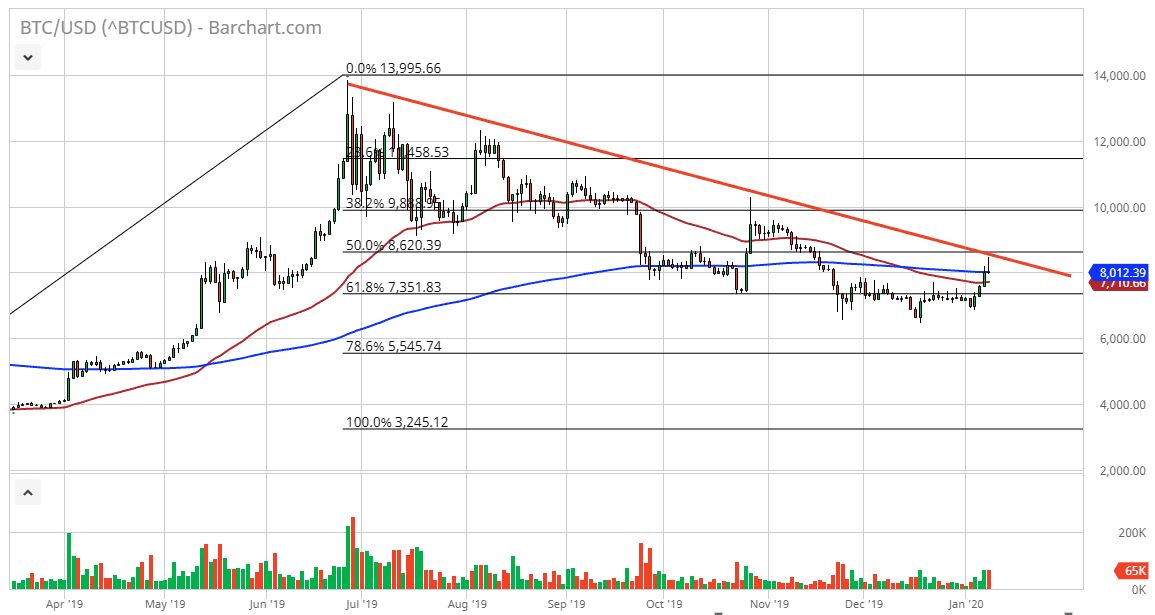

Bitcoin initially shot higher during the trading session on Wednesday, reaching towards the trendline marked on the chart and looking very much like a market that was trying to break out. However, we found resistance again at the $8500 level, and sold off quite drastically to form a shooting star. The shooting star of course is a very negative candlestick, and the fact that it is sitting at the 200 day EMA is a very clear sign of resistance. At this point, if we can break down below the lows of the trading session, or just essentially below the $8000 level, it’s likely that the market will continue to go much lower.

At this point, Bitcoin probably got most of its boost due to the missiles flying in Iraq as Iranians launched over a dozen missiles at bases housing US troops. However, they steered clear of actually hitting the basis, so this was more or less for show than anything else. That crushed the “run for safety” that may have influenced Bitcoin during the day, and now it looks likely that the market is going to continue the overall negativity that we have seen.

By forming the shooting star that we have, it shows that the market does not have the momentum to break out to the upside, it’s very likely that we will go looking to revisit the downside. I expect that this market will continue to see plenty of selling, and quite frankly as long as we remain “risk off”, Bitcoin will continue to struggle. Otherwise, if the market was to break above the top of the shooting star and essentially the $8500 level, then it would be a massive breakout to the upside, perhaps reaching towards the $10,000 level which of course has a large, round, psychological barrier attached to it. That being said, it’s obvious that the market is very negative over the last several months, and there’s really no reason to think that anything will change and that we should continue to fall apart. The Bitcoin offer of safety has been stripped away, so it makes no sense that Bitcoin would continue to go higher. Quite frankly, there’s no use for it and adoption is minimal at the very least. It’s not a payment system, but people are trying to use it as some form of “digital gold.” Because of this, Bitcoin has started act very much like gold.