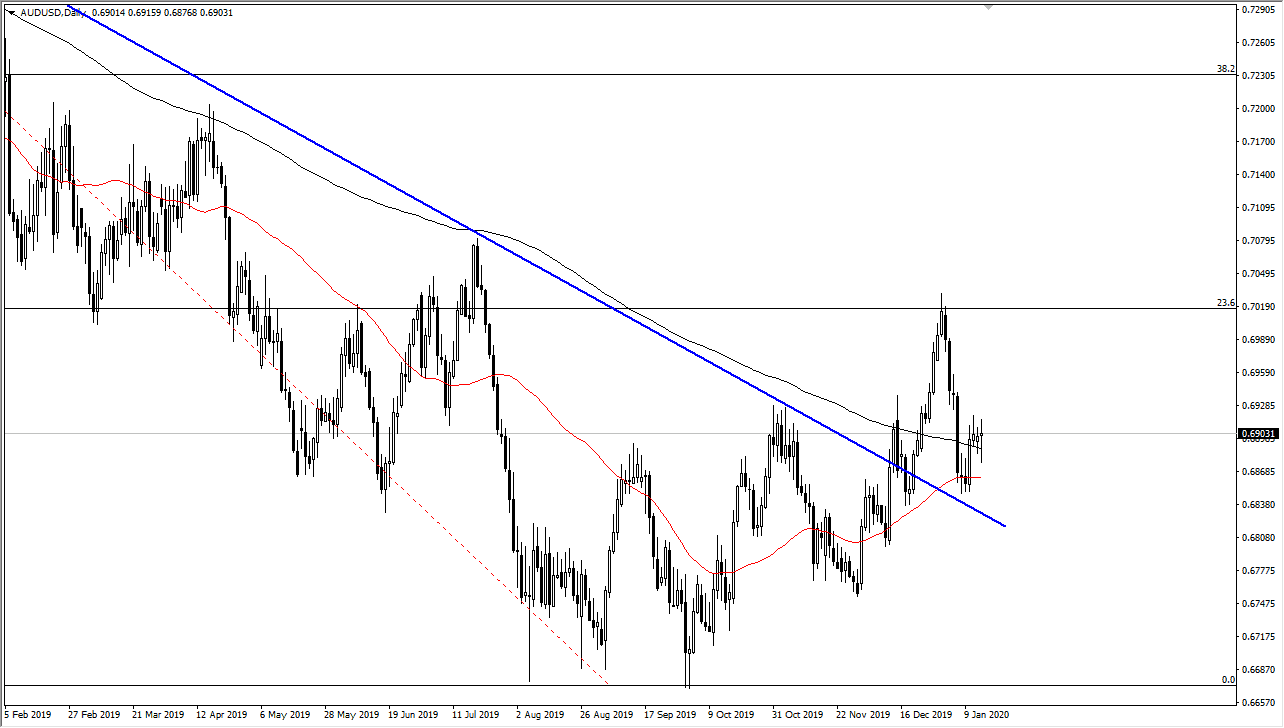

The Australian dollar has gone back and forth during the trading session on Wednesday, dipping below the 200 day EMA before turning around to show signs of support. By forming the hammer that we have, it shows that the Australian dollar is refusing to give up, and therefore I think that we will continue to go to the upside. If we can break above the shooting star shaped candle during the trading session on Monday, the market is likely to go higher, perhaps reaching towards the 0.7020 level. If we can break above that, then the market will have completely confirmed a major trend change.

It is worth noting that both the United States and China have signed on to the “Phase 1 deal”, and that should help Australia over the longer term as the Chinese will be buying more Australian commodities. Beyond that, we have quite a bit of technical signals that show that perhaps the tide is changing when it comes to the Aussie dollar.

This doesn’t mean that the market is going to be easy to trade, nor is it going to suddenly explode to the upside. That being said though, the 200 day EMA underneath should continue to offer support, just as the 50 day EMA will below that. The 50 day EMA crossing above the 200 day EMA would also be an extraordinarily bullish sign, as it is the so-called “golden cross” that so many longer-term traders look to. All things being equal I believe that this market will continue to go higher and I do think that given enough time we will find buyers to pick up the Aussie dollar as it is so cheap from historical perspectives. If we turn around and breakdown below the 0.68 level however, then I think that would be a pretty negative sign. It wouldn’t necessarily mean that we are going to collapse at that point, but it certainly throws the idea of a trend change a bit out of the window, and it could show the markets as being very difficult and confused. This is a great barometer for risk, especially with Asian markets. With this, I am of the thought process that a longer-term move to the upside is coming, and we are right on the precipice of it. When these potential trend changes come though, they tend to be very messy and noisy.