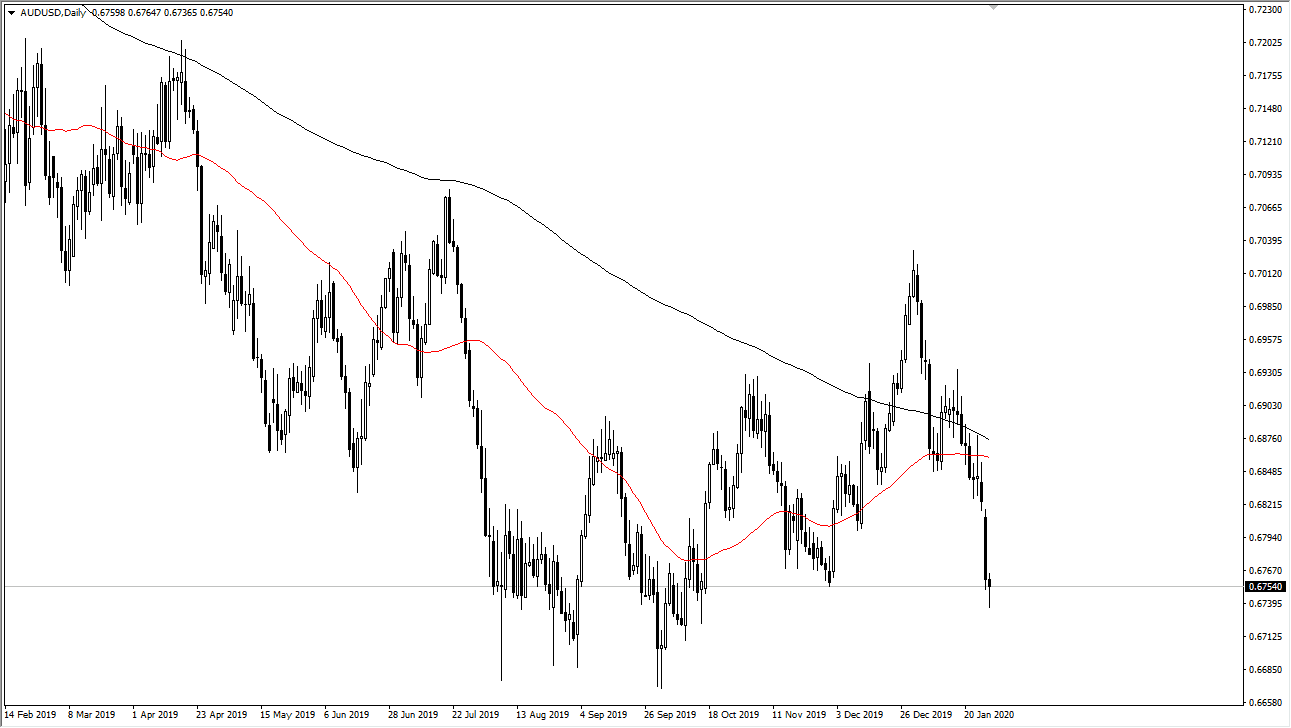

The Australian dollar has fallen quite a bit during the trading session on Tuesday but has also found buyers underneath the turn around and form a hammer. That of course is a very bullish sign and considering that the market is a bit overextended it makes quite a bit of sense that we see this market recover slightly. The 0.6750 level has been important more than once, and there is a lot of support extending all the way down to the 0.67 handle. With that in mind I think that it is likely that we are ready to go higher, at least in the short term. There is a minor gap that hasn’t been filled from Monday yet, so perhaps that’s where we end up going.

That being said, it is also a market that will be paying attention to the FOMC Statement during the trading session on Wednesday, so that could drive down the value of the greenback as well. This is a market that has gotten hammered due to the corona virus and a lot of concerns about Chinese growth anyway, so having said that if we can get a little bit of a relief rally in the Australian dollar overall. If we were to break down below the 0.67 handle, then the Aussie will start to challenge the noisy action that had been part of the financial crisis well over a decade ago.

Ultimately, I do think that we are still trying to turn the entire turn around, but we need the coronavirus situation to come down and perhaps the Chinese to get things under control for a longer-term move. If we do in fact get that, it’s very likely that the Australian dollar will be “THE” place to be. If we break down below the 0.67 handle, then there is a ton of noise between there and the 0.65 level that will eventually offer a longer-term “buy-and-hold” scenario. Quite frankly, the Australian dollar is essentially priced for absolute destruction, so unless you believe that the financial markets are going to fall apart, this is probably a market that you are looking for an opportunity to go long more than anything else. All things being equal, I am looking for some type of recovery so that we can continue to go higher over the longer term. I do recognize that the 0.70 level will continue to be a major barrier if we do rally.