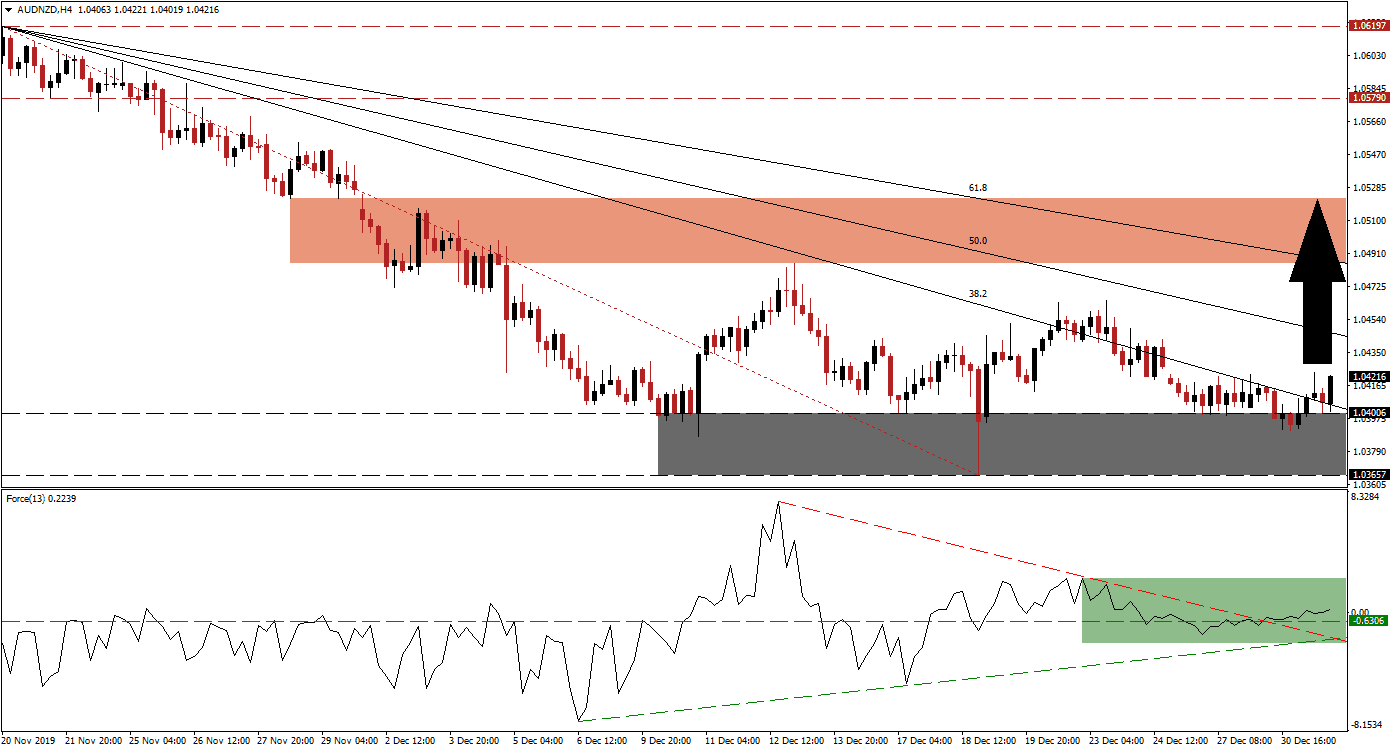

Bullish momentum is on the rise after price action in the AUD/NZD was able to ascend above its support zone. The People’s Bank of China reduced its Reserve Requirement Ratio by 50 basis points, freeing up capital to support its economic recovery, but the Caixin Manufacturing PMI for December came in weaker than anticipated. Economic developments in China have a strong impact on the Australian Dollar, as it remains the number one Chinese proxy currency. This currency pair has additionally eclipsed its descending 38.2 Fibonacci Retracement Fan Resistance Level, converting it into support.

The Force Index, a next-generation technical indicator, points towards the build-up in bullish momentum after a brief dip below its horizontal support level. The Force Index reversed above its and completed a breakout above its descending resistance level, as marked by the green rectangle. This technical indicator also pushed into positive conditions, placing bulls in charge of the AUD/NZD. Its ascending support level is providing gradual upside pressure and is anticipated to lead this currency pair farther to the upside. You can learn more about the Force Index here.

Breakdown risks in the AUD/NZD have diminished after its support zone, located between 1.03657 and 1.04006 as marked by the grey rectangle, reversed price action on three occasions. This currency pair is now positioned to move above its 50.0 Fibonacci Retracement Fan Resistance Level, which will boost bullish momentum. Forex traders are advised to monitor the intra-day high of 1.04648, the peak of a previously reversed advance. A breakout above this level will invalidate the downtrend and likely result in the addition of new net long positions.

This currency pair should be able to challenge its short-term resistance zone located between 1.04855 and 1.05225, as marked by the red rectangle. The phase-one trade truce between the US and China is expected to be signed this month, but it lacks substance and will have no major impact on the global economy. Despite the tariffs, the Chinese economy is starting to show signs of stabilization, and the central bank is taking measured steps to support the recovery. An extension of the breakout sequence in the AUD/NZD into its long-term resistance zone, located between 1.05790 and 1.06197, remains possible.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.04200

Take Profit @ 1.05200

Stop Loss @ 1.03900

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a breakdown in the Force Index below its ascending support level, the AUD/NZD is anticipated to attempt a breakdown below its support zone. Given the long-term bullish fundamental outlook, supported by an improving technical picture, the downside potential is limited. This currency pair will face its next support zone between 1.02746 and 1.03091, which represents an excellent buying opportunity.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03600

Take Profit @ 1.02850

Stop Loss @ 1.03900

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50