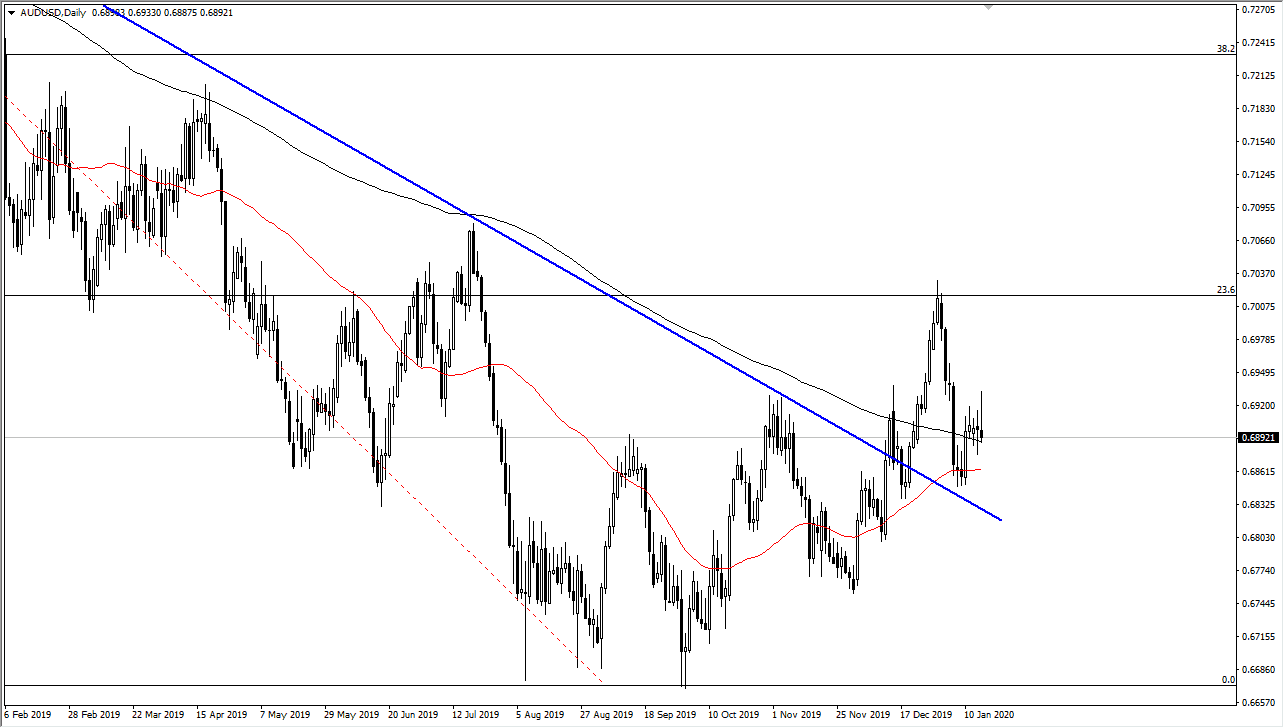

The Australian dollar has had a choppy trading session on Thursday, initially breaking above the recent highs to show signs of strength but turned around quite drastically as stronger than anticipated US economic numbers came out. Nonetheless, I think that the market hanging around the 200 day EMA is a good sign, as it is obviously becoming a relatively comfortable sitting in that region.

If you can start out slow enough, you can build up a core position for a potential Aussie long. That being said, this market will be highly sensitive to the US/China trade situation, so if we can see more positivity coming out of that situation, then it’s very likely that this might be the market you wish to be involved in. We have made a series a “higher lows”, so it does suggest that we are trying to make some type of bigger move to the upside. In fact, if we can make a fresh high again, which would be just above the 0.70 level, then I’m willing to call it a trend change.

The candlestick shape of course doesn’t lend all lot of comfort for the buyers after Thursday’s close, but at the end of the day we have seen several hammers and shooting stars recently anyway, so I think it shows a certain amount of uncertainty. This isn’t exactly uncommon when a market is trying to change the overall trend, so I think this all kind of lines up perfectly. The 50 day EMA underneath should continue to offer support as well, and most certainly the previous downtrend line should. Because of this, I have been buying the Australian dollar, but I have been doing so and little bits and pieces, not wanting to try to front run the trend and get burned in the process. Forex pairs tend to take quite some time to turn around completely, so this could be messy for a while.

If we do break down below the support though, that could open up the door back to the 0.67 handle, an area that has been massive support recently. It should also be noted that we are at the bottom of the overall range for the last decade or so, so we are most certainly in an area that would represent “value” when it comes to the Aussie dollar. All we need at this point is some type of “risk on” type of catalyst.