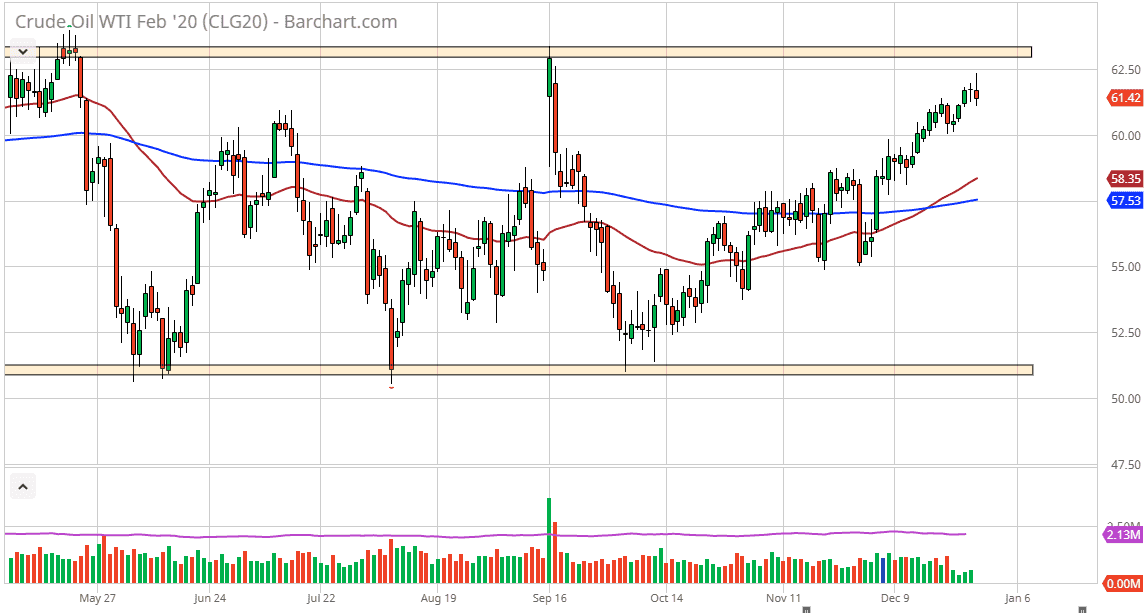

The West Texas Intermediate Crude Oil market went back and forth during the trading session on Monday, showing signs of exhaustion at the $62.50 level, and then rollover quite a bit only to bounce yet again. This neutral candlestick of course suggests that we are going to continue to see a lot of noise in general, but as we are at the top of a larger consolidation area it does make quite a bit of sense that we would stall out here. Beyond that, there is going to be a serious lack of volume so that should continue to cause this market to fail a bit anyway.

To the upside a see a significant amount of resistance in the form of the $62.50 level, perhaps even the $63.50 level. A pullback from here makes quite a bit of sense considering that the New Year’s Day holiday is on Wednesday, so to think that the markets are simply going to break out to the upside without some type of major influence is a bit of a stretch. Ultimately, I believe that the $60.00 level underneath should be support, and as a result I think that could offer a bit of a nice buying opportunity.

If we were to break down below the $60.00 level, it’s likely that we could see this market to reach down towards the 50 day EMA which is closer to the $58.50 level. At this point, the idea of bouncing from there makes quite a bit of sense as well. If we were to break down below the 50 day EMA it could send this market towards the bottom of the overall range, which could send this market down to the $52.50 level. Remember, OPEC has of course cut back production, but at this point demand is a major issue as well, so I don’t think that we can break out anytime soon. That being said though, the range seems to be holding and as a result it’s possible that we get a lot of back-and-forth trading, and the next couple of days will probably be a bit of profit-taking at best. I would be cautious about position size as it will become much thinner over the next couple of days, and ultimately that will cause a lot of issues. This is a market that is probably best left alone until the beginning of next week but if you do find yourself trading it’s likely best to use CFD markets in small doses.