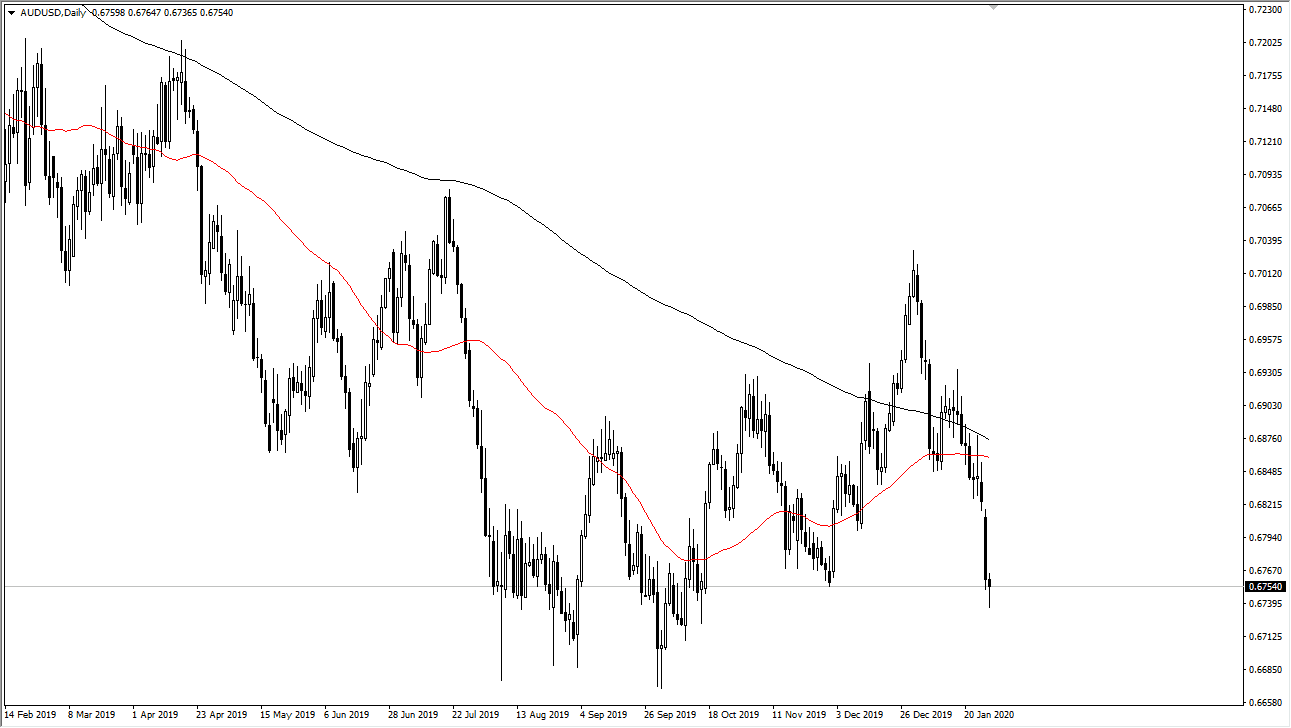

The Australian dollar has rallied a bit during the trading session initially during Wednesday, but then broke down below the 0.6750 level. There is a significant amount of support underneath there all the way down to the 0.67 level underneath, which is an area that is massive support based upon not only the last couple of months, but also previous time. At this point, the market is likely to find plenty of buyers underneath, but quite frankly if we do break down below the 0.67 level is going to get ugly considering that the area below there down to the 0.65 level was where we were trading during the financial crisis 12 years ago. In other words, it’s an extraordinarily cheap level for the Australian dollar.

If we can break above the highs from the trading session on Wednesday, this market should continue to go higher, reaching towards the moving averages. At this point, if we can break above there then it’s likely that the Aussie will go looking towards the 0.70 level, but we are all over the place right now so it’s a bit difficult to get overly aggressive with the Aussie dollar, but at the end of the day it does look like we are starting to find buyers in this region. We need to see some type of good news coming out of China in order to push this pair higher, as the Australian dollar is highly sensitive to China.

Overall, I like buying dips for a longer-term “buy-and-hold” strategy, but we need to see stability first. The last couple of days have been a good start but I think you have plenty of time to get involved. If we break down below the 0.67 level, then I will switch to the weekly candle to make my decision. I don’t have any interest in shorting at this area, even though I fully recognize that we could drop a couple of more handles. That’s because we are so historically cheap and quite frankly if the Aussie dollar is going to drop like that, we would be looking at some type of financial disaster going on. Furthermore, the Federal Reserve sounded a bit weak and dovish, so I think it’s very likely that eventually the US dollar gets punished, not only against the Australian dollar but also against several other currencies around the world. Patience will be needed more than anything else.