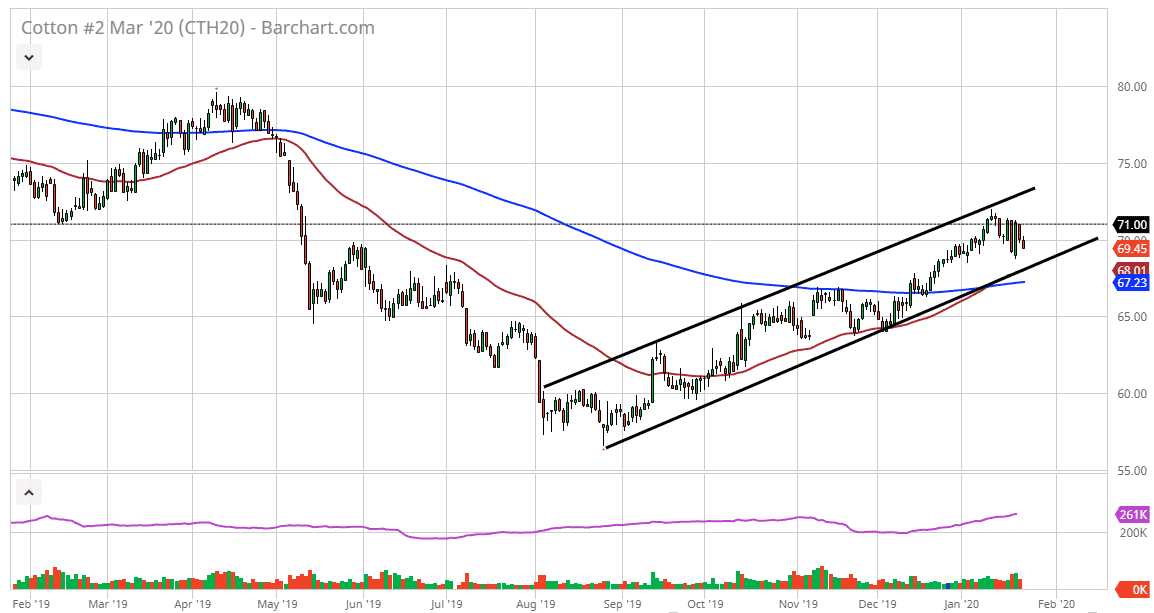

Cotton markets have fallen during the trading session on Friday, breaking below the $70 level. That’s a very important signal as to where we might be going, because quite frankly we are grinding back and forth in order to build up inertia for the next move. This is quite common, especially after we have seen such a strong move in one direction, so it looks as if the market is trying to test whether or not we can build up enough momentum to finally break out to the upside.

Looking at this chart, it’s obvious that there is an up trending channel that has been pushing this market, and of course the 50 day EMA has crossed above the 200 day EMA recently. That is a very bullish sign, and now the 50 day EMA is starting to climb right along with the uptrend line at the bottom of the channel. We are well above the 200 day EMA which in and of itself is a bullish sign but I also recognize that the $71 level is massive resistance.

If we clear the $71 level, then it’s likely that the market goes looking towards the $75 level above. It is going to take a significant amount of inertia to make that happen though, so this grind it makes a ton of sense. If we break above there, then the market is likely to go even further to the upside, but in the meantime, I believe that short-term pullbacks continue to be opportunities for short-term buying opportunities. All of this being said, if the market was to break down below the uptrend line, we will then test the 200 day EMA. Again, remember that the 50 day EMA is trying to fortify the uptrend line, so overall, it’s a very important technical indicator.

The $71 level has been crucial more than once, and therefore it’s very likely that traders will continue to look at it as a massive barrier that takes a lot to get through. If we were to break down through the support levels underneath, the market probably goes down to the $65 level, perhaps even down to the $60 level. That being said though, it’s very difficult to imagine that we break down anytime soon, and therefore it’s likely that we should get a bounce back towards the $71 level in the short term.