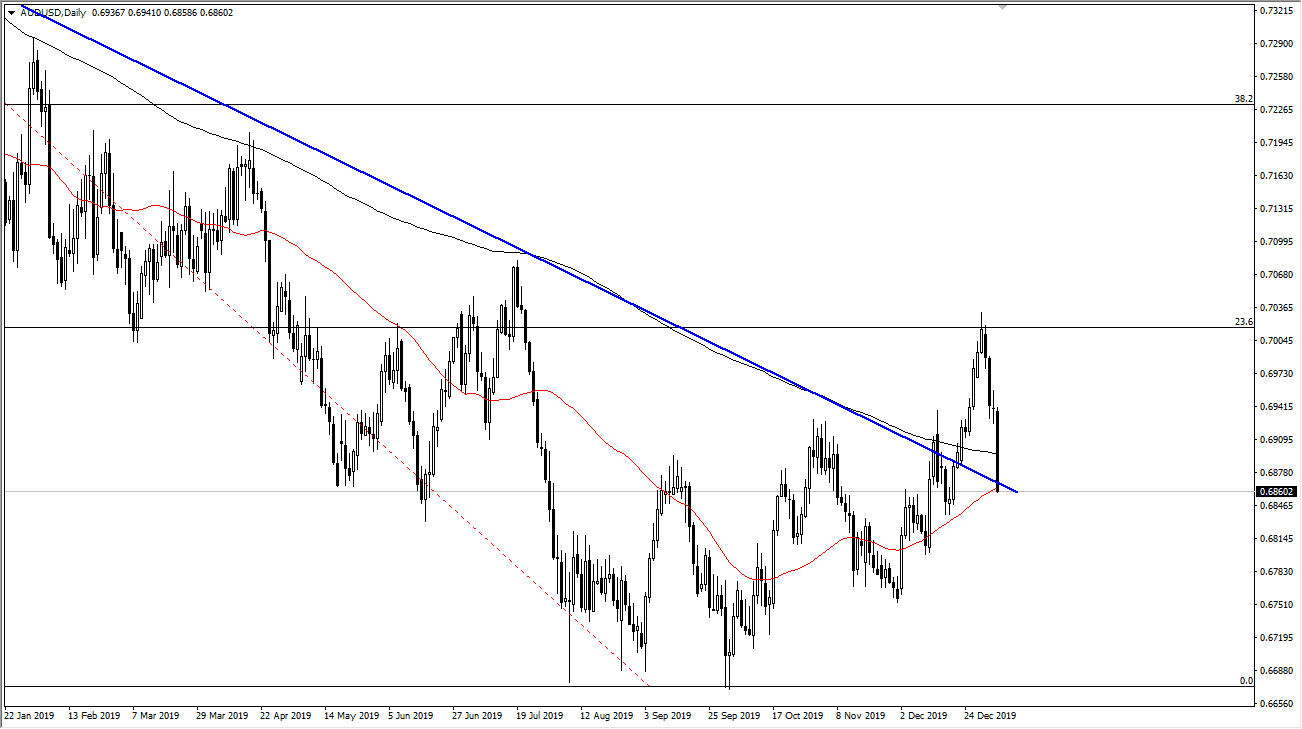

The Australian dollar has broken down significantly during the trading session on Tuesday, testing the previous downtrend line. That is an area that needs to hold for support, and it does coincide quite nicely with the 50 day EMA. That’s an area that could very well in fact offer enough value to attract those looking to pick up the Australian dollar “on the cheap.” The question now is whether or not we started to form a trend change? So far it still looks as if we are, but the market has certainly tested that theory during trading on Tuesday. Because of this it might be best to let the market run for 24 hours before you put money to work, but at this point in time I still suspect that the upside is where we are going given enough time.

The size of the candle from the Tuesday session is rather negative, considering that it is so long. Ultimately, I think that the market is going to be very noisy in this area, because the Australian dollar is highly sensitive to the US/China trade situation and also a geopolitical issues such as the Iranians situation with the Americans. That being said, the Chinese have suggested that they were not going to be buying as much grains as initially indicated, and that could put the US/China trade deal in jeopardy. They haven’t clarified yet though, because they have just agreed to by agricultural products, not necessarily grains. China needs soybeans and pork more than anything else, so it is possible that clarification will come out that helps elevate the Aussie as far as the US/China trade situation is concerned.

Regardless, I’m a technical analyst so therefore I only keep the fundamental news in the background as price will do whatever it wants to do. If prices going higher, and I think that it should be going lower, price will end up going higher. The markets never do with a “should do”, only what they “will do.” Ultimately, price has been rising as of late in the Aussie dollar but the last couple of days have been rather brutal. This shows just how on edge traders are, but the fact that we are still forming “higher highs and lower lows”, as long as that’s going to be the case it is a market you should be buying, although with a significant amount of caution.