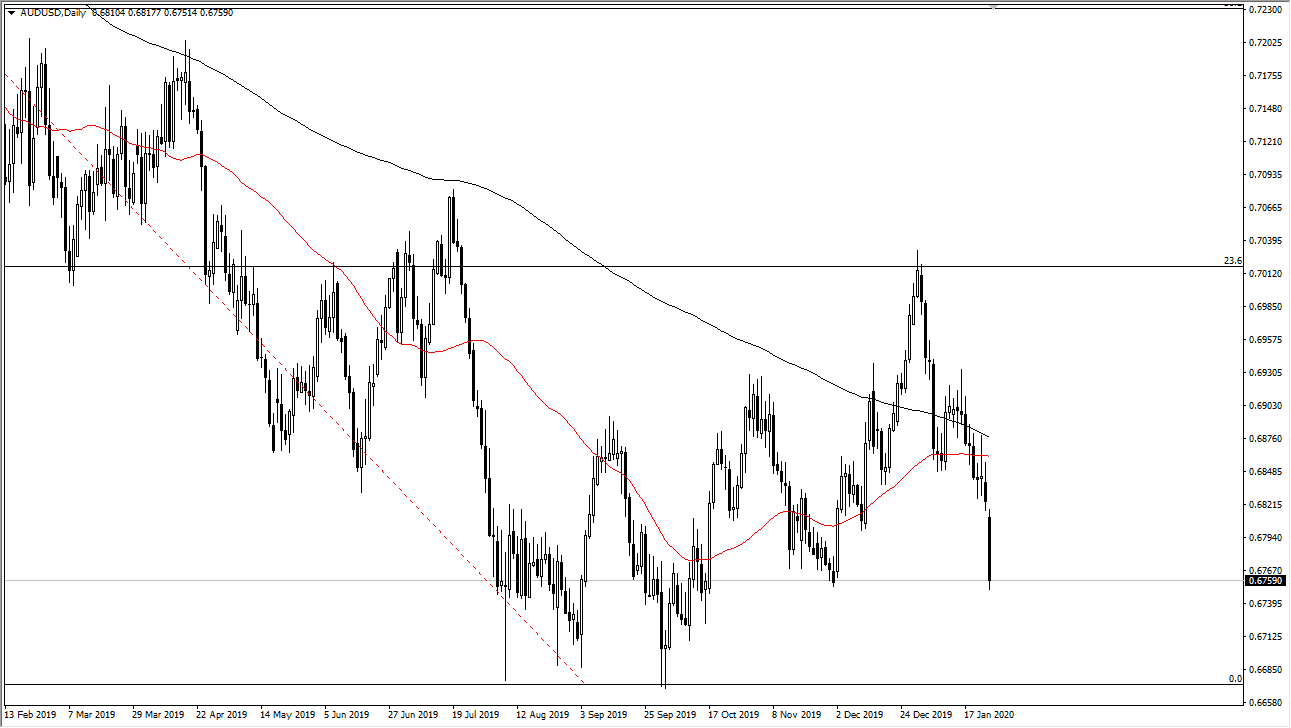

The Australian dollar has gapped lower to take off to the downside and reach towards the 0.6950 level. That’s an area that has been supported in the past, the fact that we are sitting right there is a good sign that perhaps buyers will return. However, there is a lot of noise out there and not the least of which is fear about the coronavirus. That has an effect on Asia, which in turn has an effect on the Australian dollar. The Australian dollar of course is highly sensitive to the Chinese economy, so the two come hand-in-hand.

As the Chinese quarantine several cities in the mainland, it’s likely that the Australian dollar will continue to suffer due to the fact that people will start to worry about economic situation in China. There is a huge amount of support underneath though, reaching all the way down to the 0.67 range, and that of course is the top of the financial crisis area, and therefore I think that we will probably see quite a bit of support underneath. In other words, the downside is probably somewhat limited in the short term but obviously it’s an area that will be crucial for the longer-term move. If the market get some type of recovery rally, we could see this market bounce all the way back to the 50 day EMA. Overall, the market certainly looks as if it’s in a lot of trouble though, so I’d be cautious about trying to buy the rally unless of course you see other risk appetite markets rally at the same time.

In general, if you are looking to run towards safety, the best bet might be shorting other currencies against the Japanese yen. Ultimately, you probably have a better chance shorting other currencies such as the British pound that haven’t fallen as hard. That being said, the market does break down to a fresh, new low, then we enter a whole new scenario where we are trading in the same range that we had been in during the financial crisis 12 years ago. If that’s the case, we would be at a very significant level that could determine where we go for the next couple of years. All things being equal, it’s probably better off sitting on the sidelines and waiting to see what the market does before following it.