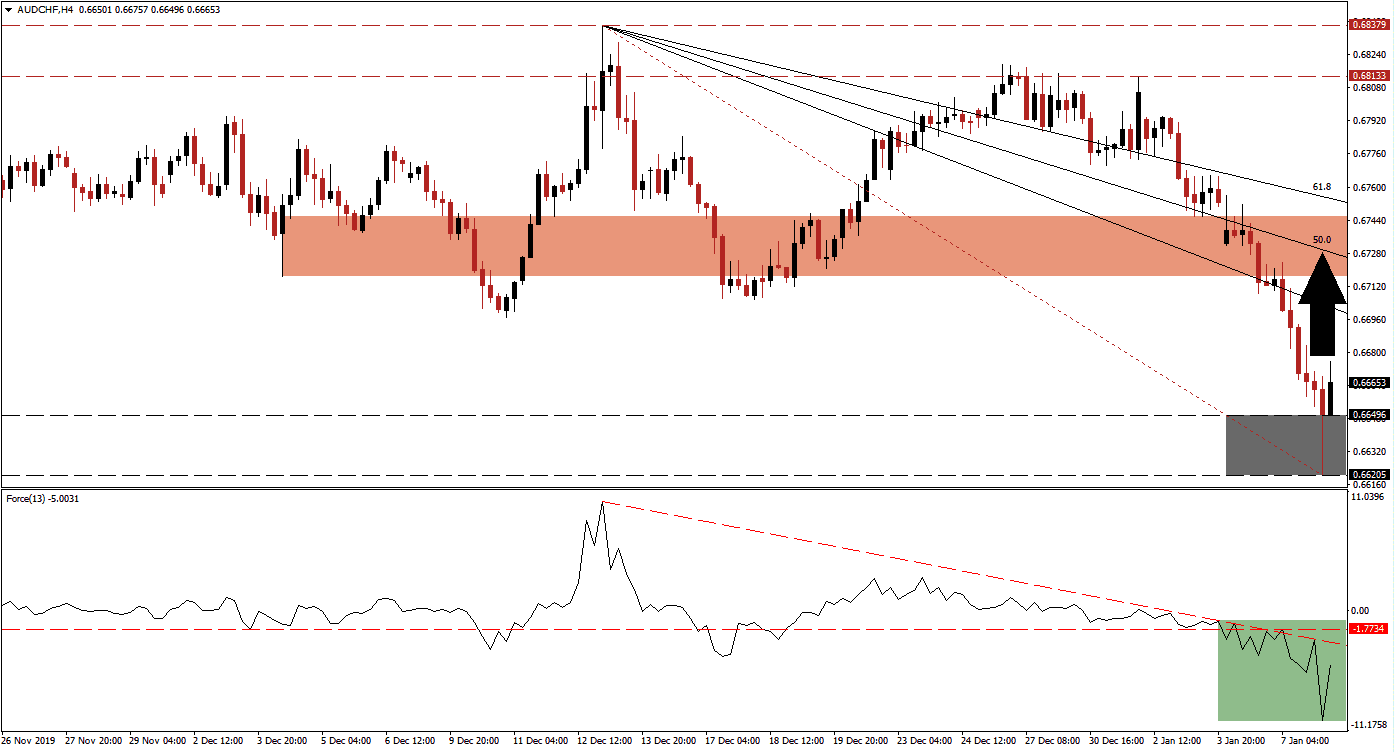

Iran fired over a dozen ballistic missiles at two military installations in Iraq that house US troops, in response to the killing of a top Iranian general in Iraq last week. Safe-haven assets like gold and the Swiss Franc surged after reports of the retaliatory strike were published. Initial releases indicate no casualties, and the US may not feel forced to act, allowing the situation to cool down. This is expected to result in a partial recovery of the quick sell-off in the AUD/CHF, which descended into its support zone.

The Force Index, a next-generation technical indicator, confirmed the strong reaction in this currency pair and recorded a fresh low. Bullish momentum started to recover, but remains in negative conditions with bears in control, as marked by the green rectangle. This technical indicator is expected to push through its descending resistance level, followed by a breakout above its horizontal resistance level. The AUD/CHF is likely to follow suit and retrace back into its short-term resistance zone.

Price action already completed a breakout above its support zone located between 0.66205 and 0.66496, as marked by the grey rectangle. As tension between the US and Iran are rising, volatility and demand for safe-haven assets are anticipated to remain dominant. Quick sell-offs are favored to be countered by reversal, but forex traders are advised to monitor the highs and lows of such developments. A series of lower lows and lower highs will signal a long-term bearish trend. Current technical developments suggest that a short-covering rally in the AUD/CHF is pending.

A recovery will close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level. This should take the AUD/CHF back into its short-term resistance zone located between 0.67169 and 0.67456, as marked by the red rectangle. It is enforced by the 50.0 Fibonacci Retracement Fan Resistance Level and anticipated to end the recovery unless a change in fundamental circumstances will emerge. A breakout will require a fresh fundamental catalyst, but Australian economic data has been soft. You can learn more about a breakout here.

AUD/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.66650

Take Profit @ 0.67250

Stop Loss @ 0.66450

Upside Potential: 60 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.00

Should the descending resistance level pressure the Force Index to the downside, the AUD/CHF may extend its corrective phase with a breakdown below its support zone. This currency pair is hovering near extreme oversold conditions, and the short-term outlook favors a counter-trend recovery. The next support zone is located between 0.64993 and 0.65232, from where more downside is possible but unlikely.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.66150

Take Profit @ 0.65000

Stop Loss @ 0.66550

Downside Potential: 115 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.88