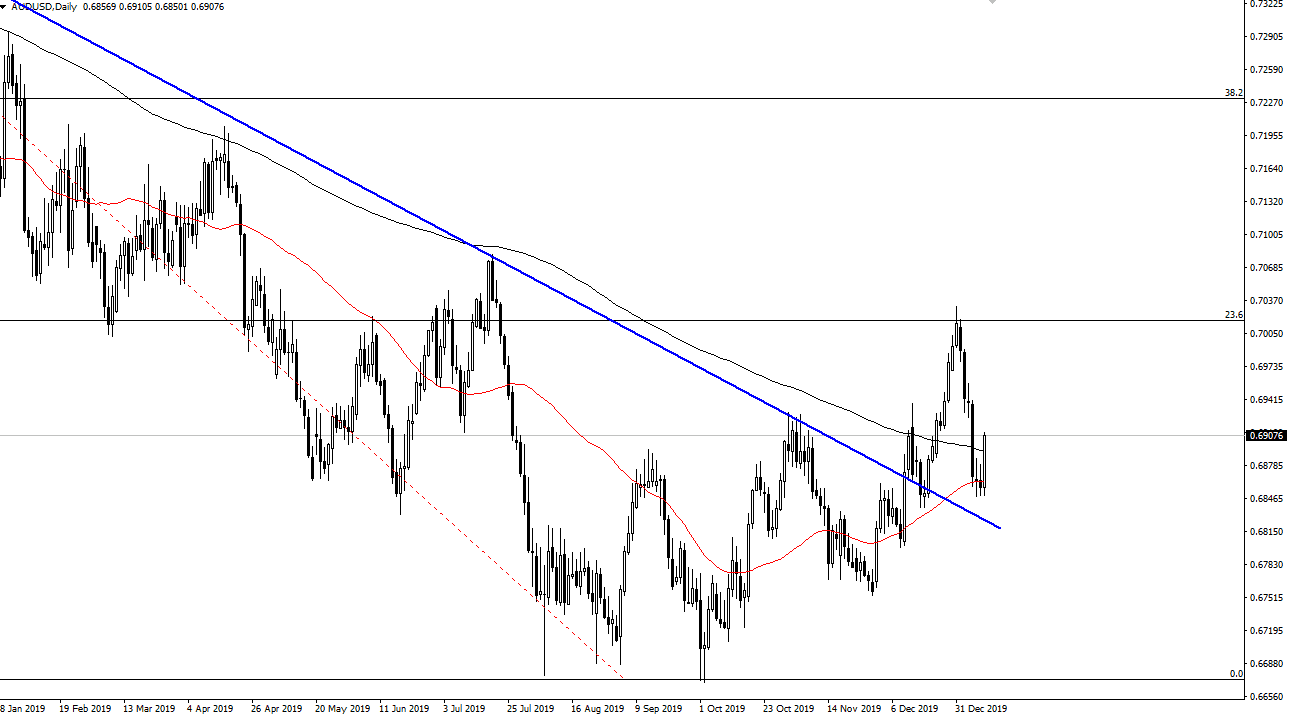

The Australian dollar has rallied significantly during the trading session on Friday, breaking above the 200 day EMA in a shows strength yet again. Ultimately, this is a market that should continue to see buyers coming in as we are starting to see the effects of an easing of tensions between the Americans and the Chinese. Quite ironically, the massive falloff in value had more to do with the troubles between the Americans and the Iranians than the Americans and the Chinese which had been the case for several months.

The fact that the market has closed above the 200 day EMA suggests that we are in fact going to continue going higher, and of course the fact that the market has broken well above the top of a couple of inverted hammer’s is also a very bullish sign. It looks as if the 50 day EMA is going to be respected, so I do think that given enough time we will eventually see this market looking towards the highs again closer to the 0.7050 level. The Australian dollar is likely to continue to attract inflows, as it is more of a “risk on” type of market, and of course the Americans had seen lower than anticipated jobs number coming out on Friday, so we have seen a bit of a negative tilt towards the US dollar over the last 24 hours. All things being equal it looks as if we are going to continue the upward push that we had seen start a couple of weeks ago, as we are trying to change the overall trend.

On top of everything else, we have the previous trendline that should offer support as well, so keep that in mind. I do like the idea of buying on dips, and I will add to a position going higher. If we can make another “higher high”, at that point one would have to assume that pretty much everyone is on the same page, and the trend change is not only in effect, but it is confirmed. That of course is something worth paying attention to, so therefore if it happens, I think that you will see bigger money traders hanging on to the Australian dollar and pushing much higher. I am currently in the process of building up a larger core position for the upside as things are starting to shift in favor of the Aussie violently.