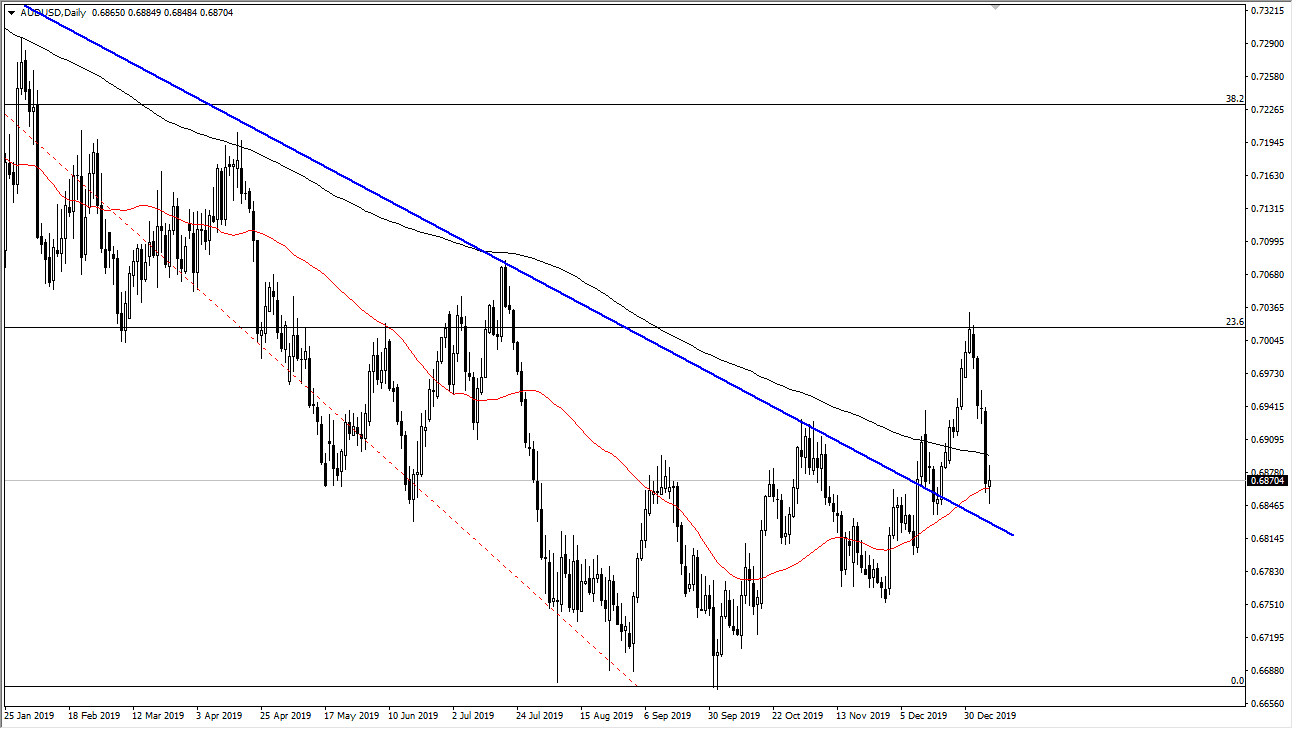

The Australian dollar has gone back and forth during the trading session on Wednesday, as we continue to hang around the 50 day EMA. We had recently exploded to the upside, but then had seen a lot of selling pressure over the last couple of days. This makes quite a bit of sense that we would see this type of major pullback, mainly due to the fact that the Australian dollar is considered to be a “risk on currency”, and therefore only tends to attract capital inflows when economic times are good or at least people are confident.

All things being equal, I like the fact that the market formed a neutral candlestick on top of the previous downtrend line which should in fact offer support anyway. Overall, we still are technically making “higher lows”, and therefore it is a market that should be thought of as trying to protect an uptrend. I think that buyers will jump back in if we can break above the 200 day EMA, but it might be difficult to slice right through that on Thursday, as the market will be waiting for the jobs figure out of America on Friday. Markets will more than likely be relatively quiet, but we are at an area where stability might be a good thing anyway.

If we were to break down below the 0.68 level it would crush the idea of an uptrend trying to form, and it’s very possible that we would see more of a breakdown at that point. However, I don’t see that happening considering that we have seen more risk enter the market due to the fact that the Americans and the Iranians are settling down and of course the US/China trade deal should be front and center next week with signing of the “phase 1” part. In the meantime, expect a lot of volatility in choppiness but I think the uptrend is going to be saved so therefore I am looking for buying opportunities in this juncture. By the time we get done with the Friday session, we should have a bit more clarity as the jobs figure will be behind us, and volumes should start to pick up again as traders will fully be back from the holiday season. This has been a brutal pullback, but quite frankly it was an explosive move to the upside. A little bit of normalcy seems to be coming back into this market.