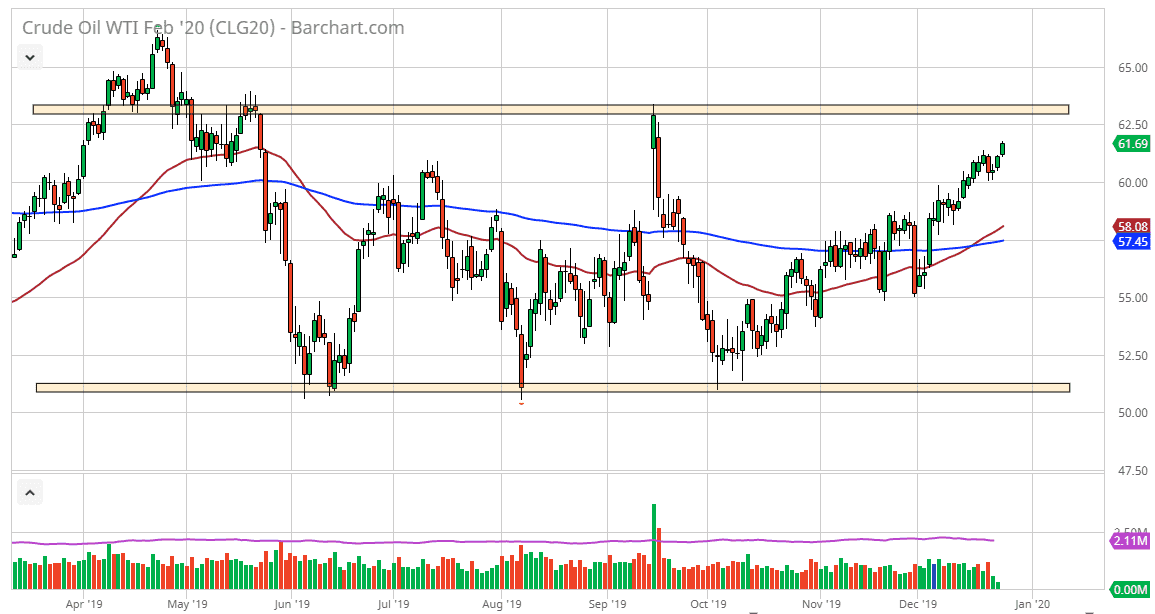

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Thursday, as we continue to reach towards the highs of the overall consolidation area. The $62.50 level above will continue to attract some selling pressure, but I think it’s only a matter of time before buyers would come back into play. Remember, OPEC has recently cut production, and therefore it’s likely that the supply could window a little bit. That being said though, the Americans are pumping out massive amounts of crude oil at the same time. Ultimately, this is a push/pull scenario based upon production.

Looking at this market, it appears that the $60 level underneath will continue to cause major issues, and I think that it’s only a matter of time before buyers would show up in that general vicinity. Do not forget, we have recently seen the “golden cross” in this market as the 50 day EMA has crossed above the 200 day EMA. That is a longer-term bullish signal, and longer-term “buy-and-hold” investors will pay quite a bit of attention to that.

If we do break out above the $62.50 level, then the market is free to go towards the $65 level above. If we can break above there, then the market should continue to go much higher than that. At this point, I do think that the buyers are more in charge than sellers, although I don’t necessarily look for some type of massive surge higher. Overall, this is a market that looks very bullish and therefore I don’t have any interest in shorting until we break down below the 50 day EMA. If we do, then the 200 day EMA will come into place, and if we break down below there then the trend changes and we go looking towards the $52.50 level. While that’s not impossible, it doesn’t look very likely at this point as we have seen such a massive surge higher. All things being equal I am bullish, but I also recognize that this time year will be very difficult at times due to the lack of liquidity. The real question will be whether or not we surge higher once the larger traders come back to work, somewhere around 6 January, as the holidays will be in the rearview mirror. I like the idea of buying but also like the idea of finding oil at lower levels.