Japanese machine orders posted a surprise surge for November, deflating bullish momentum in the CAD/JPY. The Bank of Japan cut the economic forecast on three of its nine regions yesterday but remains cautiously bullish on domestic demand. With the $95 billion core of yesterday’s signed phase-one trade deal between the US and China already in questionable, safe-haven demand is favored to provide a boost to the Japanese Yen. Bullish momentum is fading as this currency pair reached its resistance zone.

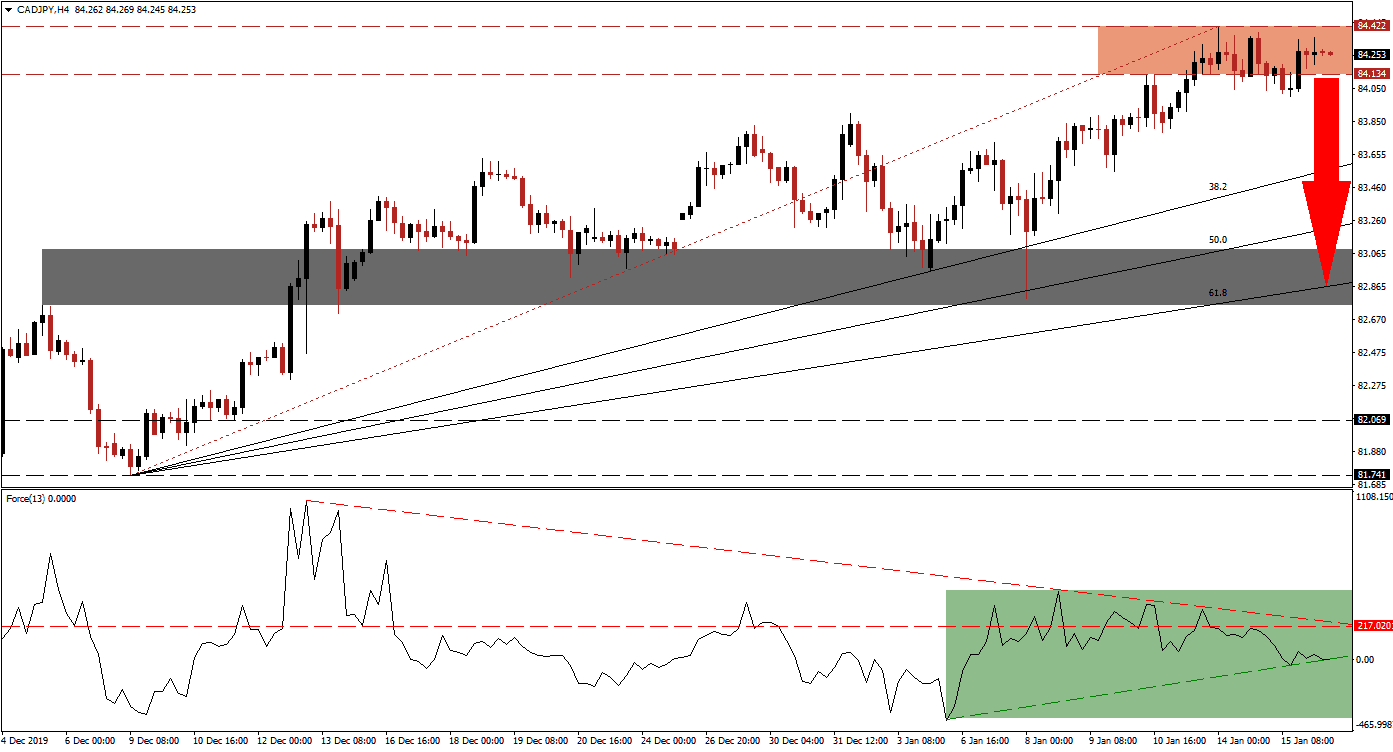

The Force Index, a next-generation technical indicator, has shown signs of weakness after price action bounced off of its ascending Fibonacci Retracement Fan sequence. A series of lower highs led to the emergence of a negative divergence, and the Force Index moved below its horizontal support level, turning it into resistance. A breakdown below the 0 center-line is favored to follow as this technical indicator is now challenging its ascending support level, as marked by the green rectangle. It will place bears in control of the CAD/JPY and preceded a move to the downside.

Following a breakdown in this currency pair below its resistance zone located between 84.134 and 84.422, as marked by the red rectangle, a profit-taking sell-off is anticipated to materialize. It should close the gape to its ascending 38.2 Fibonacci Retracement Fan Support Level. A breakdown below the intra-day low of 83.784 is likely to add new net short positions, enhancing the corrective phase. Adding to bearish developments in the CAD/JPY is the move in price action below its Fibonacci Retracement Fan trendline. You can learn more about a profit-taking sell-off here.

Canadian economic data has disappointed over the past few weeks, and the Bank of Canada has noted that an interest rate cut remains an option. The positive driver of the commodity rally after the spike in US-Iranian tensions is fading, and this currency pair is vulnerable to a breakdown. Price action is expected to move into its short-term support zone located between 82.752 and 83.088, as marked by the grey rectangle. This zone is enforced by its 61.8 Fibonacci Retracement Fan Support Level, and a breakdown extension will require a fresh catalyst for the CAD/JPY.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 84.250

Take Profit @ 82.850

Stop Loss @ 84.650

Downside Potential: 140 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.50

A breakout in the Force Index above its descending resistance level is anticipated to inspire a breakout attempt in the CAD/JPY. The upside potential is limited to its next resistance zone located between 85.224 and 85.696, which would close a minor price gap to the upside. With the long-term outlook for this currency pair bullish, any push higher from current levels represents a good short-selling opportunity.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 84.850

Take Profit @ 85.400

Stop Loss @ 84.650

Upside Potential: 55 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.75