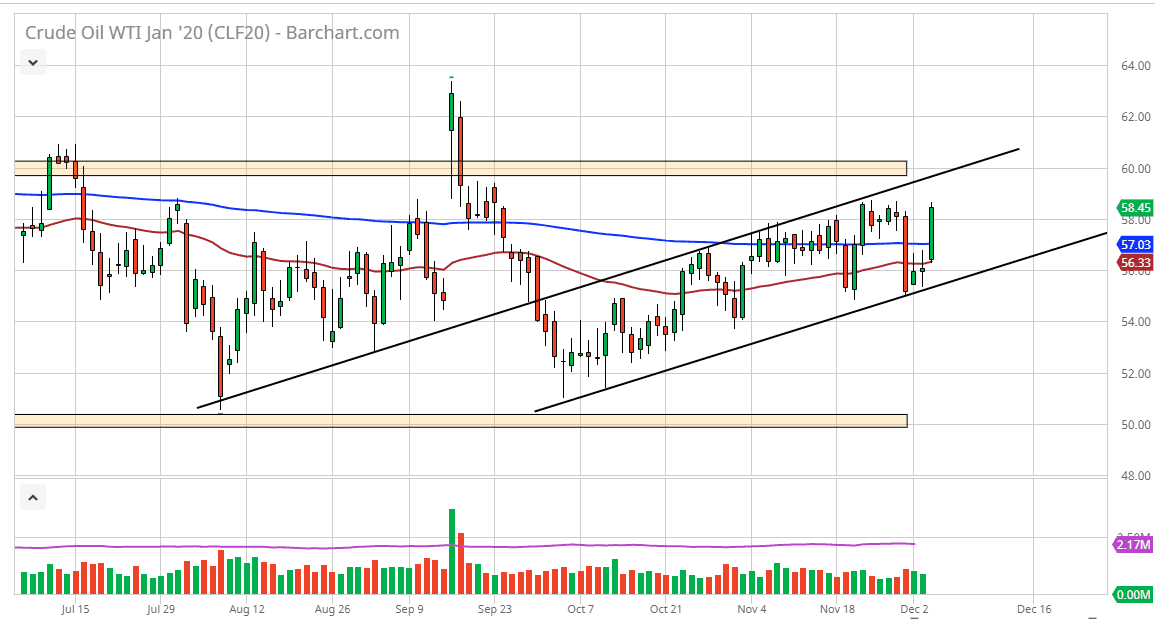

The West Texas Intermediate Crude Oil market rallied rather significantly during the trading session on Wednesday, reaching towards the $58.50 level. This is an area where we’ve seen a lot of resistance above, and it does extend towards the $60 level. Ultimately, this is an area that should continue to cause some issues and volatility to say the least. Currently, OPEC is all over the place as far as rumors are concerned, and as they are in the middle of a big meeting, it’s likely that we will get some type of disruption in this market.

When you look at the candlestick, it is very bullish, but we have also seen an extraordinarily bearish one just a few days ago. In other words, this is a market that continues to be a bit confused, and although we are in a nice uptrend in general, we still have not broken above the vital $60 level, which is the top of the overall sideways consolidation that we have seen. At this point, if we were to break above the $60 level, then the market will break out to the upside and go looking towards the $62.50 level after that. Ultimately though, if we were to run into this area just above and exhaust the bullish pressure, then it’s likely we turn around and go back down towards the blue 200 day EMA.

Crude oil is also being thrown around by the trade war situation, and therefore there should be paid attention to, as it’s all over the place as well. I think at this point we are still essentially trading between $50 on the bottom and $60 on the top, regardless of what we have seen over the last 24 hours. The 50 day EMA offered support, as it is at the bottom of the candlestick. Overall, this is a market that has been very noisy as of late, but over the longer term it looks as if we are going to go back and forth between these two major areas, at least until we get some type of clarity as to where we are going longer-term not only in production cuts, but also with the US/China trade situation as well. If we were to break down below the uptrend line, then the market is likely to go looking towards the $50 level. Crude oil remains a day trading type of situation.