Australia is suffering from a series of economic issues, with the bushfire crisis adding to an uncertain economic outlook. The government announced an A$2 billion aid package to business impacted by the fire season, and the agricultural sector may suffer a permanent loss of its workforce as it did after the drought-prolonged fire season in 2000 and 2008. Despite the Reserve Bank of Australia poised to cut interest rates, the AUD/USD managed to stabilize its sell-off just above its support zone.

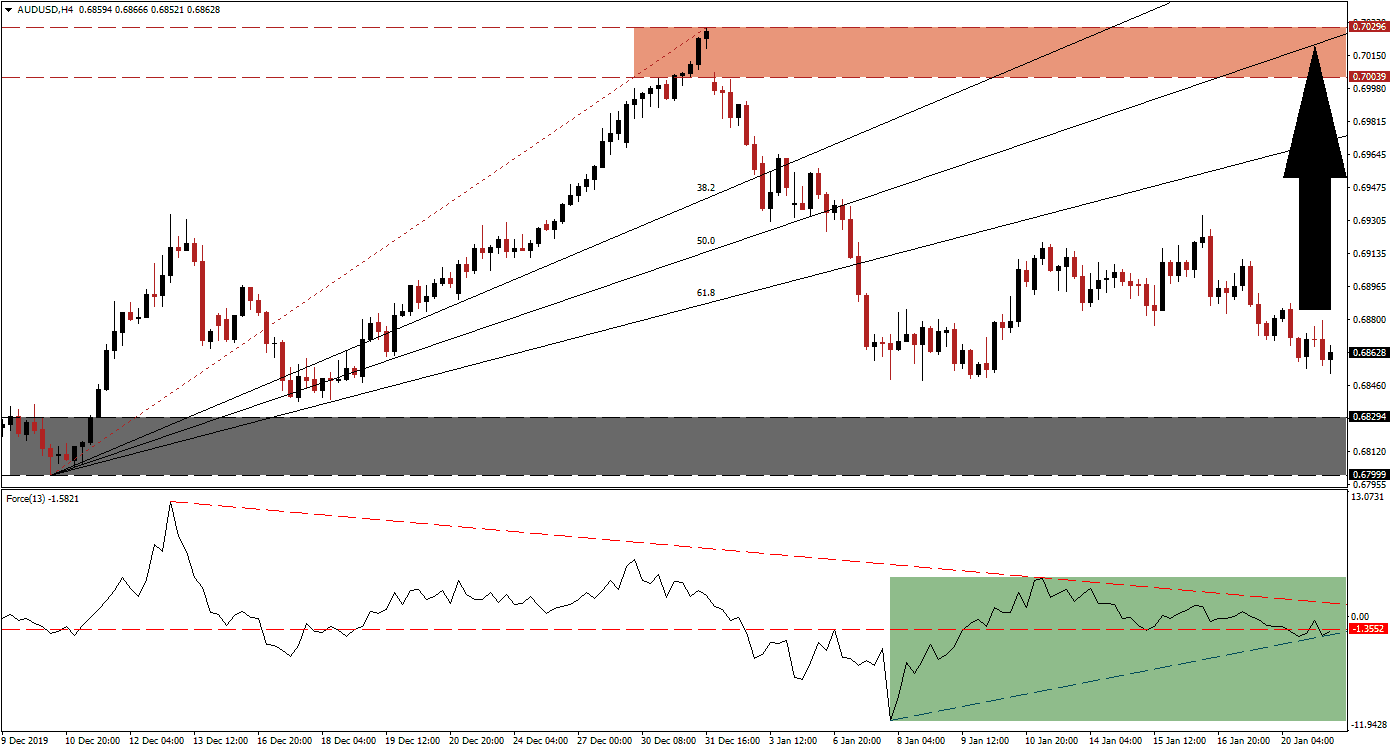

The Force Index, a next-generation technical indicator, recovered from a lower low as this currency pair initially attempted an advance. Following a failed extension, the reversal in the AUD/USD led to a retreat in the Force Index to a higher low. An ascending support level materialized, as marked by the green rectangle, and is expected to pressure this technical indicator above its horizontal resistance level. It will additionally elevate the Force Index into positive territory, placing bulls in charge of this currency pair.

Since the Australian Dollar remains the number one Chinese Yuan proxy currency, developments out of China often trump domestic ones. The support zone located between 0.67999 and 0.68294, as marked by the grey rectangle, is pending an adjustment to the upside. This will occur once the AUD/USD advances above the intra-day low of 0.68768, the top range of its new support zone, with the bottom range at 0.68380. A breakout above this zone is likely to initiate a short-covering rally.

As a result of the pending rally, inspired by momentum stabilization, the AUD/USD is anticipated to close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day high of 0.69332, the peak of the previous advance. More net buy orders are favored following a breakout above this level. US economic weakness is expected to add to the awaited move higher. Price action should be able to move back into its resistance zone located between 0.70039 and 0.700296, as marked by the red rectangle. You can learn more about a breakout here.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.68600

Take Profit @ 0.70250

Stop Loss @ 0.68150

Upside Potential: 165 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.67

In case of a deeper push into negative conditions by the Force Index, assisted by its descending resistance level, the AUD/USD may attempt a breakdown. Due to the long-term bullish fundamental outlook in this currency pair, in conjunction with the developing technical scenario, the downside potential appears limited. The next support zone awaits price action between 0.67539 and 0.67692, which resembles a sound buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.67950

Take Profit @ 0.67550

Stop Loss @ 0.68150

Downside Potential: 40 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.00