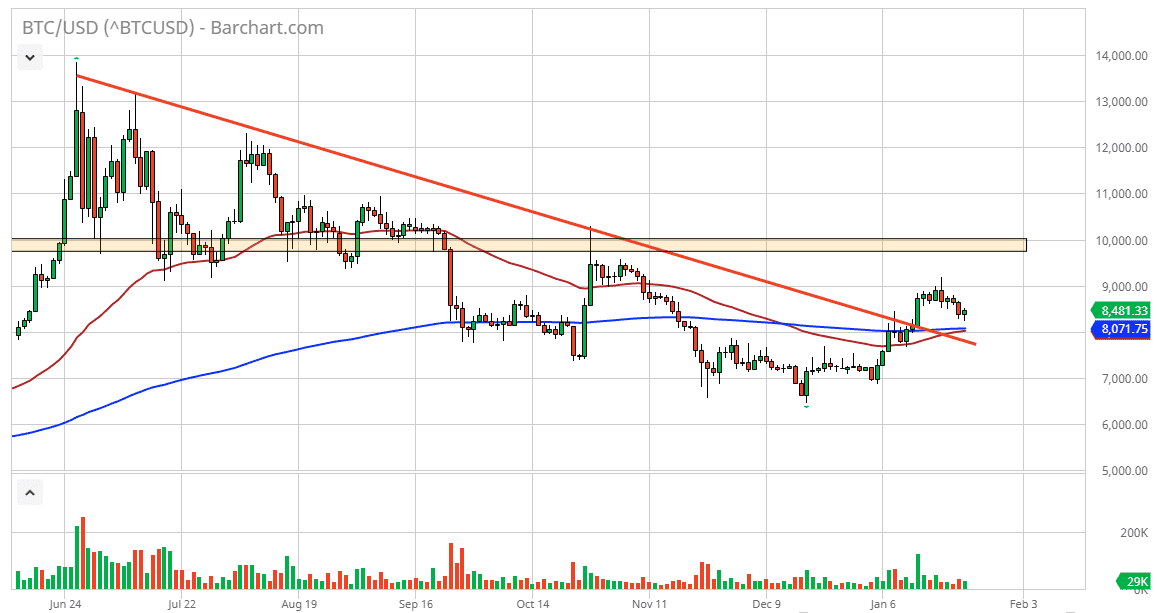

Bitcoin markets have been rather positive as of late but have also pulled back the last couple of days. At this point, we are making a bit of an argument for a potential bounce, but it should also be noted that we are in an area that is crucial longer term, so it will be worth paying attention to what happens next. I believe at this point the fact that the 50 day EMA is trying to cross above the 200 day EMA could be a sign that the longer-term uptrend might be trying to form, but you can say the exact opposite about the action from 30 days ago and it didn’t exactly fall apart at that point.

We have recently broken above a major downtrend line, and now it looks as if we are trying to find support in the same area. This coincides nicely with the moving averages, so it is possible that we do get a bit of a bounce, and the fact that the daily candlestick looks like it could form a bit of a hammer suggests that there are in fact some value hunters looking to get involved. If we do get a bounce from here, I think it’s a fairly safe assumption to think that we might be going to the $9000 level. After all, that was resistance recently, and therefore it would make sense that we would see a lot of noise in that general vicinity.

If we were to turn around and breakdown below the moving averages and perhaps even the downtrend line, which is just below the $8000 level, the market is likely to go much lower. At that point, the market will unwind and go looking towards the $7000 level, perhaps even the $5000 level. Based upon longer-term analysis, I had anticipated a move down to the $4800 level, and although we’ve had a nice bounce, it still is a very real possibility as long as we can stay below the $10,000 level. The next couple of trading sessions could be crucial as to whether or not we try to revisit that level or break down, so pay attention. Overall, this is a market that continues to undulate back and forth and even though we have broken above the downtrend line, we haven’t necessarily completed a change in trend. That will perhaps prove itself if we can break above the highs from earlier in the week.