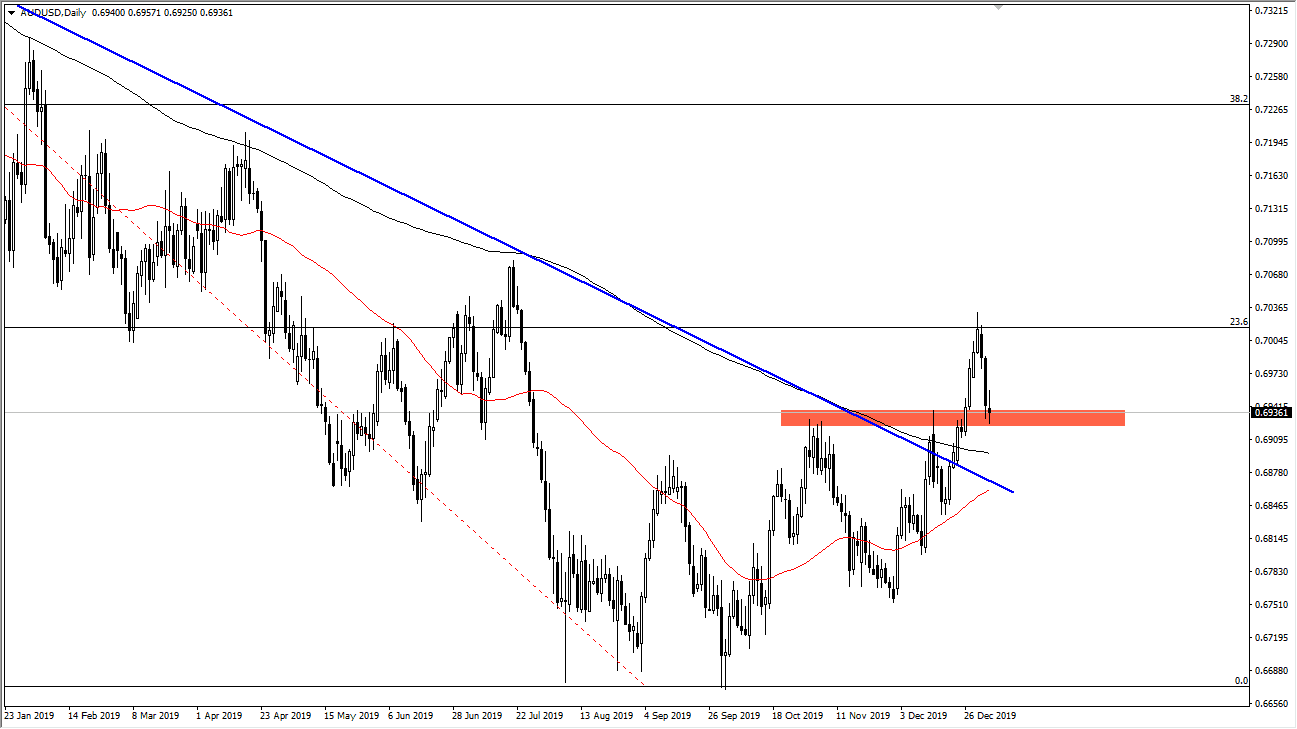

The Australian dollar has gone back and forth during the trading session on Monday, as we look ahead to see whether or not this supportive area will hold. We are currently trading near the 0.6950 level, extending down to the 0.6900 region. This is an area that previously had been very resistive, so now that we are starting to find buyers in this area, and at this point it’s likely that the markets will continue to respect this area out of “market memory.” That is a phenomenon that is common when we have seen resistance turn into support. These areas tend to repeat time and time again, and this is one of these important levels.

The 200 day EMA is just below, and it is starting to turn higher. Ultimately, this is a market that will find buyers in that area, and we are also starting to see the 50 day EMA reach towards that 200 day EMA. If we can break above there with the 50 day EMA becomes the so-called “golden cross”, which is a longer-term bullish signal. At this point, I am still bullish of the Australian dollar, because quite frankly it is so sensitive to the Chinese economy. We are starting to see better numbers coming out of China, and therefore the demand for Australian commodities will continue to strengthen in mainland China. That in turn will drive up demand for the Australian currency.

To the downside, it’s not until we break down below the 50 day EMA that I would be concerned, because we also have the previous downtrend line that should offer support. Overall, this is a market that will continue to see a lot of interest underneath, as it appears, we have been trying to change the overall trend. The trend being changed is almost always a very volatile situation, as market participants have to reverse their trading positions. While we can’t necessarily suggest that the trend has completely changed yet, the reality is that we have clearly made a major attempt at doing so. All things being equal, if the US and China can play nice with each other, it’s likely that the Australian dollar will continue to see buyers due to the fact that the Australian dollar is without a doubt the easiest proxy for China in the currency markets. That being said, if there is some type of breakdown in relations, that should weigh upon the Aussie.