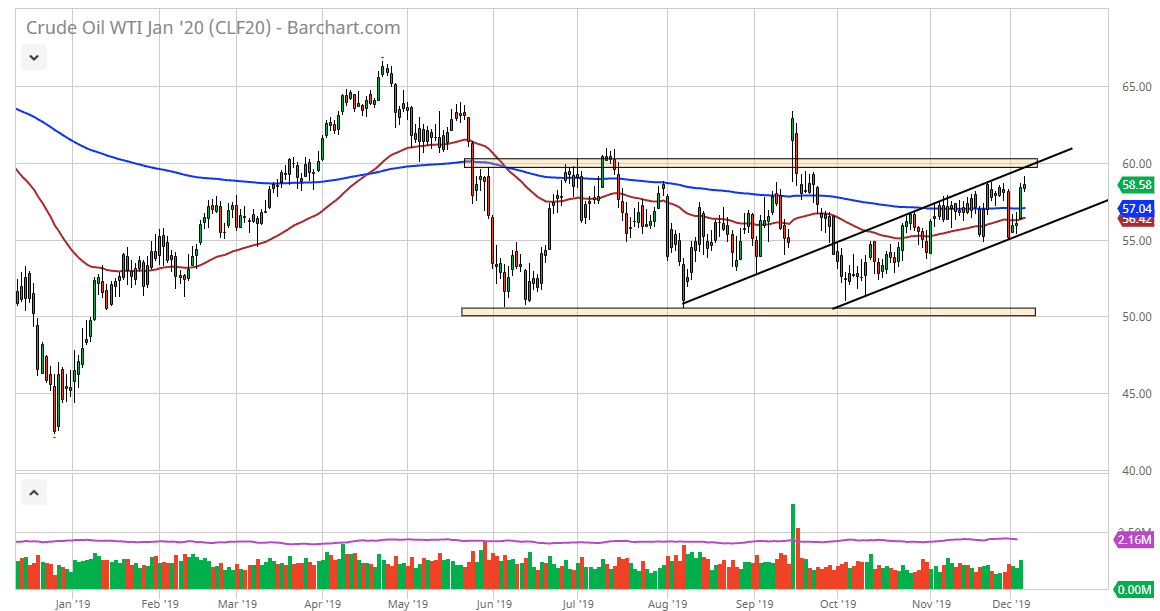

The West Texas Intermediate crude Oil market initially went back and forth during the trading session and then shot towards the top of the overall consolidation. That being said though, OPEC has announced a 500,000 barrel per day production cut and it’s likely that because we could not break above the $60 level, the market is likely to pull back from here. The $60 level has been crucial for some time as it is the top of the overall consolidation region, and of course where the top of the uptrend and channel is. If we were to break above that level, it would be an obvious sign of strength.

Jobs numbers came out stronger than anticipated during the trading session on Friday, and that of course brings up the idea of demand, but global demand in general simply hasn’t been very strong, so that will continue to cause issues when it comes to the oil markets. I don’t necessarily think that a pullback from here leads to some type of massive meltdown, just that the market is a bit underwhelmed, and therefore it needs to find a reason to continue going higher after this. Ultimately, the 200 day EMA is closer to the $57 level which is the 200 day EMA.

Until we get some type of major demand pick up, crude oil is going to continue to struggle. I believe that somewhere near the 200 day EMA we will probably have a bit of a supportive effect on this market, just as the 50 day EMA will as well. The uptrend line underneath offer support as well, so if we were to break through all of that then I believe that the market will probably drip down towards the $50 level next which is the bottom of the range. This is a very choppy market, and I think it has been the case for some time. All things being equal, this is a market that should continue to be very noisy in general, and therefore I think that the short-term traders will continue to push this back and forth, causing a lot of chop and difficulty as far as hanging onto a trade. All things being equal it’s likely to be a scenario where day trading will continue to be the case going forward, but right now we probably have much more risk to the downside than up.