With the US and China set to sign their phase-one trade truce today, the US announced that existing tariffs will remain in place until after the November election. The US claims it will use the time to assess compliance by China with the agreed terms. This will give China time to strengthen its economy, and markets may have to wait until the end of this year or the beginning of next year for more clarity. The AUD/CHF retreated from its breakout intra-day high, but the bullish trend remains intact.

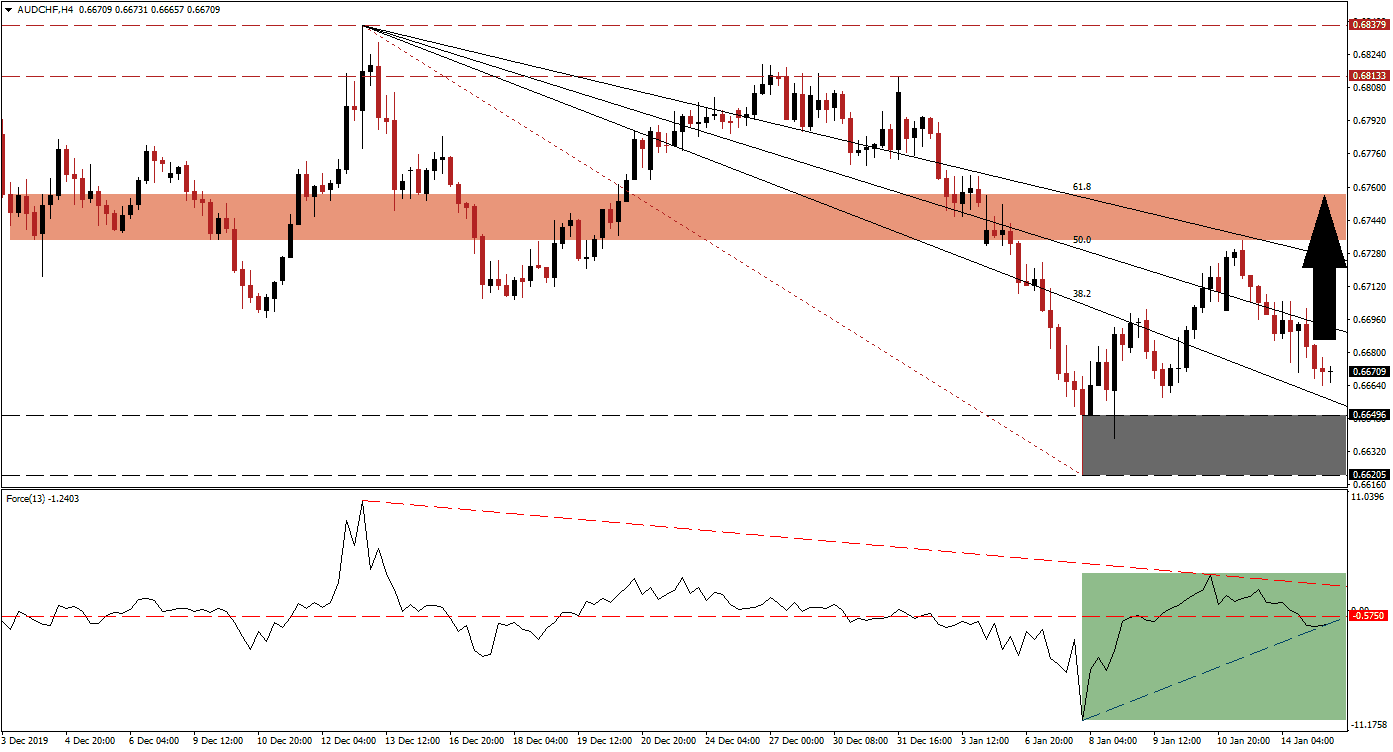

The Force Index, a next-generation technical indicator, advanced as this currency pair pushed out of its support zone until it was rejected by its short-term resistance zone. Bullish momentum contracted, and the Force Index moved below its horizontal resistance level, which allowed a descending resistance level to materialize. This technical indicator has now stabilized in negative territory, as marked by the green rectangle. Its ascending support level is expected to push it above the 0 center-line, and initiate a fresh advance in the AUD/CHF.

After this currency pair completed a breakout above its support zone located between 0.66205 and 0.66496, as marked by the grey rectangle, the downtrend was broken. Price action remains inside its descending Fibonacci Retracement Fan sequence, with the 38.2 Fibonacci Retracement Fan Support Level closing in on the top range of the support zone. With the pending increase in bullish momentum, the AUD/CHF is anticipated to eclipse its 50.0 Fibonacci Retracement Fan Resistance Level.

A reversal from current levels will create a higher low, following the higher high before the corrective phase. This represents another bullish development in the AUD/CHF. Both currencies are exposed to central banks open to further monetary easing. The exposure of the Australian Dollar to the Chinese economy makes it superior to the Swiss Franc, which was added to the US Treasury Department currency watch list. Price action is favored to ascend into its short-term resistance zone located between 0.67340 and 0.67566, as marked by the red rectangle.

AUD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

- Long Entry @ 0.66700

- Take Profit @ 0.67550

- Stop Loss @ 0.66450

- Upside Potential: 85 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 3.40

In case of a breakdown in the Force Index below its ascending support level, the AUD/CHF may attempt to push below its support zone. The downside potential remains limited due to the long-term fundamental outlook in this currency pair. Any move lower from current levels is therefore likely to remain limited and should be considered a good buying opportunity. The next support zone awaits price action between 0.64993 and 0.65350.

AUD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 0.66100

- Take Profit @ 0.65350

- Stop Loss @ 0.66400

- Downside Potential: 75 pips

- Upside Risk: 30 pips

- Risk/Reward Ratio: 2.50