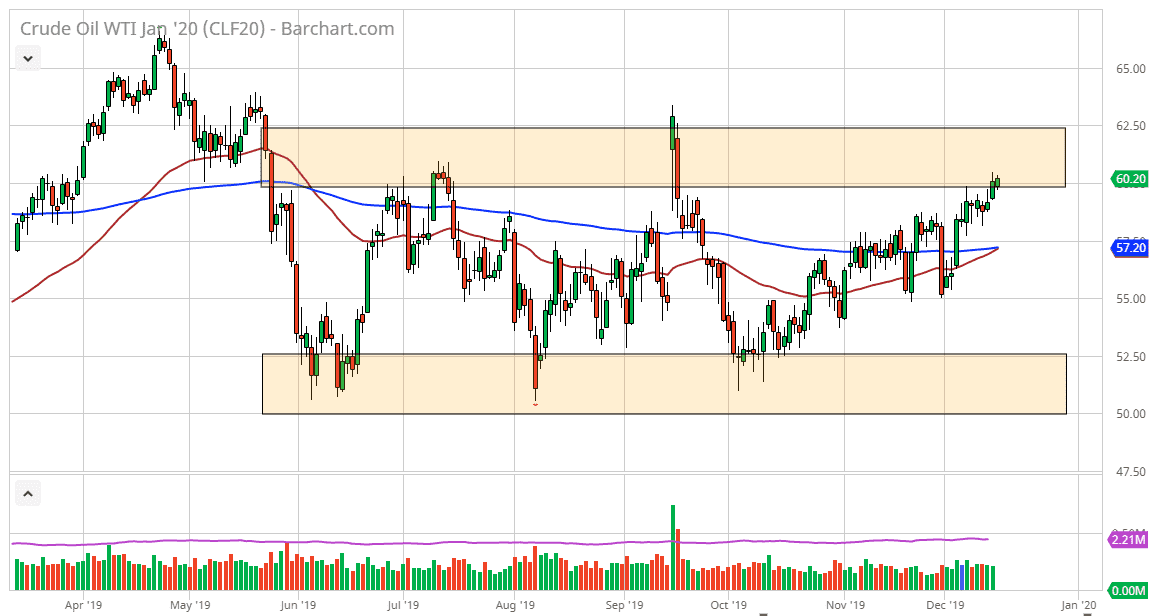

The West Texas Intermediate Crude market did rally a bit during the trading session on Monday to kick off the week but as you can see, we have a lot of noise just above that extends all the way to the $62.50 handle. The market breaking above the $60 level of course is a good sign, but we also have to worry about whether or not there is going to be enough demand around the world. Crude oil course has multiple input when it comes to where we go next, and we have a lot of different moving pieces at the same time which of course will continue to cause issues.

Breaking above the $60 level is a good sign, but I anticipate seeing a lot of noise above. Even if we do rally to the $62.50 level, it’s going to be very thick resistance between here and there. In the meantime, if I wish to buy crude oil I would like to do so on a pullback because it will offer a little bit of value. This is an obviously bullish market, so I’m not interested in shorting, at least not quite yet.

OPEC has cut production, and that of course is a bullish sign for crude oil, but at the same time the global markets are starting to price and slowing economic conditions. In other words, demand will continue to drop. The Americans continue to flood the market with oil at the same time, and we also have had the US/China trade deal come into the picture, but it seems as if the market isn’t completely convinced. In other words, we are all over the place when it comes to risk appetite. This of course will have a major influence on the price of crude oil. From a technical analysis standpoint, we are seeing the moving averages trying to cross underneath which of course is bullish and the so-called “golden cross” comes into play. Ultimately, this is a market that has a lot of work to do but looking at it from a longer-term standpoint I think we are still simply in consolidation. A pullback makes a lot of sense, and therefore I would be more interested in buying this market closer to the $59 level if I get that opportunity. Otherwise, buying and holding could work but it’s not going to be an easy ride to the $62.50 region.