Safe-haven demand, due to the widening crisis posed by the deadly coronavirus, boosted demand for the Japanese Yen. Forex traders ignored the series of disappointing economic reports released out of Japan, home to a central bank debating a deeper excursion into negative interest rates. The Bank of Japan already owns roughly 80% of its domestic equity market and controls its bond market. As bullish momentum in the CAD/JPY is expanding, a short-covering rally is anticipated to follow.

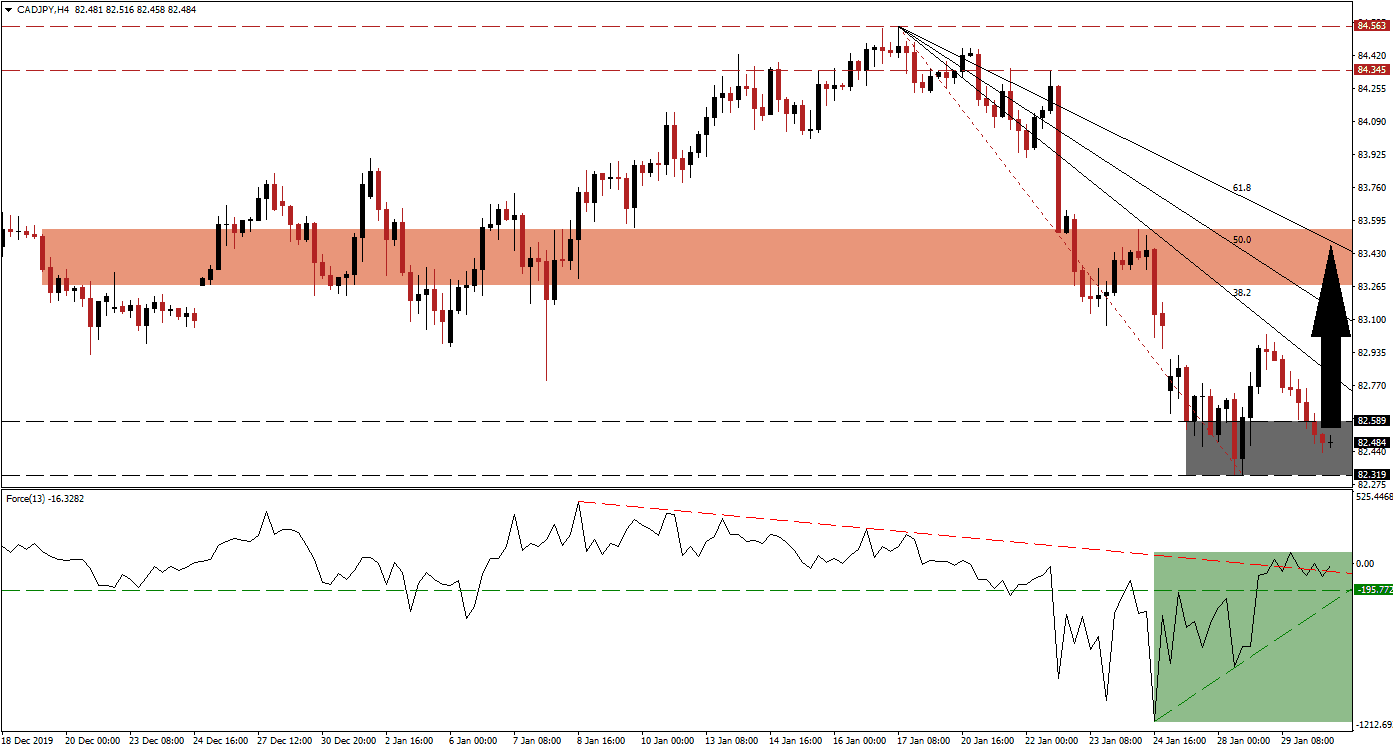

The Force Index, a next-generation technical indicator, initially contracted to a lower low before this currency pair reached its support zone. It quickly recovered as the CAD/JPY extended its sell-off, and a positive divergence formed. The Force Index pushed through its horizontal resistance level, converting it into support. This technical indicator is now completing a breakout above its descending resistance level, as marked by the green rectangle, with its ascending support level adding upside pressure. A move above the 0 center-line will place bulls in charge of price action.

This currency pair has now stabilized inside of its support zone located between 82.319 and 82.589, as marked by the grey rectangle. A breakout is pending, which should result in a short-covering rally with a series of breakouts through its Fibonacci Retracement Fan sequence. Forex traders are advised to monitor the intra-day high of 83.024, the peak of a previously reversed advance. More net buy orders are expected if the CAD/JPY crosses above this level. You can learn more about breakout here.

An advance by the CAD/JPY into its short-term resistance zone, enforced by its descending 61.8 Fibonacci Retracement Fan Resistance Level, will keep the long-term downtrend intact. This zone is located between 83.269 and 83.546, as marked by the red rectangle. Canada is on track to welcome 200,000 economic migrants through 80 programs in 2020, but the impact of the coronavirus has not been priced-in. Following a spike into its short-term resistance zone, a resumption of the long-term sell-off may materialize unless fundamental conditions change.

CAD/JPY Technical Trading Set-Up - Short-Covering Scenario

- Long Entry @ 82.450

- Take Profit @ 83.450

- Stop Loss @ 82.150

- Upside Potential: 100 pips

- Downside Risk: 30pips

- Risk/Reward Ratio: 3.33

A breakdown in the Force Index below its ascending support level is likely to be mirrored by the CAD/JPY. The long-term outlook for this currency pair, despite persistent weakness in the Japanese economy, remains cautiously bearish. Short-term technical developments favor a counter-trend advance, which will ensure the longevity of the long-term downtrend. Price action will face its next support zone between 81.277 and 81.514.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 81.900

- Take Profit @ 81.300

- Stop Loss @ 81.150

- Downside Potential: 60 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 2.40