After the Bank of Canada kept its interest rate unchanged at 1.75%, in a move widely anticipated by financial markets, the central bank did lower its 2020 economic growth forecast. This sent the Canadian Dollar into a sharp sell-off, with the CAD/CHF plunging into its support zone. While the cut merely resembled 0.1% to an annualized GDP expansion of 1.6%, it does reflect a trend likely to be echoed across many central banks as they reassess economic reality. The BoC noted that global uncertainty is affecting the domestic economy more than previously predicted.

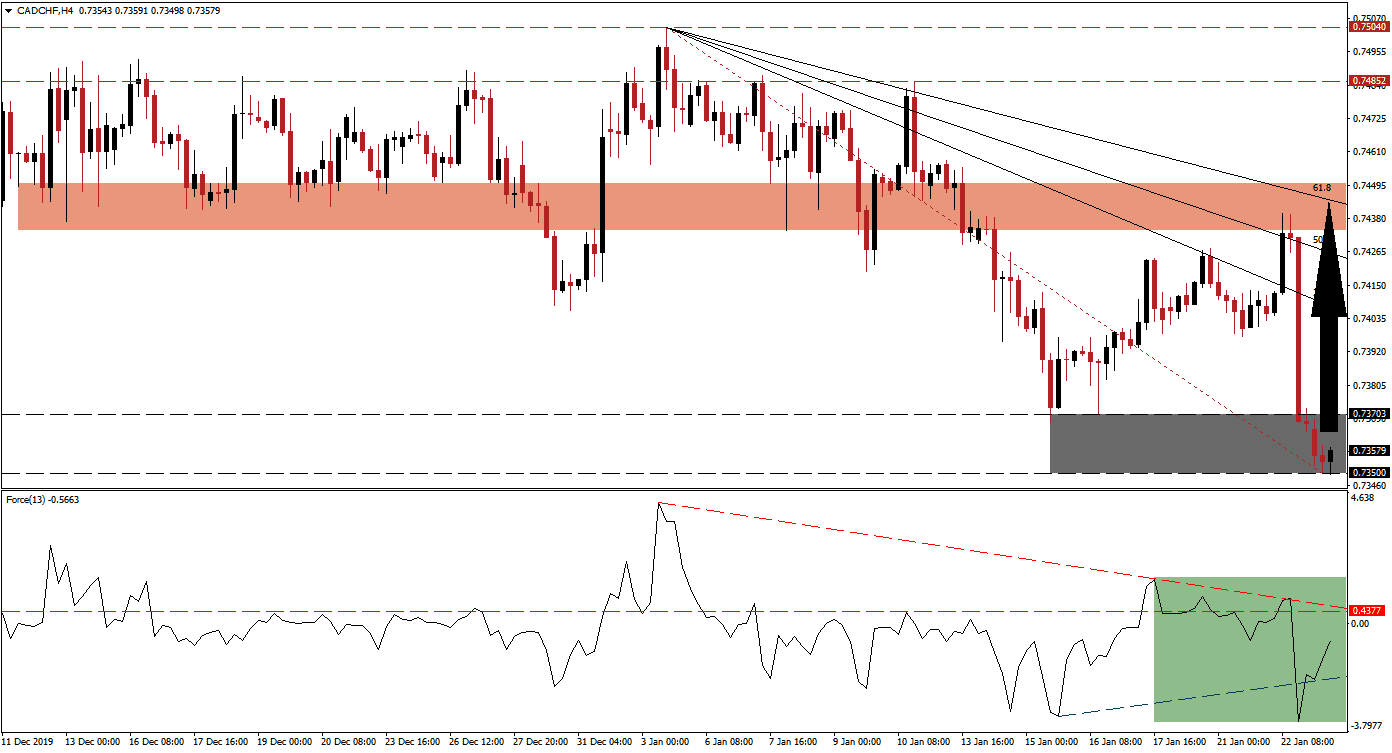

The Force Index, a next-generation technical indicator, confirmed the collapse in price action with a temporary drop below its ascending support level. It was quickly reversed as bullish momentum is expanding, and the Force Index is expected to cross above the 0 center-line, allowing bulls to take control of the CAD/CHF. A breakout in this technical indicator above its descending resistance level is likely to materialize, leading this currency pair into a reversal. You can learn more about the Force Index here.

A breakout in the CAD/CHF above its support zone located between 0.73500 and 0.73703, as marked by the grey rectangle, is favored to ignite a short-covering rally. The Swiss National Bank, known for its market manipulation, may additionally step in and prevent a strengthening of its currency. Adding to short-term bullish developments was the move in this currency pair above its Fibonacci Retracement Fan sequence, which materialized inside of the support zone.

Price action is anticipated to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. The pending breakout sequence in the CAD/CHF may extend into its 61.8 Fibonacci Retracement Fan Resistance Level, from where more upside will require a new fundamental catalyst. This level is currently crossing through the short-term resistance zone located between 0.74340 and 0.74499, as marked by the red rectangle. You can learn more about a breakout here.

CAD/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.73550

Take Profit @ 0.74400

Stop Loss @ 0.73300

Upside Potential: 85 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.40

In case of a reversal in the Force Index below its ascending support level, the CAD/CHF is likely to attempt a breakdown. The fundamental outlook for this currency pair remains uncertain, which favors a resumption of the long-term downtrend, due to the safe-haven appeal of the Swiss Franc, with the SNB interference a wild card. A breakdown from current levels can take price action into its next support zone, located between 0.71768 and 0.72117.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.72900

Take Profit @ 0.71800

Stop Loss @ 0.73300

Downside Potential: 110 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.75