As the global economy continues to cool, many central banks implement interest rate cuts, hoping to assist the slowdown. The People’s Bank of China surprised markets this morning as it kept its one-year loan prime rate (LPR) unchanged at 4.20%, against expectations of a third-cut to 4.15%. This injected bullishness in the Australian Dollar, the top Chinese Yuan proxy currency, and the AUD/SGD stabilized inside of its support zone. A breakout is anticipated to follow.

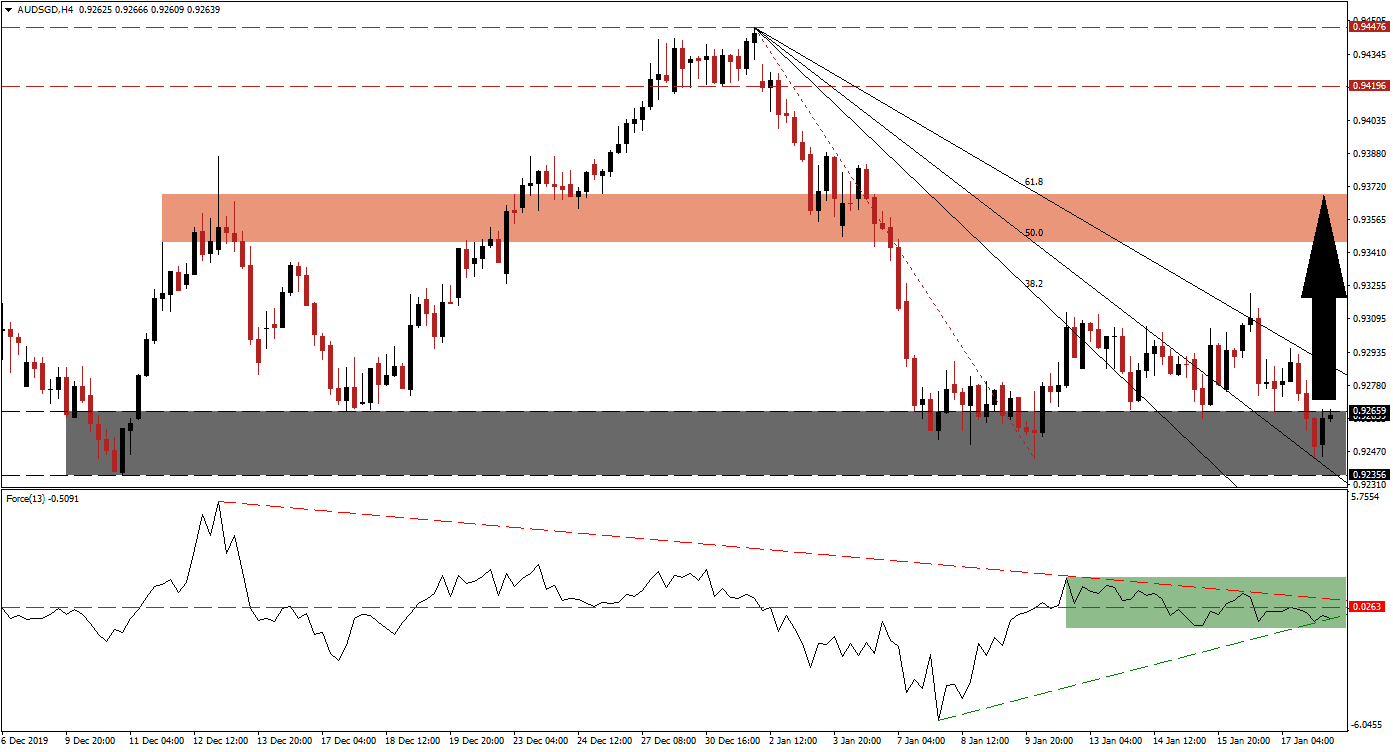

The Force Index, a next-generation technical indicator, ended its uptrend following the first breakout above its support zone. A descending resistance level formed, which continues to apply downside pressure on the Force Index. After a breakdown in the Force Index below its horizontal support level, a brief reversal resulted in another rejection, as marked by the green rectangle. This technical indicator crossed below the 0 center-line, but its ascending support level is expected to push it back into positive territory, placing bulls in charge of the AUD/SGD. You can learn more about the Force Index here.

This currency pair was reversed to the upside on two previous occasions after descending into its support zone located between 0.92356 and 0.92659, as marked by the grey rectangle. Trade data out of Singapore released late last week showed a surprise increase in exports as well as imports, providing a short-term catalyst for the AUD/SGD. Price action bounced off of its steep descending 50.0 Fibonacci Retracement Fan Support Level, which just crossed below the support zone. The 61.8 Fibonacci Retracement Fan Resistance Level is now approaching, adding to pressures for either a breakout or breakdown.

A breakout in the AUD/SGD above its support zone is likely to carry it above its 61.8 Fibonacci Retracement Fan Resistance Level and spark a short-covering rally. Forex traders are advised to monitor the intra-day high of 0.93215, the peak of the previous advance. It also marked a higher high as compared to the peak of the first breakout above its support zone. A move above this level should attract more net buy orders and push price action into its short-term resistance zone located between 0.93458 and 0.93682, as marked by the red rectangle. You can learn more about a breakout here.

AUD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.92650

Take Profit @ 0.93650

Stop Loss @ 0.92350

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

In case of a sustained breakdown in the Force Index below its ascending support level, the AUD/SGD may attempt a breakdown below its support zone. With a long-term bullish outlook and a strengthening technical picture, any move to the downside should be viewed as a solid buying opportunity. The next support zone awaits this currency pair between 0.91160 and 0.91570, dating back to 2001.

AUD/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.92150

Take Profit @ 0.91400

Stop Loss @ 0.92450

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50