The Australian dollar has rallied a bit during the trading session on Monday to break above the top of the candlestick from the Friday session. However, we did give back a significant amount of the profit for the day, which makes a bit of sense as there has been a lot of choppy trading recently. That being said, we get the so-called “phase 1 deal” this week, which is one of the main drivers of the Australian dollar. The Australian economy is highly levered to the Chinese mainland, and if the Americans and the Chinese are going to ease tensions, that should help the Australian dollar and economy.

Recently, we have seen a little bit better in the way of Australian economic data, so that of course has an effect on the Aussie dollar as well. With that in mind, and more of a “risk on” attitude, it makes sense that the Aussie dollar would get a bit of a boost. From a technical analysis standpoint, the first thing that you will notice on longer-term charts is that we are at very cheap levels. This isn’t reason enough to buy a currency, but it is certainly reason enough to start looking for set ups.

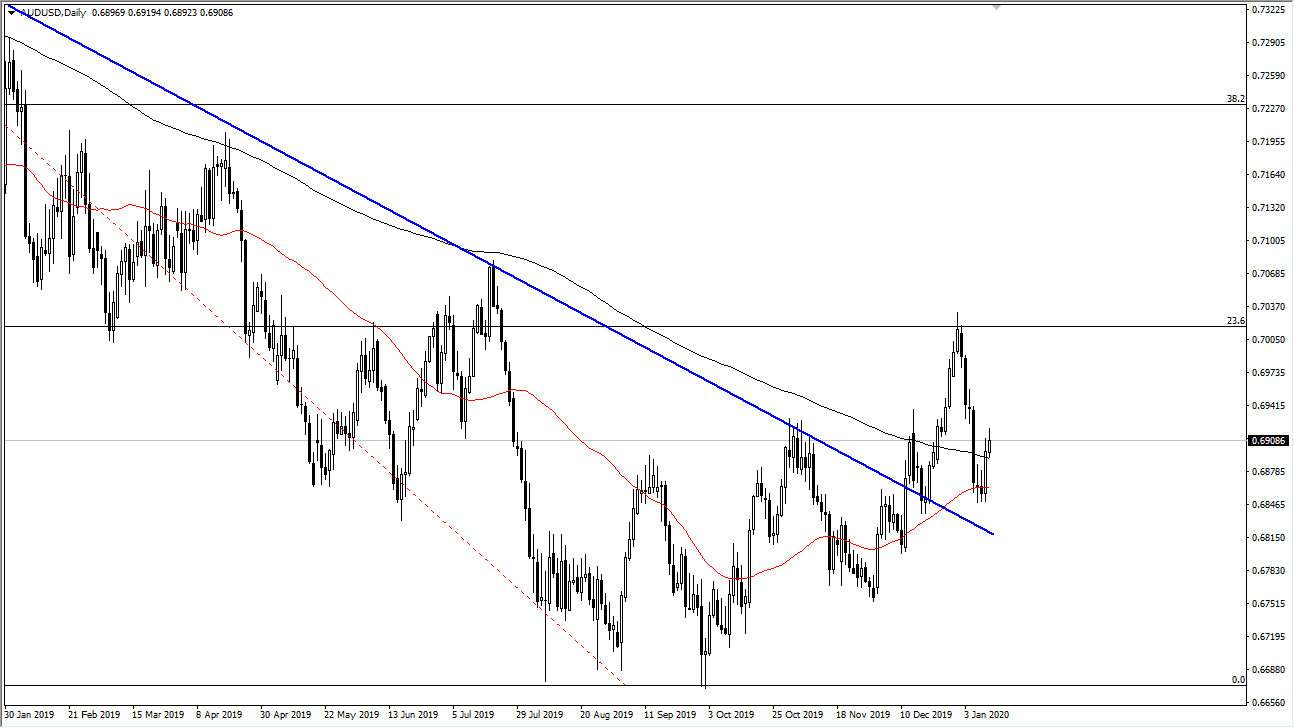

We had recently broken above a major downtrend line and have now come back to essentially test that line for support. It is worth noting that the Australian dollar rallied rather significantly on Friday, after going sideways for a couple of days. That’s a good sign, and it’s very likely that the Australian dollar will continue to follow through from that move. This doesn’t mean that there won’t be a pullback, but that should be thought of as a buying opportunity as long as we stay above the downtrend line, it don’t make a “lower low.” All things being equal, when you get a bit of a trend change, things can get very noisy in the meantime and I believe that’s part of what you are seeing here in the Aussie. Ultimately, this is a market that I do believe goes looking towards the 0.70 level again, but it might be very noisy and messy on the way up. If for some reason something happens with the situation involving trade between the Americans and the Chinese, then things could turn around quite rapidly for this market as money would go flowing out of Australia again.