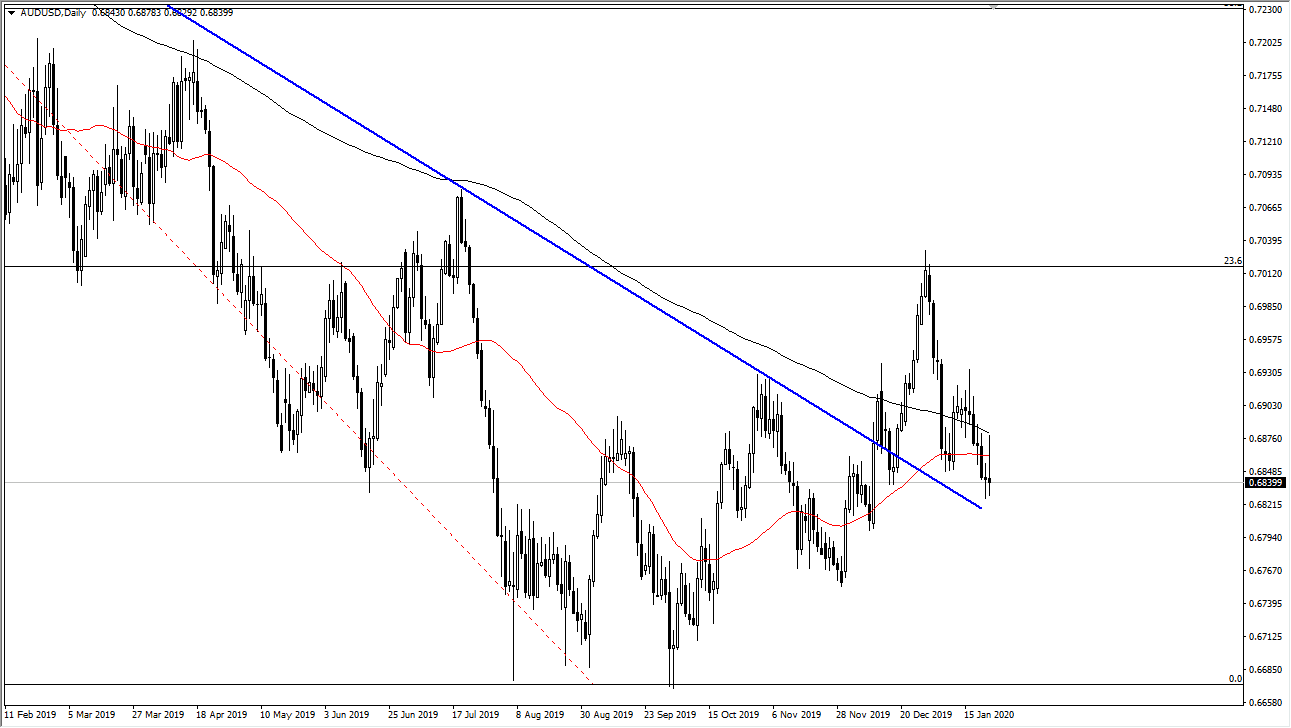

The Australian dollar has been all over the place during the trading session on Thursday, initially shooting higher due to the employment figures being better than anticipated. In fact, the employment figures for the month of December were almost twice as good as anticipated, and this of course sent the Australian dollar straight up in the air and reaching towards the 200 day EMA. That being said, we have turned right back around to show signs of exhaustion at that point. The candlestick for the day is very negative as it is an inverted hammer, which of course is a positive sign if you can break above the top of it. Not only would that be positive by breaking through the resistance during the trading session on Thursday, but it would also show the market breaking out above the 200 day EMA.

On the other hand, if the market reaches down to the previous downtrend line, there should be plenty of support. However, the Australian dollar breaks down below the 0.68 level it’s likely to go much further. If that happens, then I think you can anticipate that the market would break down towards the 0.67 level, as it is a massive support level.

To the upside, if we were to break out it’s likely that the market would try to grind its way towards the 0.70 level, where we had seen sellers jump back in. This is a market that’s going to be all over the place as the US/China trade situation has gotten a bit better or at least has calmed down a bit. However, the question now is whether or not we can turn around completely? The 50 day EMA is starting to reach towards the 200 day EMA, and if we were to break above there, then it would be a sign that longer-term traders might be getting involved. To the downside, if we were to break out to a fresh, new low then we will start to test the lows during the financial crisis over a decade ago. That is an extreme low level, so I do think that eventually value hunters will get involved and push this market to the upside. The fact that we broke above the downtrend line was a good sign, but even if that were the case it’s quite often that these trend changes are extraordinarily messy situations, so even if this market rallies and is ready to go higher, it’s not going to be easy.