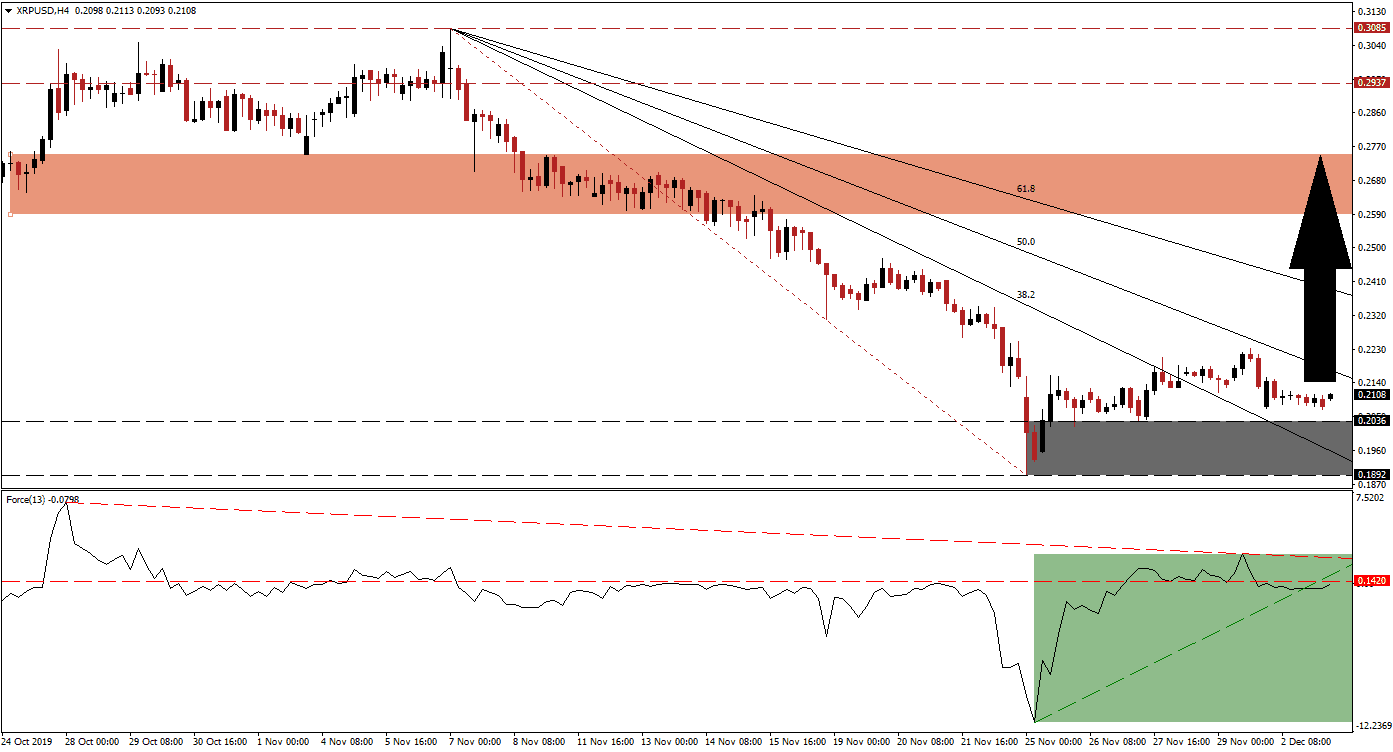

Ripple continues to be exposed to bearish pressures, after the breakout in the XRP/USD above its support zone was reversed. Price action remains above the top range of its support zone, and bullish momentum has stabilized. Memories from the Crypto Winter of 2018 are recent, but from a fundamental perspective, this cryptocurrency pair remains extremely oversold. Traders with a long-term time horizon are presented with a valuable buying opportunity, as price action holds on to the breakout above its support zone. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, descended below its horizontal support level and converted it into resistance, as price action was rejected by its descending 50.0 Fibonacci Retracement Fan Resistance Level. The Force Index additionally moved below its ascending support level but stabilized shortly thereafter as marked by the green rectangle. This technical indicator was pushed into negative conditions, but a triple breakout is anticipated to follow, and elevate the Force Index above its descending resistance level, leading the XRP/USD to the upside.

One area of concern remains dumping by the Ripple Foundation. On December 2nd 2019, one billion XRP tokens were transferred out of the foundation’s escrow account in two transactions totaling $219 million; seven minutes later the equivalent amount was sent back to escrow in three transactions. Moves like this have on occasion distorted price action, but the support zone located between 0.1892 and 0.2036 as marked by the grey rectangle is anticipated to prevent a breakdown in the XRP/USD from materializing. You can learn more about a breakdown here.

Accusations of price manipulation have been rejected by the Ripple Foundation as it claims the tokens are invested to enhance the ecosystem. Despite several high profile investments, the beneficial impacts have not played out. There is a reasonable degree if untapped fundamental potential in the XRP/USD and a short-covering rally may follow once this cryptocurrency pair can eclipse its 50.0 Fibonacci Retracement Fan Resistance Level. This should suffice to lift price action into its next short-term resistance zone located between 0.2607 and 0.2756 as marked by the red rectangle. More upside is possible and the next long-term resistance zone awaits between 0.2937 and 0.3085.

XRP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.2100

Take Profit @ 0.2750

Stop Loss @ 0.1925

Upside Potential: 650 pips

Downside Risk: 175 pips

Risk/Reward Ratio: 3.71

In the event of a breakdown in the Force Index below its ascending support level, the XRP/USD could attempt a breakdown below its support zone. The extremely oversold state of this cryptocurrency pair in combination with fundamental developments makes a sustained breakdown unlikely and any move to the downside should be considered an excellent long-term buying opportunity. Price action will face its next support zone between 0.1642 and 0.1784.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.18250

Take Profit @ 0.16500

Stop Loss @ 0.19000

Downside Potential: 175 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 2.33