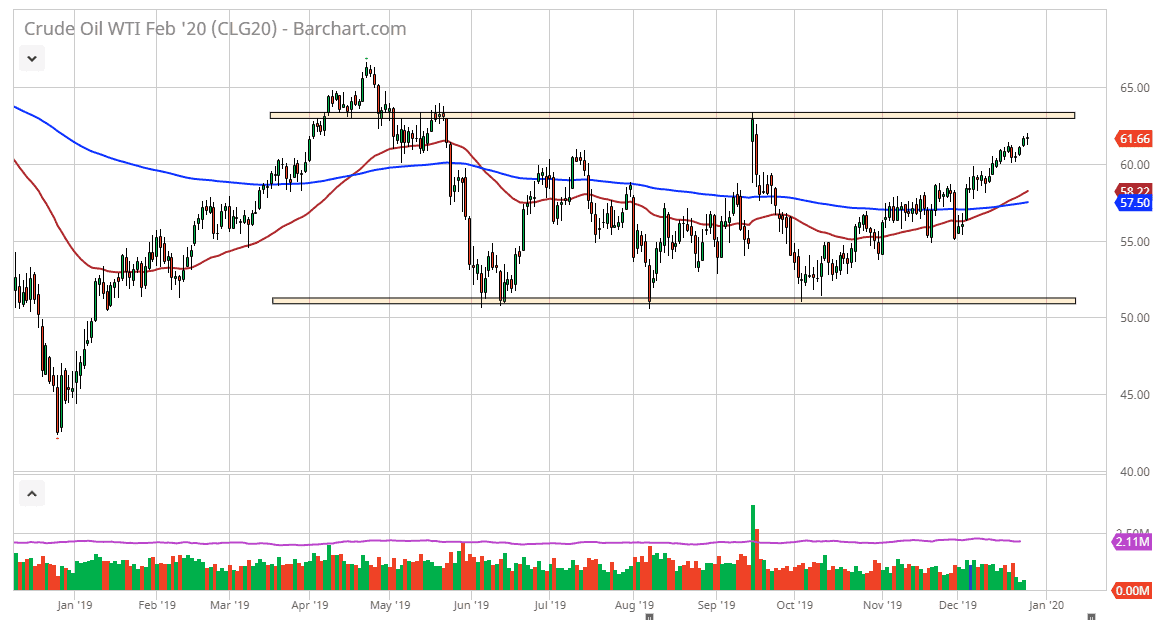

The West Texas Intermediate Crude Oil market did almost nothing during the day on Friday, as the markets have gotten a bit overextended. At this point, the $62.50 level should offer a significant amount of resistance as it is the top of the recent consolidation area. At this point, OPEC has extended production cuts and even added to them, so it does make sense that there could be a bit more demand for crude oil if there’s less supply. Beyond that, we also have the US/China trade situation that comes into play as well, so keep in mind that if that does fairly well, then it could drive up demand, at least in theory.

In the short term, we are getting close to the top of the range and as we are getting close to New Year’s Day as well, it’s difficult to imagine that a lot of volume is going to suddenly jump into the marketplace, so I think a short-term pullback makes quite a bit of sense. The $60 level underneath is the next major support level so I would anticipate that a pullback to that level should be interesting for the bullish traders out there, but even if we break down below there, I think that the 50 day EMA will come into play. Keep in mind that we have recently seen the 50 day EMA has broken above the 200 day EMA, and therefore the “golden cross” has started. That is in theory a very bullish sign but given enough time I doubt that it will be as important as the US/China trade situation.

Breaking down below that mass would of course in the market much lower and probably down towards the bottom of the consolidation region, meaning that we could get down to the $52.50 level. At this point though, it doesn’t look very likely to happen as we have seen so much in the way of buying pressure and of course the fundamental situation does seem to be suggesting that we could start getting more demand. At a break above the $62.50 level, I think the $65 level will be targeted, and then eventually above there to reach towards the $70 level based upon the longer-term charts. In the short term though, I would anticipate that there should be a bit of a pullback that you should consider taking advantage of.