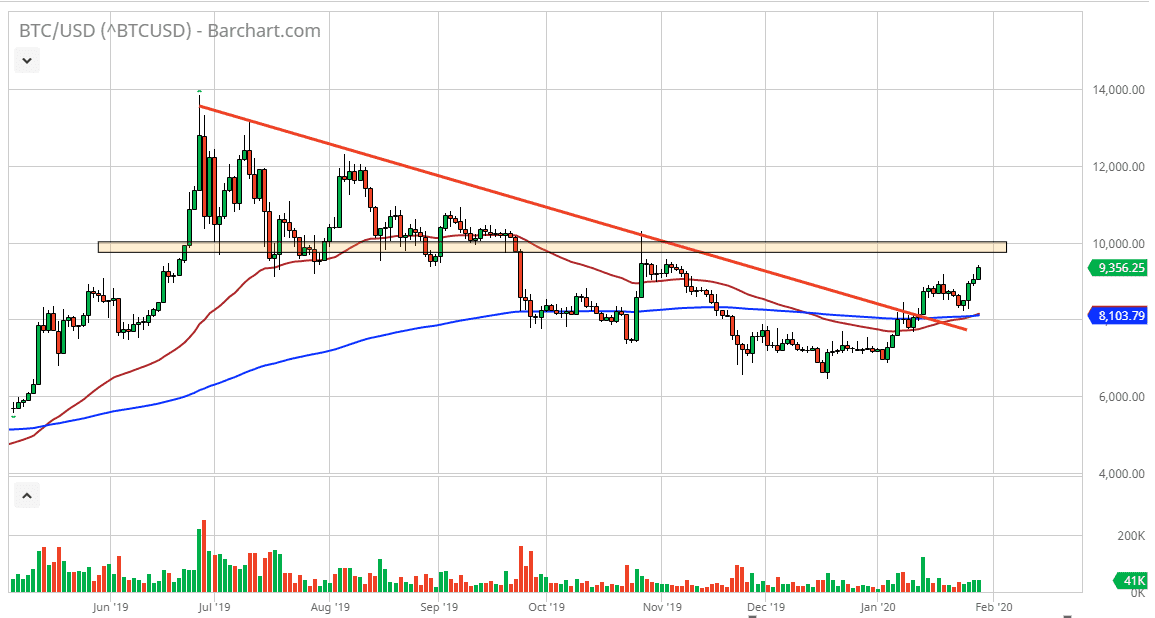

Bitcoin markets continue to plow higher, and during the day on Wednesday even managed to break above the top of the shooting star from the previous session that signals such strength. At this point, the market looks very likely to go looking towards the $10,000 level, an area that obviously catches a lot of attention. This is an area that has been important more than once, so it does look very likely to continue to cause a bit of noise. This is an area that has seen a lot of noise recently, going back a few months. It has been both support and resistance, and at this point we should see more of the same. In other words, I believe that the next day or two will probably be somewhat positive but clearly there will be a lot to work through once we get closer to the $10,000 level.

If we were to close above the $10,000 level on a daily or perhaps even a weekly chart, then it’s likely that the market then goes looking for $10,500 followed by the $11,000 level. If we fail there, then the market probably pulls back towards the $9000 level. The 50 day EMA is currently crossing above the 200 day EMA, the so-called “golden cross” which of course is a very bullish sign. All things being equal, it’s very likely that the market will continue to pay attention to whether or not the US dollar strengthens, and of course whether or not the crypto markets in general attract monetary flow. I do think that breaking above the $10,000 level is going to take a significant amount of momentum, but I am the first person to admit that we are starting to see a lot of strength in this move. Even though I am a well-known skeptic when it comes to Bitcoin, price is price, and price is what matters. At this point, it looks as if pullbacks will be thought of as buying opportunities, and therefore it’s not until we break down below the moving averages underneath that I would consider the uptrend that has just started to be threatened. However, I will keep you up-to-date if I hear or see something that makes me change my mind here at Daily Forex. With that being the case, position sizing will be crucial, so therefore you need to keep that in mind.