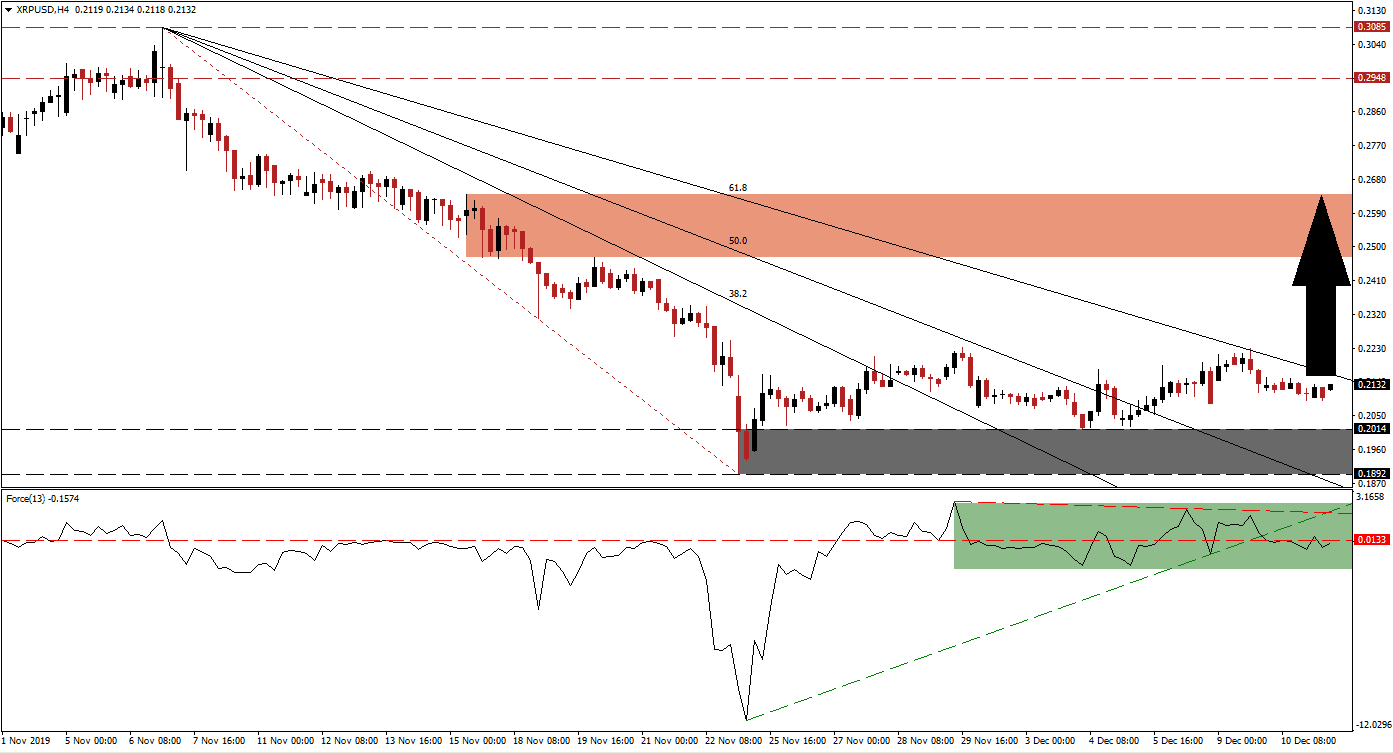

Bitcoin is pressuring the cryptocurrency market to the downside and may peak below the $7,000 level yet again. Despite the broad bearish momentum, the XRP/USD was able to catch a bullish drift following the breakout above its support zone. The Ripple Foundation revamped its Xpring platform; this is anticipated to drive development, which will boost the price of its token. A breakout in this cryptocurrency pair above its descending 61.8 Fibonacci Retracement Fan Resistance Level is now pending.

The Force Index, a next-generation technical indicator, remains confined to a narrow zone as marked by the green rectangle, while bullish momentum awaits a catalyst. Bank of America admitted that it tested a project on the Ripple XRP Ledger, and as the bullish fundamental news flow continues, the technical confirmation is only a matter of time. The Force Index is located below its horizontal resistance level, in negative territory, but a minor catalyst will result in a breakout and lead the XRP/USD to the upside. This technical indicator is favored to push through its descending resistance level, and reclaim its ascending support level, which currently acts as temporary resistance.

Following the breakout in price action above its support zone located between 0.1892 and 0.2014, as marked by the grey rectangle, selling pressure eased. The first reversal resulted in a higher low, but the subsequent advance failed to record a higher high and started to drift lower. Cryptocurrency traders are recommended to monitor the intra-day low of 0.2014, the top range of its support zone, and low of the previous reversal in the XRP/USD; as long as this cryptocurrency pair remains above this level, a breakout is possible. You can learn more about a support zone here.

With the 61.8 Fibonacci Retracement Fan Resistance Level adding to bearish momentum, breakout pressures are on the rise. Another bullish development emerged after this cryptocurrency pair moved above its Fibonacci Retracement Fan trendline. A breakout above its 61.8 Fibonacci Retracement Fan Resistance Level is expected to initiate a short-covering rally, and drive the XRP/USD back into its short-term resistance zone. This zone is located between 0.2471 and 0.2640, as marked by the red rectangle; it additionally marks a critical resistance level, and an extended breakout would deliver is a significant bullish driver.

XRP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.2130

Take Profit @ 0.2640

Stop Loss @ 0.1990

Upside Potential: 510 pips

Downside Risk: 140 pips

Risk/Reward Ratio: 3.64

Should the Force Index fail to push above its descending resistance level, a reversal in the XRP/USD is possible. While a breakdown below its support zone cannot be ruled out, the long-term fundamental outlook is bullish and expands into that direction. Any breakdown is anticipated to remain limited to its next support zone, which awaits this cryptocurrency pair between 0.1642 and 0.1784; this would provide an outstanding buying opportunity.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.1860

Take Profit @ 0.1700

Stop Loss @ 0.1930

Downside Potential: 160 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.29