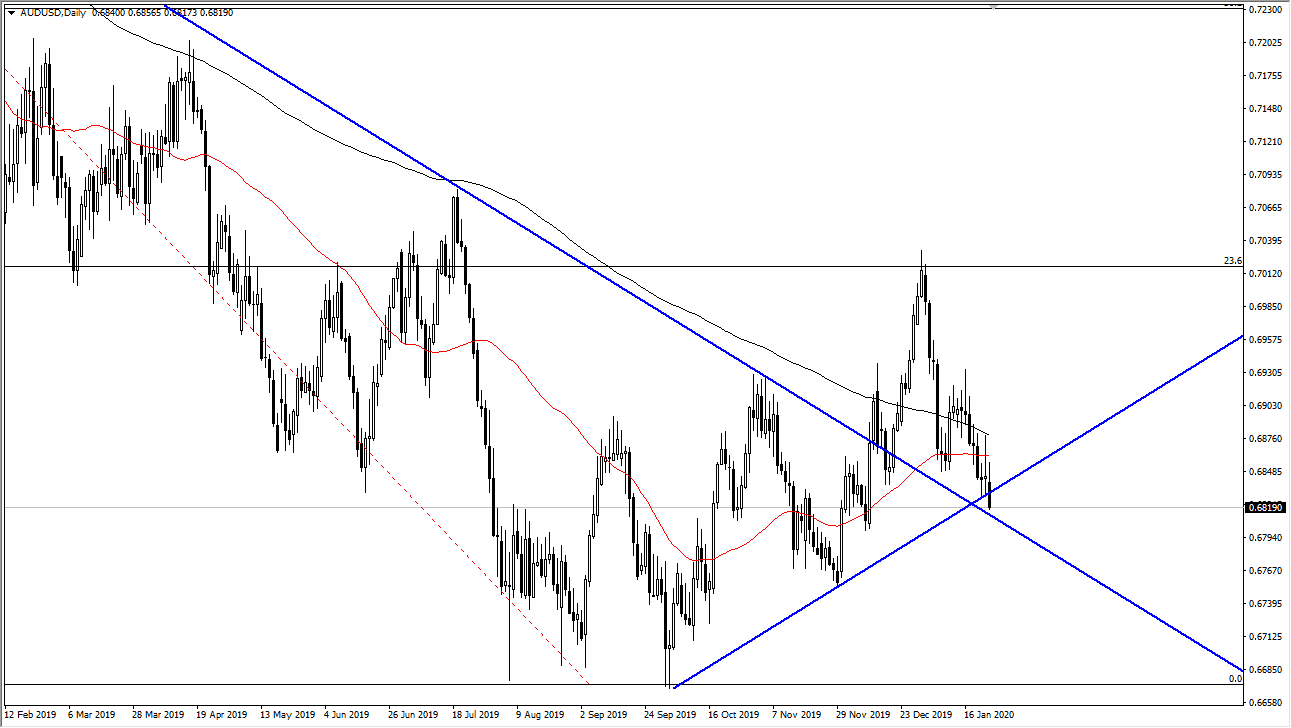

The Australian dollar rallied initially during the trading session on Friday, but then broke down significantly to reach towards the downtrend line that we are so aware of. At this point, a bounce from here would continue to show just how important that downtrend had been. That being said, there is also an uptrend line that we have broken through so all things being equal it’s likely that the market needs to make some type of decision rather soon. It will be interesting to see how this plays out and I would suggest that you should probably stay out of it in the short term.

If we were to break down below the 0.68 level, then the market is likely to reach down towards the 0.6750 level, and then possibly even the 0.67 level. One thing that should be paid attention to is the fact that we have reached the very top of the consolidation area from the financial crisis 12 years ago, and that something that should be taken into account as it shows just how oversold the Aussie dollar is. Keep in mind that the Australian dollar is highly sensitive to the Chinese economy and of course global growth. It is also very sensitive to copper and other commodities, which traces back to the Chinese situation. As the Americans and the Chinese have at the very least come to some type of an agreement to not increase the hostilities, it’s likely that it could favor the Aussie dollar. However, what is important to think about is that even though the employment figures were so strong this week, we have given back those gains.

I believe that the 0.68 level needs to hold, and if it doesn’t then we could go much lower. Alternately, if we were to turn around and reach to the upside, it’s likely that we go looking towards the black 200 day EMA line on the chart. If we can break above that level, the market then could continue to go much higher. With all of the noise that I see in this chart, it’s obvious that we are very skittish at this point and it’s very likely that we will have to make some type of longer-term decision. If the previous downtrend line does in fact hold, it could lead the market into changing the overall trend, and that’s a very messy situation to say the least. However, if we break down then we need to take a look at the fresh lows to see whether or not the buyers are going to return. We are getting tantalizingly close to extremely supportive levels on multi-decade charts.