Major Asian markets remain closed for various holidays, draining volume from this morning’s trading session. Fears relating to the spreading of a new string of coronavirus have resulted in a spike in demand for safe-haven assets. Unless the virus is contained, analysts predict more hardship for a slowing global economy. The AUD/JPY opened with a price gap to the downside amid the lack of trading volume. It paused after reaching the top range of its support zone, while bullish momentum is on the rise.

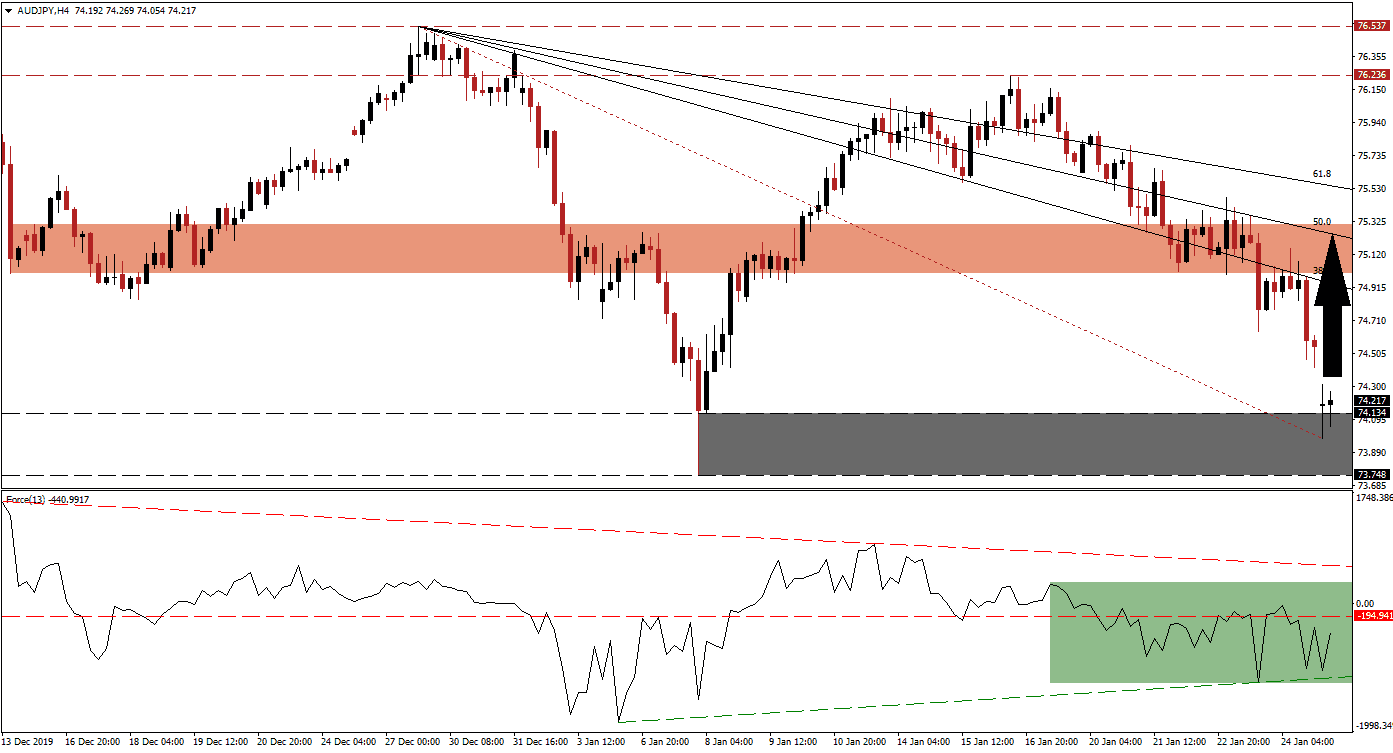

The Force Index, a next-generation technical indicator, contracted as this currency pair dropped into its support zone. A higher low resulted in the emergence of a positive divergence, and this bullish trading signal is anticipated to precede an advance in the AUD/JPY. The Force Index is on track to push above its horizontal resistance level, turning it into support, as marked by the green rectangle. It should carry this technical indicator into positive territory, and allow bulls to regain control of this currency pair. The ascending support level is likely to provide a floor and keep upside pressure on the Force Index.

After this currency pair halted its descend, a higher low was created, and the Fibonacci Retracement Fan sequence was redrawn. This materialized inside of its support zone located between 73.748 and 74.134, as marked by the grey rectangle. A short-covering rally is favored to follow, which will close the price gap to the downside, and allow the AUD/JPY to challenge its descending 38.2 Fibonacci Retracement Fan Resistance Level. Volatility is expected to remain elevated. You can learn more about a short-covering rally here.

Economic data out of Australia has been soft, as the country continues to suffer from the negative impact of bush fires, pushing global CO2 levels to new record highs. The rising threat of the coronavirus is adding to the long-term bearish outlook for this currency pair, which is expected to end its advance once it reaches its short-term resistance zone. This zone is located between 75.005 and 75.310, as marked by the red rectangle. It is enforced by its 50.0 Fibonacci Retracement Fan Resistance Level and anticipated to prevent a breakout in the AUD/JPY.

AUD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 74.200

Take Profit @ 75.200

Stop Loss @ 73.900

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a reversal in the Force Index, pressured by its descending resistance level, the AUD/JPY is likely to attempt a breakdown. With the increase in global issues, the Japanese Yen is favored to benefit due to its safe-haven status. A breakdown should take this currency pair into its next support zone, located between 74.471 and 72.800. More downside is possible, but it will require a fresh catalyst.

AUD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 73.600

Take Profit @ 74.500

Stop Loss @ 74.000

Downside Potential: 110 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.75