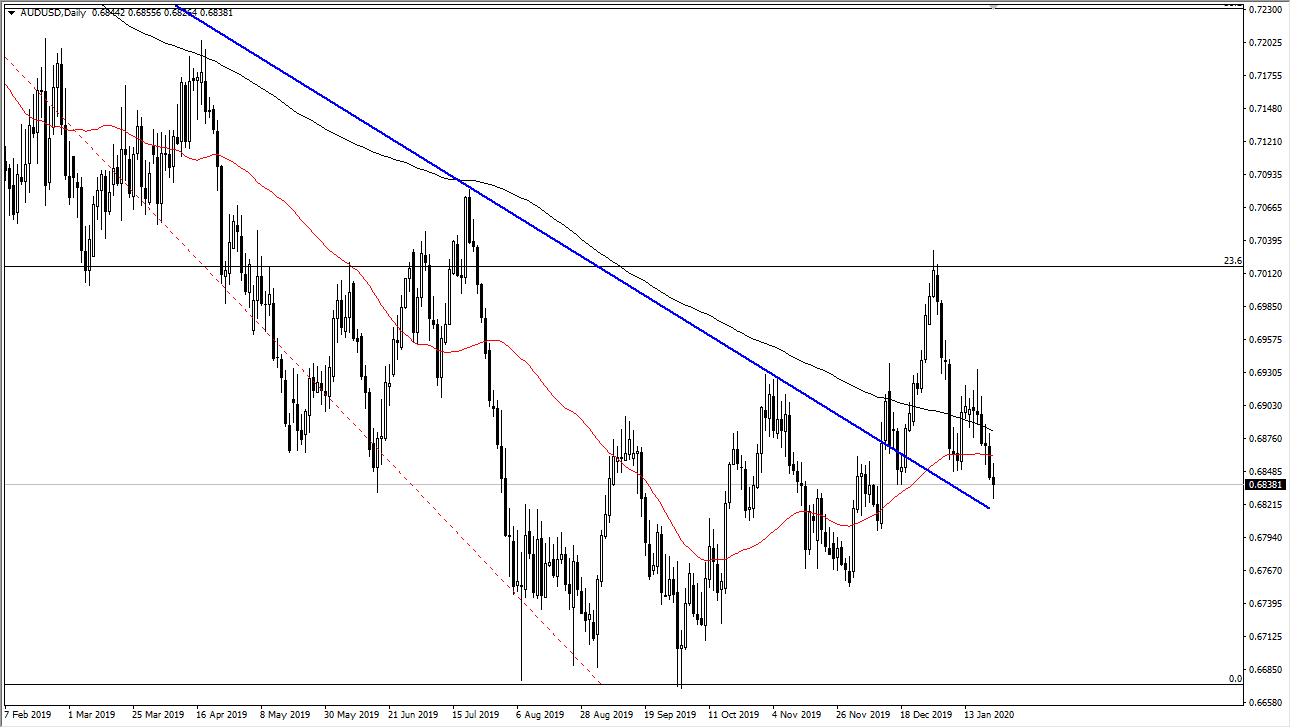

The Australian dollar has gone back and forth during the course of the session on Wednesday, as we had reached towards the down trending line that previously had been resistance. Now that we have retested this yet again, it shows just how resilient this line is. At this point, it looks as if the Australian dollar is trying to turn things around and I even believe that we could be looking at a potential trend change. However, trend changes are an absolute nightmare to deal with at times, because they don’t necessarily turn around right away unless something drastic happens. The typical trend change is a very noisy and difficult, so therefore this action is not a huge surprise. That being said, there are a lot of moving pieces when it comes to the Aussie dollar right now.

The wildfires in Australia continue to be a major issue, and I do think that it will continue to weigh against the value of the Aussie. However, at the same time we have seen the United States and China cool off the trade tensions, which in and of itself is rather good for the Australian dollar as the Australian economy is highly pushed around by the Chinese demand for commodities.

That being said, if we can break above the top of the candlestick from the trading session on Wednesday, then it would show that the market could very well go looking towards the 200 day EMA, possibly even higher than that. At this point, the market looks confused at best, so no matter what happens next it probably isn’t going to be an easy move.

Ultimately, if we break down below the 0.68 level then I think the market probably rolls over completely. Otherwise, if we can clear the 200 day EMA to the upside it would be yet another breach of that potential resistance barrier, wearing down the usefulness of that indicator in the short term. Because of that, then I think the market would probably be much more comfortable being at those higher levels. Ultimately, this is a scenario that I believe will eventually present itself as an easier trade, but we need an impulsive candlestick. The initial surge towards the 0.70 level has been repelled, but the fact that we did break that much higher suggests that a lot of damage has been done to the sellers, something that we may see proven again rather soon.