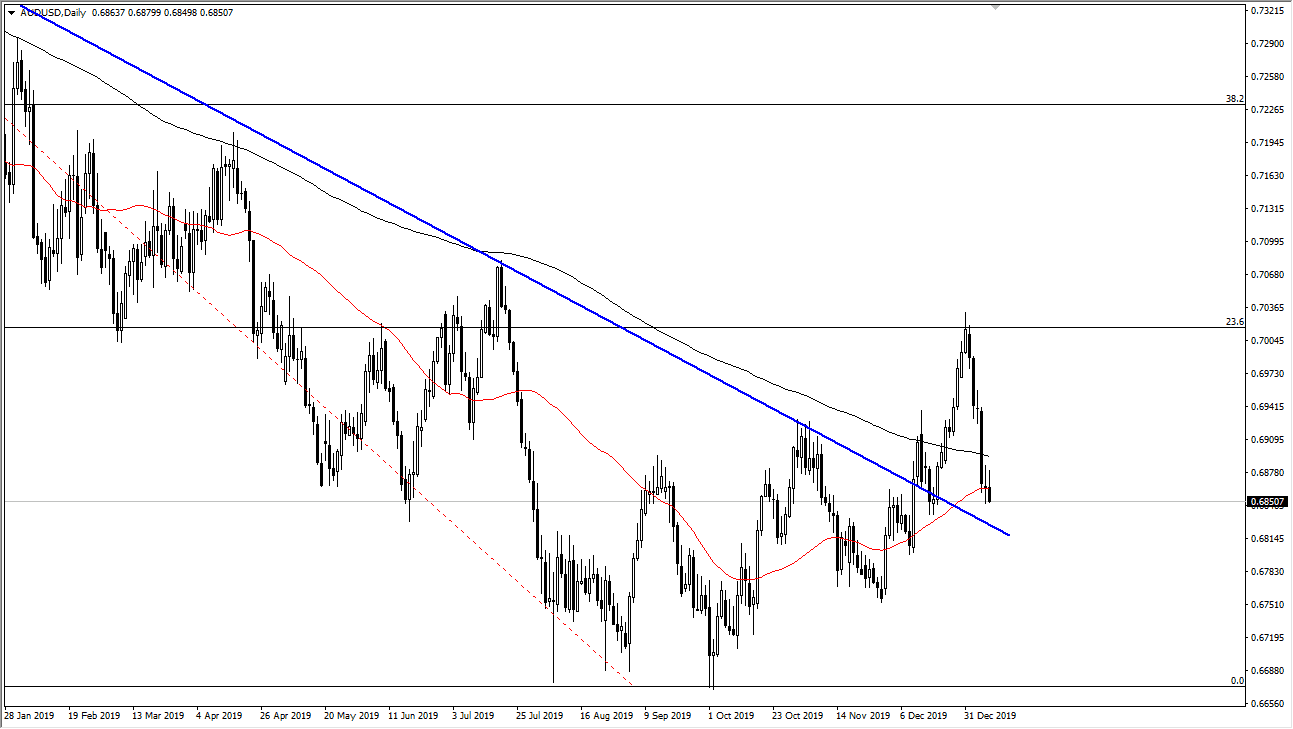

The Australian dollar has initially tried to rally during the trading session on Thursday but gave back the gains to show signs of exhaustion again. At this point though, we are in an area that should continue to attract a lot of attention so I like the idea of going long if we can break above the highs from both Wednesday and Thursday. If that does in fact get cleared, at that point I believe that the Australian dollar will probably go looking towards the 0.70 level. On the other hand, if we break down below the downtrend line, we could continue to go much lower. That being said, the Australian dollar has been very noisy as you would expect, because I think it’s in the process of trying to change the overall trend.

The Americans and the Chinese coming to terms with the beginning of the trade deal will of course help the Australian dollar, and most certainly if we can keep from more tariffs being levied, or some type of extension of hostilities, given enough time the Australian dollar should continue to benefit. I believe this point this is simply an extension of what’s going on between the United States and China. Ultimately, the Australian dollar will eventually try to go higher, but it doesn’t mean that it will be easy.

We are still technically in an uptrend over the last couple of months as we have yet to make a “lower low”, so although we are barely hanging on at this point, it certainly looks as if we are quite ready to give up. Because of this, the market is very likely to continue to be noisy and based upon the latest headlines. The market had rallied in favor the US dollar due to a bit of risk aversion, as the tensions in the Middle East escalated. Ultimately, the market breaking down from here though would be very negative, and a break below the 0.68 level would of course be very negative. With the jobs number coming out during the Friday session, you can expect a lot of volatility so the real trigger will probably be whether or not we can close on the daily charts above those highs from the last couple of days. Obviously, it’s the same thing with some type of daily close below the 0.68 handle.