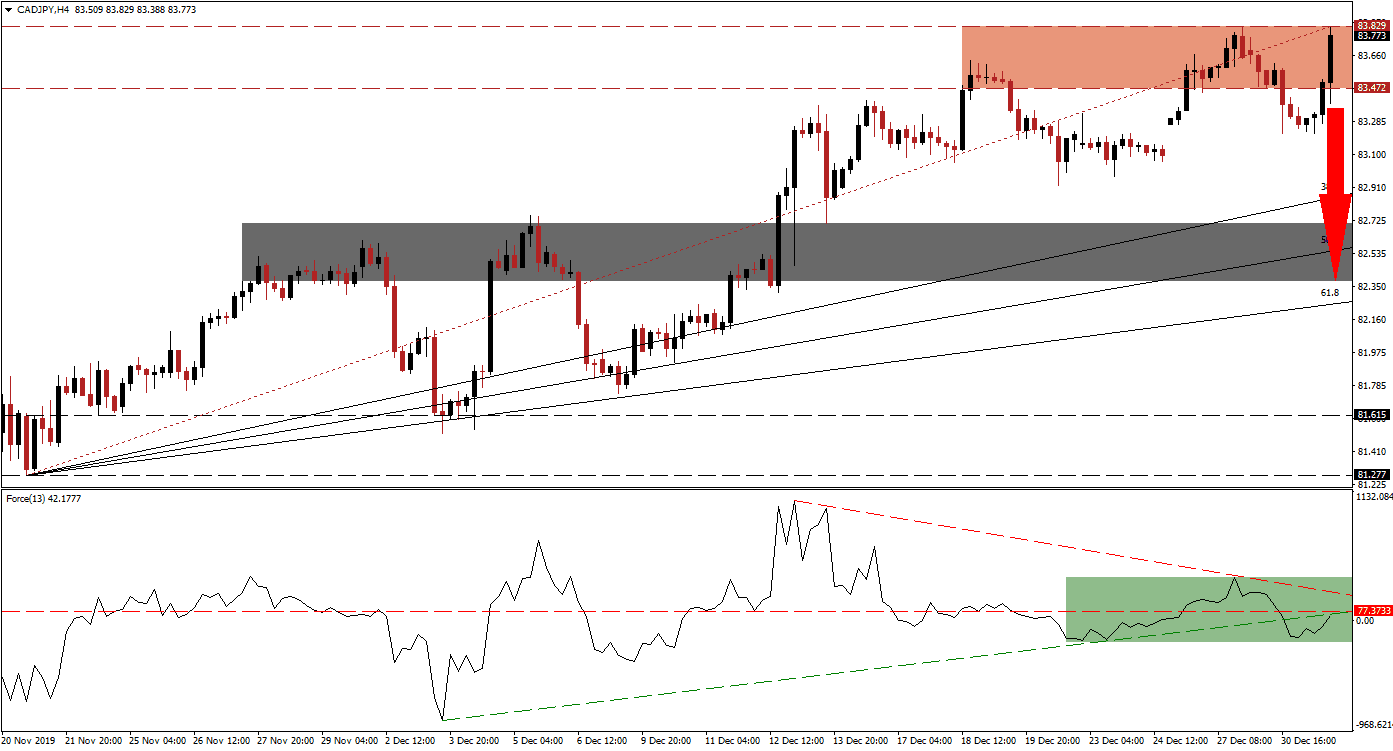

While Japanese economic data has been soft, aiding the rally in the CAD/JPY, the Japanese Yen is anticipated to benefit from the return of a risk-off period. It remains the top safe-haven currency pair for forex traders, and the Canadian Dollar may come under pressure from profit-taking. After this currency pair advanced into its resistance zone, it moved below its Fibonacci Retracement Fan trendline. This added to bearish pressures, and a breakdown is expected to follow. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum after price action initially pushed into its resistance zone. The Force Index was rejected by its descending resistance level, and a double breakdown followed. This technical indicator converted its horizontal support level into resistance, and pushed through its ascending support level, as marked by the green rectangle. The Force Index remains in positive territory, but the descending resistance level is favored to pressure it below the 0 center-line, placing bears in charge of the CAD/JPY.

Bullish momentum is fading inside the resistance zone located between 83.472 and 83.829, as marked by the red rectangle. A breakdown is likely to follow, which is expected to initiate a profit-taking sell-off. This can close the gap between this currency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level. Downside pressures will increase if the CAD/JPY moves below its intra-day low of 83.218, the low of its previous breakdown attempt. You can learn more about a breakdown here.

Price action should be able to move down into its short-term support zone located between 82.375 and 82.706, as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is currently passing through this zone and enforcing it with the 61.8 Fibonacci Retracement Fan Support Level closing in on the bottom range of it. This would keep the uptrend intact, but given the current fundamental outlook, a further breakdown cannot be ruled out. The next long-term support zone awaits the CAD/JPY between 81.277 and 81.615.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 83.750

Take Profit @ 82.400

Stop Loss @ 84.100

Downside Potential: 135 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.86

A breakout in the Force Index above its descending resistance level could inspire a breakout attempt in the CAD/JPY. Volatility is anticipated to increase over the next few trading sessions, as portfolio managers make adjustments for the new year. The long-term outlook for this currency pair remains bearish, and any breakout attempt is likely to remain limited to its next resistance zone located between 84.866 and 85.229. Forex traders are advised to view this as a solid short-selling opportunity.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 84.250

Take Profit @ 85.200

Stop Loss @ 83.900

Downside Potential: 95 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.71