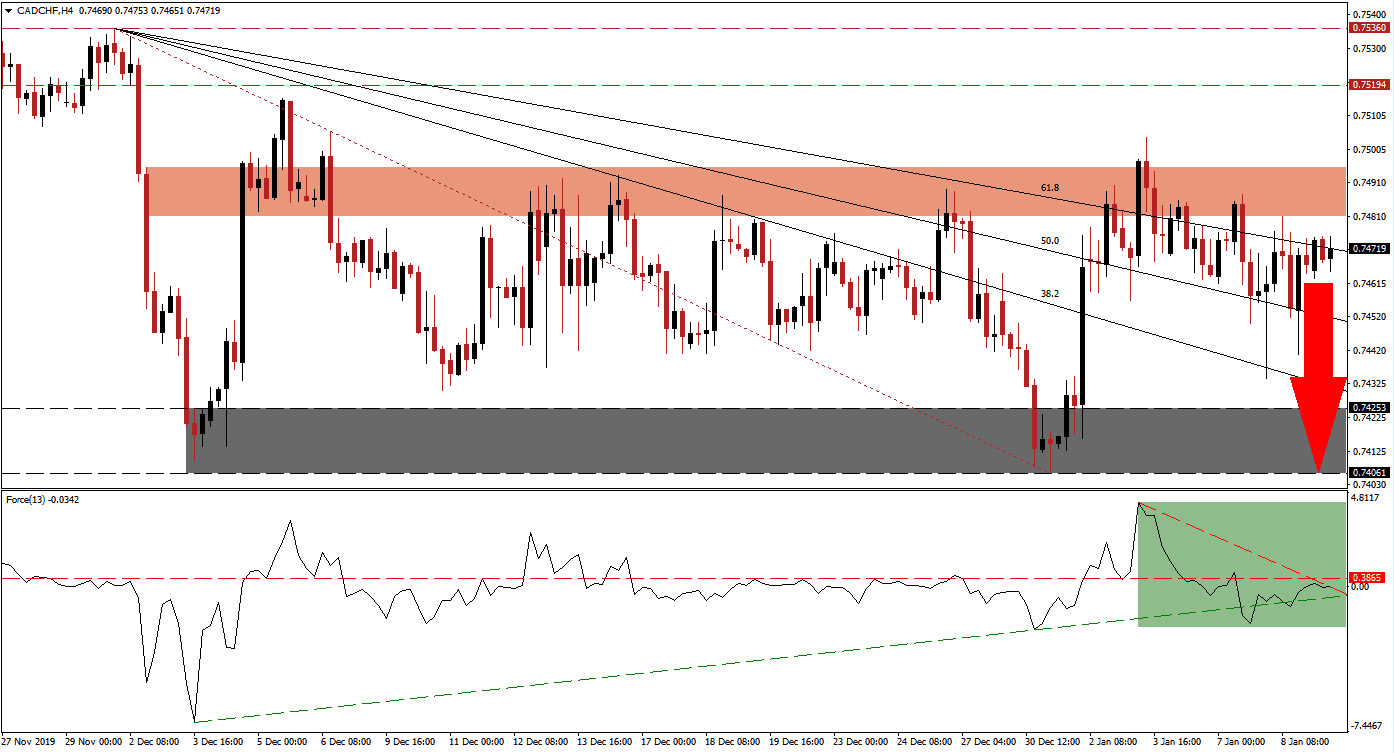

Following a price spike in this currency pair, which led to a brief move above its short-term resistance zone, a bearish chart pattern emerged. Canadian economic data disappointed, adding to selling pressure. The Swiss Franc, a safe-haven asset, is supported by an increase in geopolitical tensions. They have eased over the past 24 hours, but remain at an elevated level. The CAD/CHF has moved back into its descending Fibonacci Retracement Fan sequence, which is favored to guide it farther to the downside.

The Force Index, a next-generation technical indicator, spiked with price action before bullish momentum faded. This led to a breakdown in the Force Index below its horizontal support level, converting it into resistance. Volatility remains heightened, and after a temporary breakdown below its ascending support level, a drift higher emerged, as marked by the green rectangle. Bears remain in control of the CAD/CHF with this technical indicator in negative territory, and the descending resistance level is likely to pressure for more downside.

Due to the breakdown in this currency pair below its short-term resistance zone located between 0.74810 and 0.74953, as marked by the red rectangle, the bearish trend remains dominant. The CAD/CHF has been confined to a trading range between its support zone and its short-term resistance zone, but the rise in volatility is favored to break this pattern to the downside. A breakdown in price action below its 50.0 Fibonacci Retracement Fan Support Level is anticipated to invite a fresh round of nest sell orders. You can learn more about the support and resistance zones here.

Price action is expected to descend into its support zone located between 0.74061 and 0.74253, as marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level is approaching the top range of this zone, from where a breakdown is possible. The Canadian Dollar failed to fully capture the positive impact of higher commodity prices, especially oil, which represents a major revenue source for the Canadian economy. With the ongoing global economic slowdown, more downside in the CAD/CHF should be considered.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.74750

Take Profit @ 0.74100

Stop Loss @ 0.74950

Downside Potential: 65 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.25

A sustained breakout in the Force Index above its descending resistance level with a push above the 0 center-line, may inspire a breakout attempt in the CAD/CHF. With the long-term bearish fundamental outlook in this currency pair, any breakout attempt should be viewed as a great short-selling opportunity. The next resistance zone is located between 0.75194 and 0.75360.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.75050

Take Profit @ 0.75350

Stop Loss @ 0.74900

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00