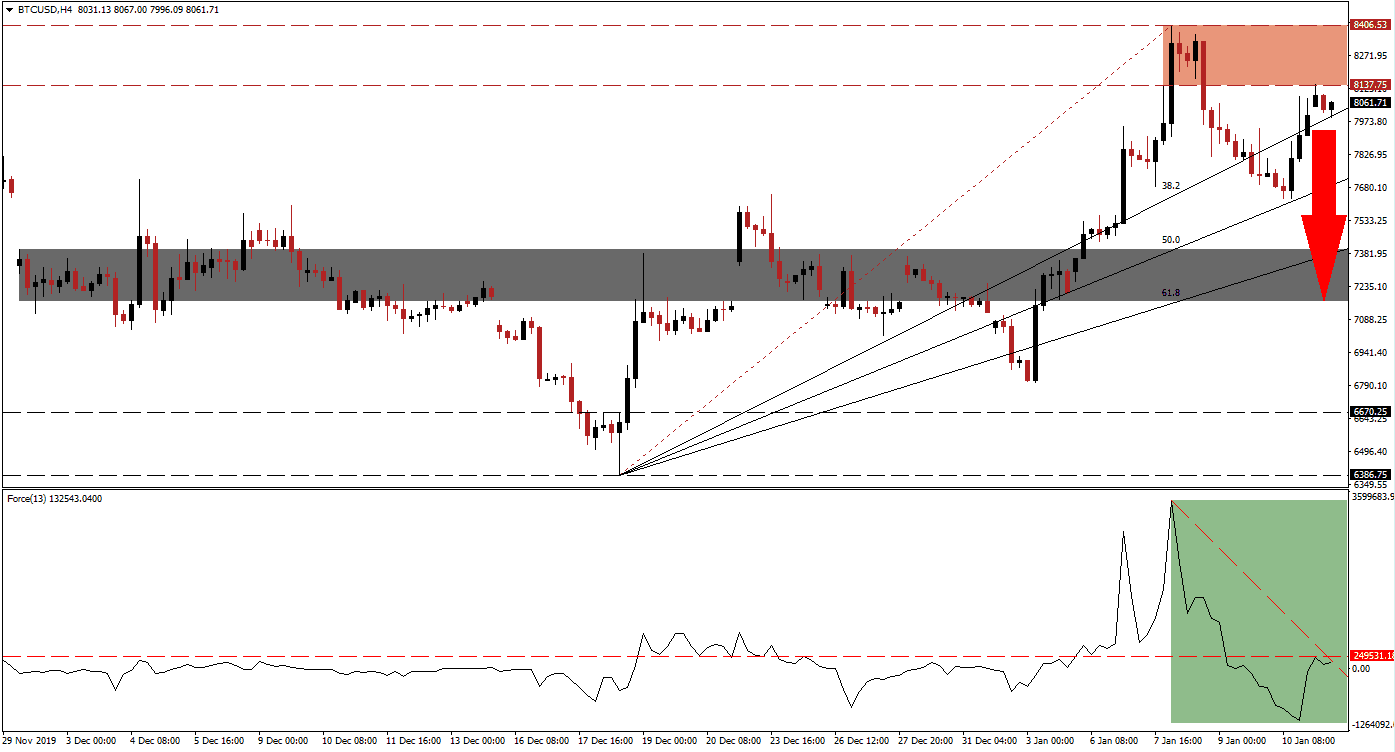

Volatility has returned to the cryptocurrency market, and Bitcoin added over $2,000 from its December intra-day low of 6,386.75 to its current January intra-day high of 8,406.53. While euphoria over the rally in the BTC/USD to start 2020 remains elevated, early signs of a breakdown in the uptrend have materialized. Bullish momentum collapsed after this cryptocurrency pair failed to push through its resistance zone. This year’s third halving event in Bitcoin remains in the headlines, but it ignores key developments. You can learn more about a breakdown here.

The Force Index, a next-generation technical indicator, spiked together with price action during the 30%+ rally. After this cryptocurrency pair moved into its resistance zone, bullish momentum quickly contracted. It pushed the Force Index below the 0 center-line to a fresh low, as marked by the green rectangle. This technical indicator recovered into positive conditions but stalled at its horizontal resistance level. A descending resistance level formed, favored to pressure the Force Index into negative territory, placing bears in control of the BTC/USD.

After this cryptocurrency pair failed to keep the uptrend alive, the corrective phase that followed took it into its ascending 50.0 Fibonacci Retracement Fan Support Level. A quick advance materialized but was rejected by the bottom range of its resistance zone. This zone is located between 8,137.75 and 8,406.53, as marked by the red rectangle. The 38.2 Fibonacci Retracement Fan Support Level is now approaching, and increasing pressures for either a breakout or breakdown. Due to the loss in bullish momentum, a profit-taking sell-off in the BTC/USD is anticipated.

This cryptocurrency pair is expected to descend into its short-term support zone located between 7,170.50 and 7,399.70, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is on the verge of exiting this zone, and a push below it will increase bearish pressures. A correction into this support zone will additionally close two previous price gaps, oner to the downside and one to the upside. It may also establish the BTC/USD price floor for 2020, with a bullish long-term outlook. You can learn more about a price gap here.

BTC/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 8,050.00

Take Profit @ 7,170.00

Stop Loss @ 8,250.00

Downside Potential: 88,000 pips

Upside Risk: 20,000 pips

Risk/Reward Ratio: 4.40

In case of a renewed push higher in the Force Index, the BTC/USD may attempt a third breakout. The next resistance zone awaits this cryptocurrency pair between 9,040.80 and 9,315.00. Until the having event on May 20th 2020, traders should watch out for a series of higher highs and higher lows. The previous two events pushed price action higher, this time the outcome may be less favorable.

BTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 8,550.00

Take Profit @ 9,160.00

Stop Loss @ 8,300.00

Upside Potential: 61,000 pips

Downside Risk: 25,000 pips

Risk/Reward Ratio: 2.44