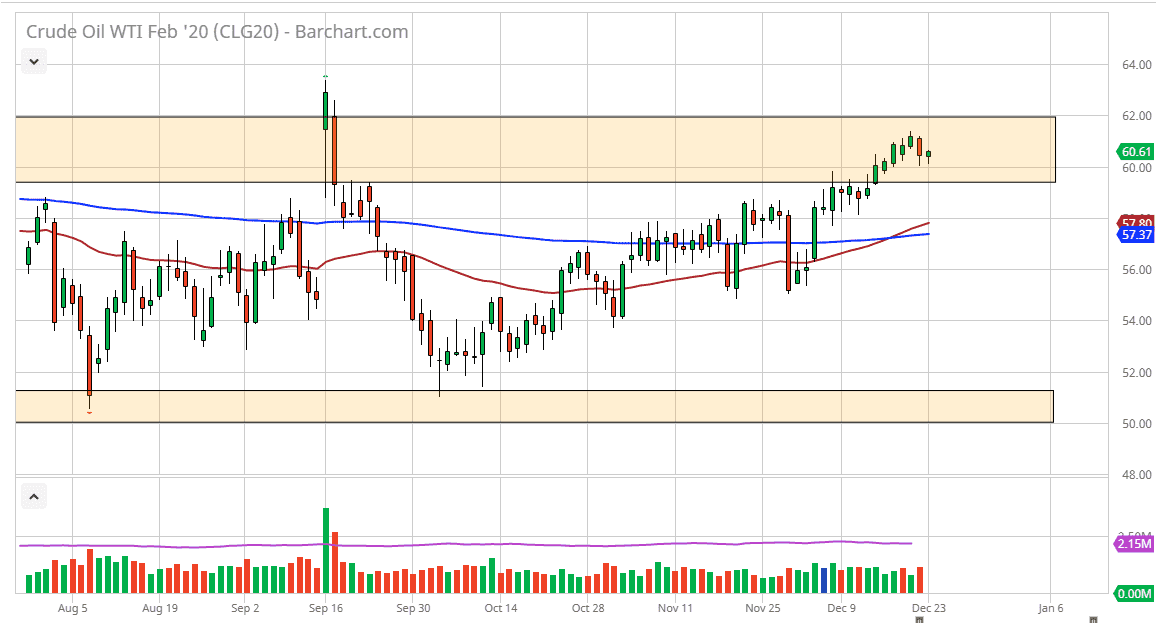

The West Texas Intermediate Crude Oil market rallied slightly during the trading session on Monday in very thin trading. The market is at the very top of an overall consolidation area, which extends to the $62.50 level. The market at this point is probably going to continue to see a lot of volatility, but in the next couple of days we will probably see almost no volume. There will be limited trading on Christmas Eve and of course no trading on Christmas day. Because of this, there’s not much to do here but if the market does break down below the $60 level over the next couple of days it’s likely that the market will go looking towards the $58 level.

To the upside I believe that the $62.50 level is the top of the overall range and if we can get above there it’s likely that we could go much higher. I think ultimately this is a market that even if we did break down from here it would be somewhat limited by the major moving averages below. The 50 day EMA and the 200 day EMA are starting to slant higher so that of course gives technical traders a reason to get long. Having said all that, OPEC has cut production again and that is giving crude oil little bit of a boost. The United States and China look likely to continue moving forward with the trade war resolution, and although we are light years away from getting that, as trade starts to pick back up, it should drive up demand for crude oil.

If we do somehow break above the $62.50 level, then it’s very likely that the market will go much higher, perhaps reaching towards the $65 level and the $70 level. All things being equal I believe that this market will probably pull back, and that pullback could be a longer-term buying opportunity but that is probably going to be a story for early next year, not necessarily in the next few days. If we do turn around a break down below the moving averages, then it’s likely that this market will go looking towards the $52.50 level. With that in mind, I have a couple of levels that I am paying attention to and will keep you up-to-date here at Daily Forex.