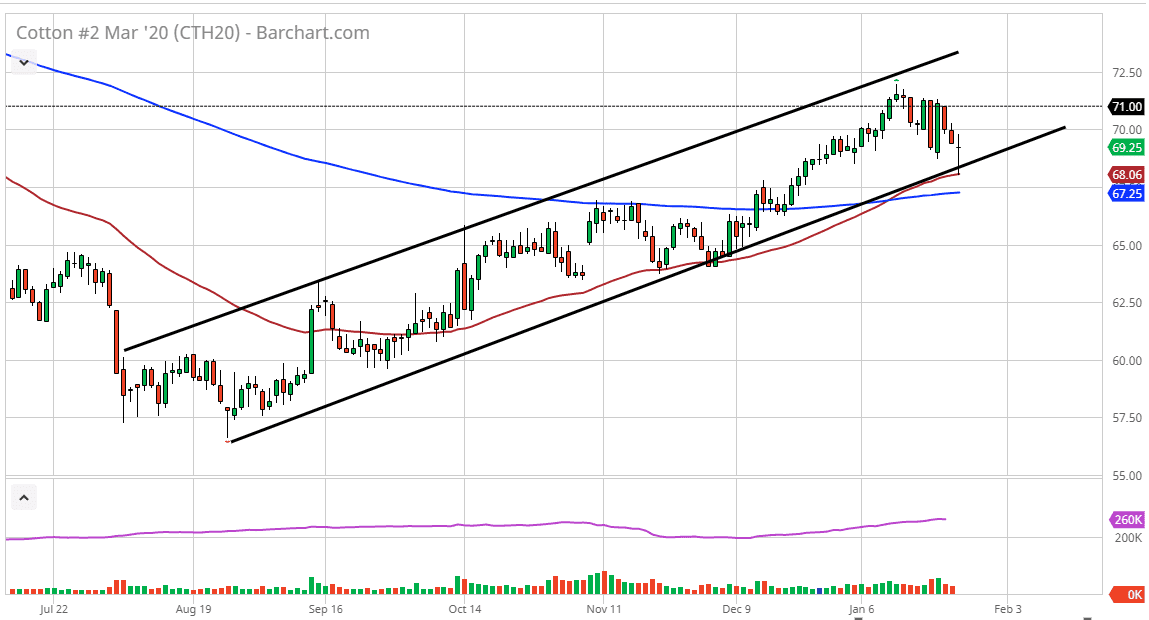

The market has dropped towards the bottom of the up trending channel, and then bounced significantly from the 50 day EMA. By turning around the way it has and forming a hammer, that is a very bullish sign. To me, it appears that if we can break above the $70 level, we will probably go back towards the $71 level, and then make another attempt to break to fresh, new highs. Keep in mind that the $71 level is crucial due to the way it has behaved over the longer term, as it has been both support and resistance several times. If we can break above to a fresh, new high and wipe out the $72.50 level, that means Cottonwood go much higher.

In the short term though, it does look like the buyers are willing to step in. If we do break down below the bottom of the candlestick for the Monday session, that opens up the door to the 200 day EMA which is currently trading at the $67.25 level. Ultimately though, this is a market that has been very bullish for quite some time, and therefore the fact that we are bouncing from the trend line in the 50 day EMA tells me that there are plenty of traders out there willing to take advantage of value when it occurs.

All of that being said, the market breaks down below the 200 day EMA it’s likely that the market probably unwinds a lot of the bullish pressure that we had seen, and it could in fact show a trend change. At that point the $65 level would be targeted, and then a break below their opens up the door to the $60 handle. That being said, it would take an extraordinarily strong amount of pressure to make that happen and the set up for the trading session is essentially perfect for buyers, as it has at least three factors involved in the market that should continue to push cotton higher.