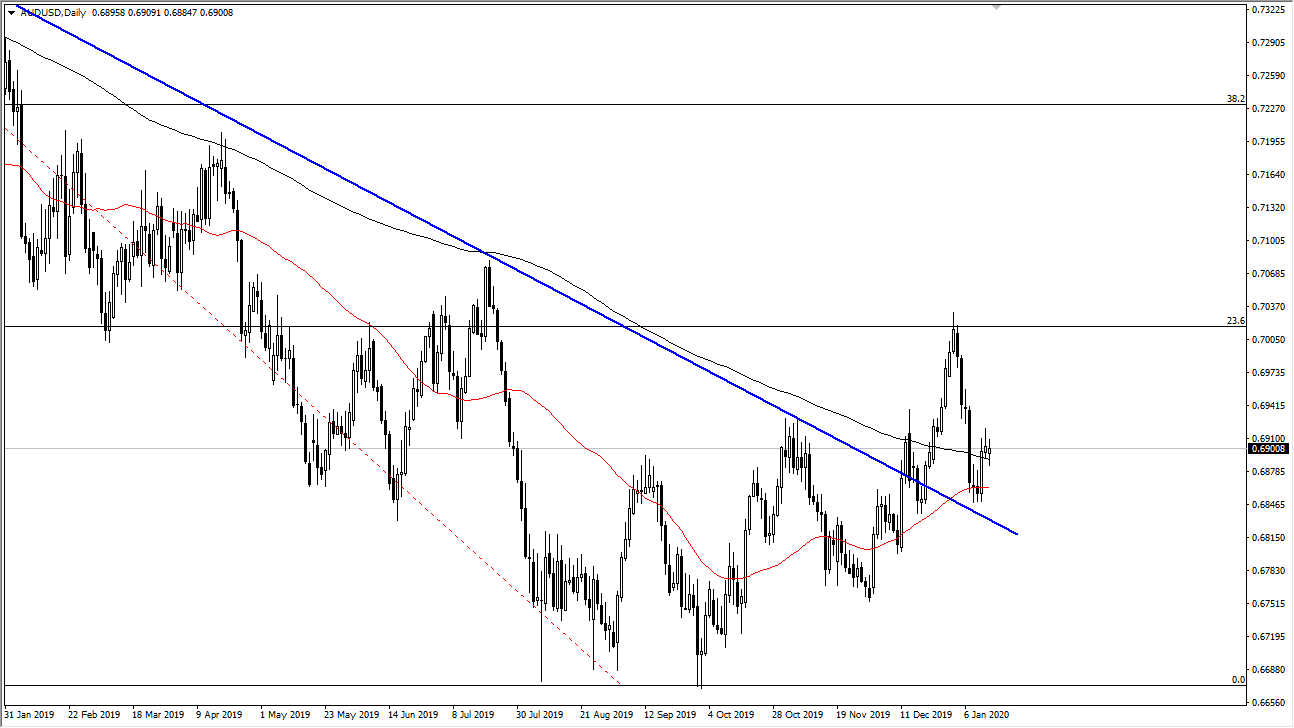

The Australian dollar initially fell during the trading session on Tuesday, but then turned around to form a bit of a hammer. The market dropped down below the 200 day EMA initially, which of course is a negative sign, but the 0.69 level has handled the selling pressure and then turned around. Keep in mind that the Monday trading session is a shooting star, and that of course shows that the market had run out of momentum a bit, but longer-term it looks as if we are still trying to grind to the upside. We had recently broken quite a bit of resistance, and that will of course keep the markets moving to the upside.

The Australian dollar initially shot straight up in the air a couple of weeks ago, but then pulled back to test the downtrend line that we had broken above. With that in mind, I believe that the market will probably continue to look at that previous downtrend line as potential support but I would also point out that the 50 day EMA is coming dangerously close to the 200 day EMA and could cross, forming the “golden cross” which longer-term traders like to pay attention to.

The shooting star being broken to the upside from Monday would open up the door to the 0.70 level, and then if we can break above there it’s likely that the market could go to the 0.72 handle. I believe that the Australian dollar will continue to get a bit of a boost from the US/China trade situation, especially now that some of the details of the “phase 1 deal” are a bit more in depth than people had anticipated. If that’s going to be the case, it’s very likely that the Australian dollar will be a major beneficiary of economic activity due to the Chinese buying so much in the way of commodities from Australia itself. Ultimately, this is a market that I think is looking at the charts as being historically cheap, and therefore I believe that a lot of value hunters are out there looking to take advantage of this. Ultimately, I am a buyer of short-term dips and I am willing to build up a larger core position to take advantage of what I think is going to be a trend change for the longer term. Remember though, if I’m right, trend changes are very messy affairs.