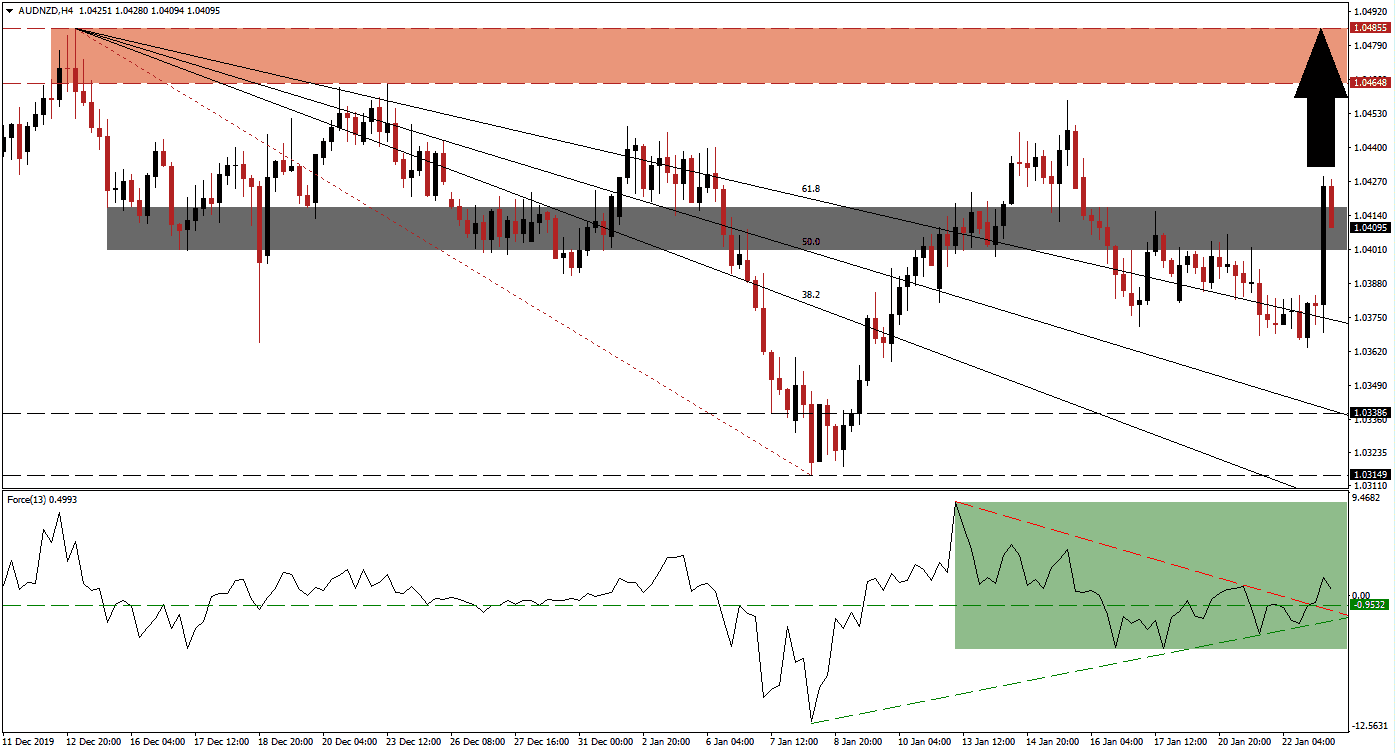

Australian consumer inflation expectations surged to 4.7% in January. While this may be a temporary spike due to the bush fires raging across the country, it is a situation that warrants attention. The Reserve Bank of Australia opened the door for more interest rate cuts, but if inflation and inflationary expectations remain elevated, it may force the RBA to stay on the sidelines. Price action in the AUD/NZD converted its short-term resistance zone into support and is now validating it. An extension of the breakout is favored to follow.

The Force Index, a next-generation technical indicator, indicates the rise in bullish momentum and advanced off of its ascending support level. It allowed the Force Index to push above its horizontal resistance level, turning into support, as marked by the green rectangle. This technical indicator additionally eclipsed its descending resistance level, which now acts as a temporary support. Bulls are in charge of the AUD/NZD after the Force Index crossed above the 0 center-line.

Following the conversion of its short-term resistance zone into support, located between 1.04006 and 1.04171, as marked by the grey rectangle, this currency pair has retreated into it. This is a necessary confirmatory step and allows traders to enter positions. Given the most recent fundamental developments, more upside is anticipated. The breakout in the AUD/NZD was enabled after it bounced off of its descending 61.8 Fibonacci Retracement Fan Resistance Level.

This currency pair is now likely to accelerate into its next resistance zone located between 1.04648 and 1.04855, as marked by the red rectangle. A move above its previous intra-day high of 1.04582 will confirm the presence of a bullish trend, as it will mark the second higher high, separated by a higher low. New Zealand economic data has shown temporary weakness, further enhancing the upside potential. A breakout in the AUD/NZD remains an option, but a new catalyst is required. You can learn more about a resistance zone here.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.04100

Take Profit @ 1.04850

Stop Loss @ 1.03900

Upside Potential: 75 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.75

In the event of a breakdown in the Force Index below its ascending support level, the AUD/NZD may attempt to reverse its breakout. The downside potential remains limited to its next support zone located between 1.03149 and 1.03386. Forex traders are advised to consider this as an excellent buying opportunity, as the long-term outlook for this currency pair remains increasingly bullish.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03650

Take Profit @ 1.03150

Stop Loss @ 1.03900

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00