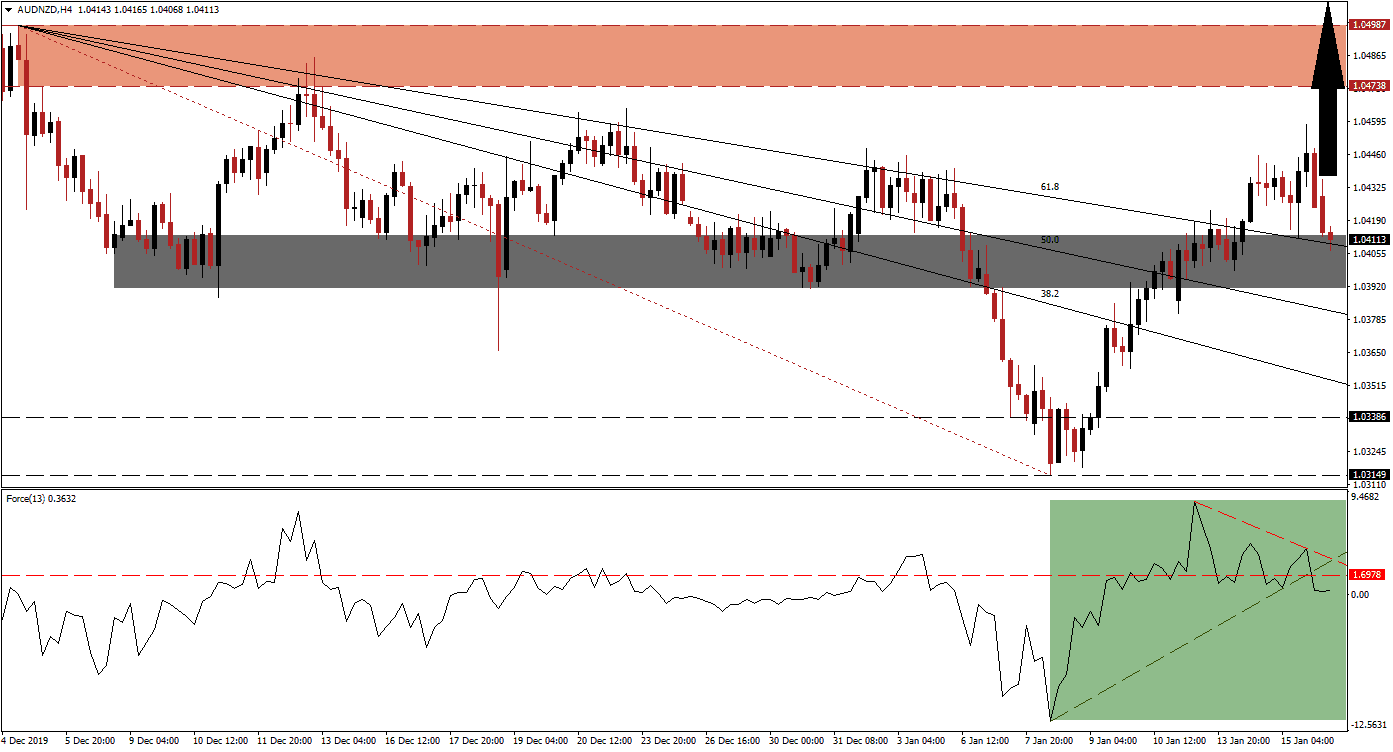

After the US and China signed the phase-one trade truce, where China pledged to purchase $200 billion worth of goods over the next two years, the market reaction was muted. The secrecy surrounding this deal and the host of unanswered questions confirm it was rushed through to score a political victory by both parties involved amid a slowing global economy. Price action in the AUD/NZD retreated from its higher high into its descending 61.8 Fibonacci Retracement Fan Support Level, which is crossing through its short-term support zone.

The Force Index, a next-generation technical indicator, flashed an early warning sign that the breakout sequence in this currency pair is vulnerable to a pullback. As the AUD/NZD extended its advance, the Force Index converted its horizontal support level into resistance, and a negative divergence formed. It also pushed this technical indicator below its ascending support level but remained in positive territory with bulls in charge of price action, as marked by the green rectangle. You can learn more about the Force Index here.

A new push to the upside is likely to follow after the AUD/NZD corrected into its short-term support zone located between 1.03918 and 1.04130, as marked by the grey rectangle. Australian data showed a strong reading in home loans and investment lending, providing a short-term fundamental factor that helped eased selling pressure in this currency pair. The Chinese economy has shown signs of stability, which benefits the Australian Dollar due to its status as the primary Chinese Yuan proxy currency. You can learn more about a support zone here.

This currency pair is expected to bounce off of its 61.8 Fibonacci Retracement Fan Support Level and advance into its resistance zone. This zone is located between 1.04738 and 1.04987, as marked by the red rectangle. Forex traders are advised to monitor the intra-day high of 1.04582, the peak of the dominant breakout sequence. A move above this level is anticipated to result in the addition of new net buy orders and may lead to a fresh breakout. The next resistance zone awaits the AUD/NZD between 1.05688 and 1.06048.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.04150

Take Profit @ 1.06000

Stop Loss @ 1.03750

Upside Potential: 185 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 4.63

In case of a sustained push in the Force Index into negative conditions, driven by its descending resistance level, the AUD/NZD is expected to attempt a breakdown below its short-term support zone. Given the bullish fundamental outlook, supported by technical developments, the downside remains limited to its next long-term support zone. This zone is located between 1.03149 and 1.03386 and should be considered an excellent buying opportunity.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03600

Take Profit @ 1.03150

Stop Loss @ 1.03800

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25