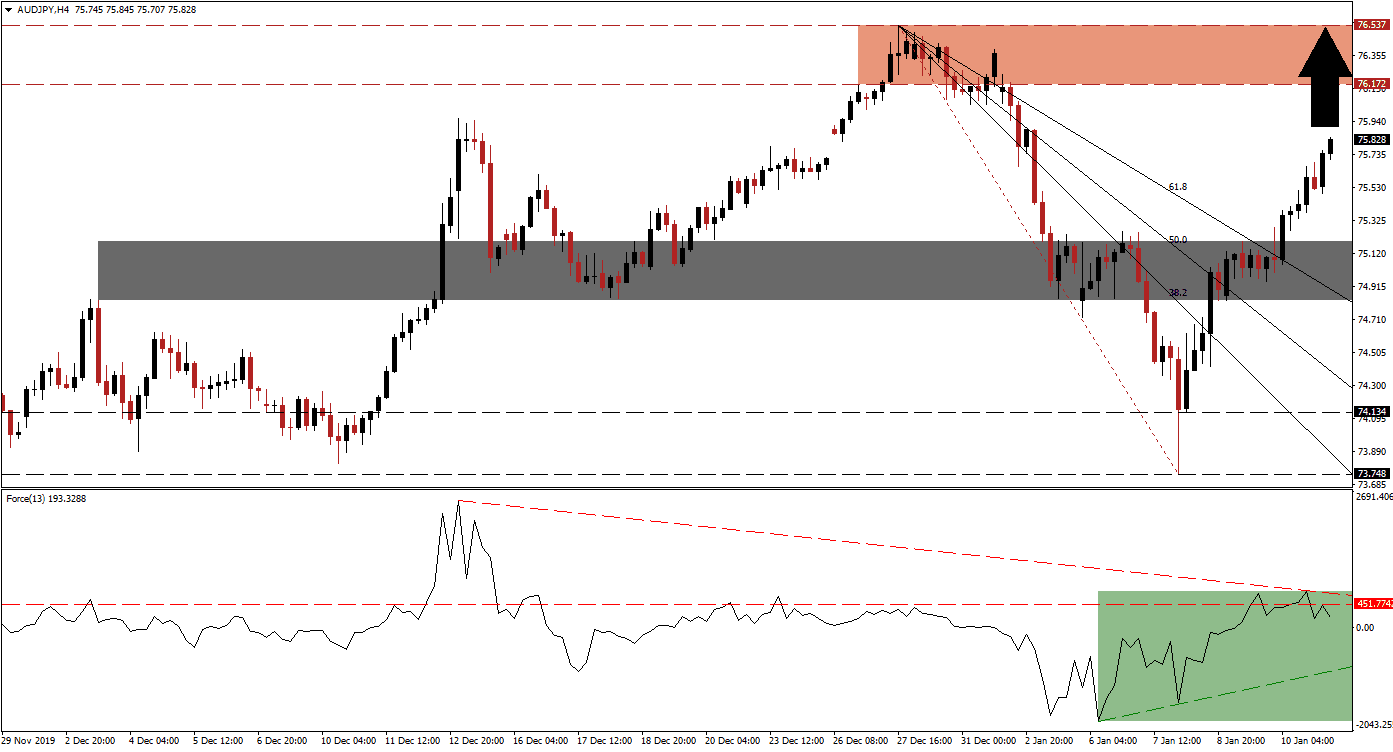

A light start into the fresh trading week is likely to see a continuation of risk-on mood across asset classes. Australian monthly inflation pressures nudged up slightly, while the Japanese Yen is under selling pressure as traders reallocated positions. This combination is pushing the AUD/JPY to the upside. After this currency pair completed a breakout above its descending 61.8 Fibonacci Retracement Fan Resistance Level, it converted its short-term resistance zone into support. A final push into its resistance zone is expected to follow.

The Force Index, a next-generation technical indicator, advanced as price action extended to the downside. A minor positive divergence materialized and suggested a reversal. As tensions between the US and Iran eased, the Force Index continued its advance and briefly moved above its horizontal resistance level. Bullish momentum started to show signs of exhaustion with the emergence of a descending resistance level, as marked by the green rectangle. More upside in the AUD/JPY is anticipated unless the Force Index contracts into negative conditions.

With US-Iran tensions fading, the focus will shift towards the US-China phase one trade truce. Despite both sides praising the deal as a major accomplishment, it lacks substance and fails to address the issues leading to the trade war. The extent of agricultural purchases by China seems to be well-above what may be delivered, creating a future flashpoint. After the breakout in the AUD/JPY above its short-term resistance zone that converted it into support, fading bullish momentum should extend the advance into its long-term resistance zone. This zone is located between 76.172 and 76.537, as marked by the red rectangle.

Forex traders are advised to monitor the intra-day high of 75.964, the peak of a previous breakout above its short-term support zone. A move above this level will ensure more temporary upside. Failure to eclipse it will likely force a retreat into its short-term support zone located between 74.830 and 75.199, as marked by the grey rectangle, from where a breakdown cannot be ruled out. The descending Fibonacci Retracement Fan sequence may guide the AUD/JPY farther to the downside, and a rise in volatility is anticipated. You can learn more about a breakdown here.

AUD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 75.800

Take Profit @ 76.500

Stop Loss @ 75.600

Upside Potential: 70 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.50

In the event of a breakdown in the Force Index below its ascending support level, the AUD/JPY is favored to change direction. The long-term outlook for this currency pair remains uncertain, with bullish and bearish factors emerging simultaneously. A breakdown in this currency pair below its short-term support zone will require a fresh catalyst, like issues regarding the signing of the US-China trade truce. The next long-term support zone awaits price action between 73.748 and 74.134.

AUD/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 75.300

Take Profit @ 74.900

Stop Loss @ 75.500

Downside Potential: 40 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.00