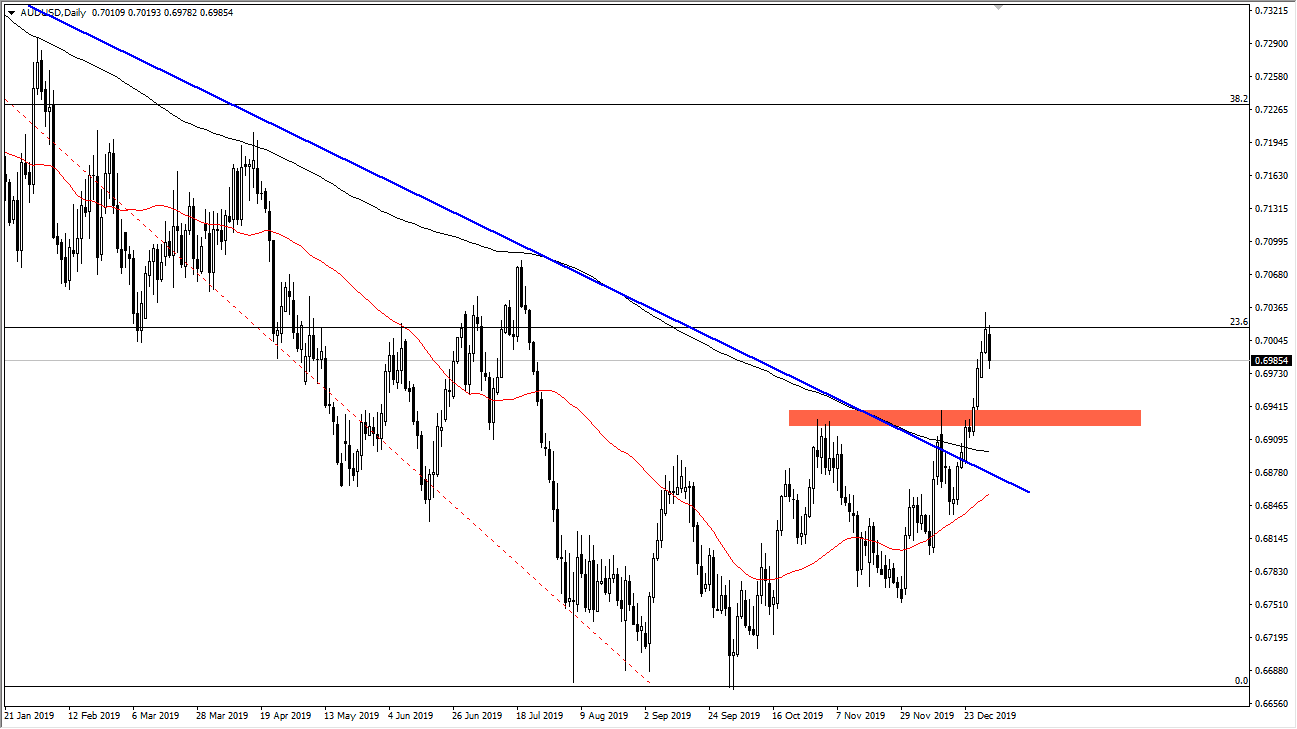

The Australian dollar has initially tried to rally during the trading session on Thursday but found the market a bit overextended. That being the case, the market is very likely to reach towards the 0.6950 level underneath. That is an area that was previous resistance, so therefore it should be support now. We have broken above major resistance barriers to show signs of strength in the Australian dollar, so I feel at this point pullbacks will offer value given enough time.

Looking at this chart, you can see that I have it clearly marked as an area that should be of interest. The downtrend line has been broken to the upside as well, just as the market has broken above the 200 day EMA. Because of this, there should be plenty of buyers in that general vicinity, and therefore I’m hoping to see an opportunity to get long of the Aussie dollar in that vicinity. Furthermore, the 50 day EMA is starting to curl higher, perhaps reaching two and then eventually through the 200 day EMA. The fact that we pullback should not be a huge surprise, because quite frankly we had gotten so overextended and also had reached towards the 0.70 level which will attract a certain amount of attention anyway.

Overall, keep in mind that the Australian dollar is highly sensitive to the US/China trade situation, and therefore as long as we have some type of positive momentum in the trade war, the Australian dollar should continue to benefit. Australia provides China plenty of raw materials for construction and manufacturing. In that sense, Australia is the easiest way to play China, as the connection is so tight. Beyond that, it’s very difficult to trade the Chinese currency, so quite often the Australian dollar is used as a proxy.

With this, to me it looks like the market is trying to change its overall trend, and these tend to be very messy affairs. By pulling back from here, it should offer plenty of value given enough time. Be patient, you should get a nice set up below, especially near that previously mentioned 0.6950 level. However, if the market did break out to the upside to make a fresh, new high before doing so, then you have to assume that we are going to go looking towards the 0.71 level next. I am bullish and have no interest whatsoever in shorting this market.